Last Update27 Aug 25Fair value Increased 4.80%

Despite a significantly lower consensus revenue growth forecast and a notable rise in future P/E, the consensus analyst price target for Taylor Morrison Home has increased from $72.52 to $76.00.

What's in the News

- Repurchased 1,729,436 shares (1.72%) for $110.07 million from April 1 to June 30, 2025.

- Completed total repurchase of 5,195,503 shares (5.1%) for $326.06 million under the buyback program announced October 2024.

Valuation Changes

Summary of Valuation Changes for Taylor Morrison Home

- The Consensus Analyst Price Target has risen slightly from $72.52 to $76.00.

- The Consensus Revenue Growth forecasts for Taylor Morrison Home has significantly fallen from -0.4% per annum to -8.5% per annum.

- The Future P/E for Taylor Morrison Home has significantly risen from 9.40x to 11.11x.

Key Takeaways

- Lower buyer demand and increased reliance on spec home sales are pressuring margins and could constrain future revenue and earnings growth.

- Slower land acquisition and conservative expansion signal the company is prioritizing efficiency over aggressive growth, limiting potential upside.

- Pricing power, product diversification, tech-driven efficiency, strong financial flexibility, and demographic demand trends position the company for stable growth and resilient profitability.

Catalysts

About Taylor Morrison Home- Operates as a land developer and homebuilder in the United States.

- The company's current backlog is down ~30% year-over-year and order activity (net orders) is down 12%, reflecting softening buyer demand despite favorable demographic trends; if this persists, future revenues and earnings growth could fall short of expectations even as current deliveries are supported by high spec inventory.

- An accelerated shift toward spec home sales (71% of Q2 sales, up from 59% YoY) is being driven by consumer desire for discounts in a competitive market; since specs yield lower gross margins than to-be-built homes and require higher incentives, sustained high spec penetration will compress margins and limit future earnings leverage.

- While persistent U.S. housing supply constraints should benefit the industry longer term, Taylor Morrison faces rising cancellations and more selective homebuyer behavior due to macroeconomic uncertainty-suggesting that expected demand "catch-up" from demographic trends may materialize slower than investors anticipate, weighing on top-line growth.

- Company guidance acknowledges that sequential margin moderation is expected into Q3 and likely Q4, and that the cadence of gross margins could remain pressured by continued incentive offers and spec mix, which could undermine consensus expectations for stable or rising profitability.

- The company is prioritizing capital efficiency and returns over volume growth for the near term and plans a slower pace of land acquisition and new community starts-even as it invests in technological tools and digitalization-indicating that operational expansion driven by secular housing demand may be capped, limiting upside to revenue and earnings growth.

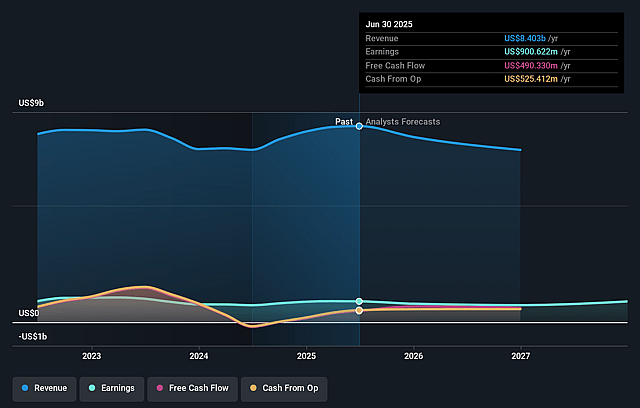

Taylor Morrison Home Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Taylor Morrison Home's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 10.8% today to 10.6% in 3 years time.

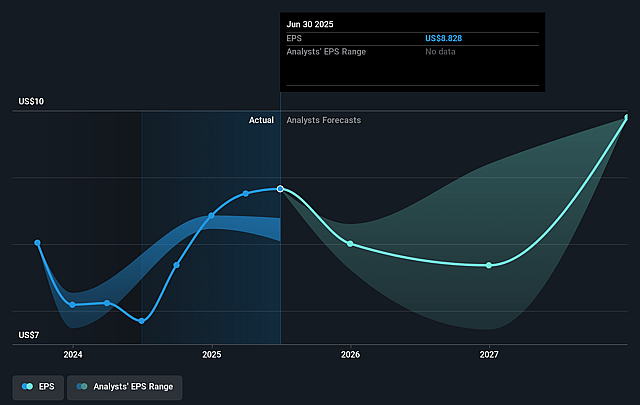

- Analysts expect earnings to reach $874.5 million (and earnings per share of $10.12) by about July 2028, down from $906.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, up from 7.4x today. This future PE is lower than the current PE for the US Consumer Durables industry at 10.4x.

- Analysts expect the number of shares outstanding to decline by 3.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

Taylor Morrison Home Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Taylor Morrison's resilient gross margin performance, which has stayed in the 23–25% range for over two years and is expected to remain in the low-mid 20% range even through elevated incentives and mix shifts, indicates pricing power and operational efficiency that could sustain net margins and earnings.

- The company's well-diversified product portfolio (entry-level, move-up, resort lifestyle/Esplanade, and build-to-rent), focused in core submarkets, positions it to capitalize on broad consumer trends and migration/demographic shifts, supporting stable or growing revenue streams.

- Significant investment in digital sales environments, cost controls, and operational/data analytics is driving SG&A leverage and reducing costs, supporting continued improvement in profit margins and return on equity over time.

- The newly secured $3 billion finance facility with Kennedy Lewis increases financial flexibility, improves balance sheet optionality, and enables Taylor Morrison to optimize returns, hedging against industry cyclicality and supporting long-term earnings growth.

- Underlying housing demand remains fundamentally supported by migration patterns, persistent supply shortages, and favorable demographics (including affluent active adult buyers), suggesting the revenue base and buyer pool are likely to remain robust as confidence returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $72.516 for Taylor Morrison Home based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.3 billion, earnings will come to $874.5 million, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 8.4%.

- Given the current share price of $66.82, the analyst price target of $72.52 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.