Last Update 08 Dec 25

Fair value Increased 0.85%TMHC: Sector Tailwinds Will Support Earnings Power Despite Limited Fed Cut Impact

Analysts have modestly increased their fair value estimate for Taylor Morrison Home to $74.25 from $73.63, citing updated price targets that reflect supportive sector dynamics, despite expectations that the recent Fed rate cut will not materially alter near term housing market trends.

Analyst Commentary

Analyst commentary on Taylor Morrison Home reflects a broadly constructive stance on the company’s execution and earnings outlook, even as the macro backdrop for housing remains largely unchanged following the recent Fed rate cut.

Bullish Takeaways

- Bullish analysts highlight the price target increase to the mid 70 dollar range as evidence of rising confidence in Taylor Morrison’s earnings power and return on invested capital.

- Supportive sector dynamics, including resilient demand and disciplined inventory management, are seen as underpinning the company’s ability to sustain margins and cash generation.

- The updated valuation framework assumes Taylor Morrison can continue to out execute peers on cost control and land strategy, supporting a premium multiple versus prior estimates.

- Analysts view the company’s balance sheet strength and flexibility as a key advantage for funding selective growth initiatives without materially increasing risk.

Bearish Takeaways

- Bearish analysts caution that, despite the Fed’s rate cut, underlying housing affordability pressures and tight supply conditions may still cap near term volume growth.

- There is concern that the recent move in the price target largely reflects sector wide re rating rather than a step change in Taylor Morrison’s fundamental trajectory.

- Some analysts flag execution risk around maintaining current margin levels if input costs re accelerate or if pricing power softens in key markets.

- Valuation is viewed as less compelling if the housing market normalizes more quickly than expected, leaving limited room for multiple expansion from current levels.

What's in the News

- Completed a share repurchase of 6,473,036 shares, or 6.39 percent of shares outstanding, totaling approximately 399 million dollars under the buyback program announced on October 23, 2024 (company filing)

- Between July 1, 2025 and September 30, 2025, repurchased 1,277,533 shares, representing 1.29 percent of shares outstanding, for roughly 83 million dollars as part of the latest buyback tranche (company filing)

Valuation Changes

- The fair value estimate has risen slightly to 74.25 dollars from 73.63 dollars, reflecting a modestly higher intrinsic value assessment.

- The discount rate has fallen slightly to approximately 9.42 percent from 9.45 percent, implying a marginally lower required rate of return.

- Revenue growth remains effectively unchanged at about negative 5.86 percent, indicating no material revision to the top line outlook.

- The net profit margin remains effectively unchanged at roughly 9.92 percent, suggesting stable expectations for profitability.

- The future P/E has risen slightly to about 12.1 times from 12.0 times, pointing to a modest uptick in the valuation multiple applied to forward earnings.

Key Takeaways

- Lower buyer demand and increased reliance on spec home sales are pressuring margins and could constrain future revenue and earnings growth.

- Slower land acquisition and conservative expansion signal the company is prioritizing efficiency over aggressive growth, limiting potential upside.

- Pricing power, product diversification, tech-driven efficiency, strong financial flexibility, and demographic demand trends position the company for stable growth and resilient profitability.

Catalysts

About Taylor Morrison Home- Operates as a land developer and homebuilder in the United States.

- The company's current backlog is down ~30% year-over-year and order activity (net orders) is down 12%, reflecting softening buyer demand despite favorable demographic trends; if this persists, future revenues and earnings growth could fall short of expectations even as current deliveries are supported by high spec inventory.

- An accelerated shift toward spec home sales (71% of Q2 sales, up from 59% YoY) is being driven by consumer desire for discounts in a competitive market; since specs yield lower gross margins than to-be-built homes and require higher incentives, sustained high spec penetration will compress margins and limit future earnings leverage.

- While persistent U.S. housing supply constraints should benefit the industry longer term, Taylor Morrison faces rising cancellations and more selective homebuyer behavior due to macroeconomic uncertainty-suggesting that expected demand "catch-up" from demographic trends may materialize slower than investors anticipate, weighing on top-line growth.

- Company guidance acknowledges that sequential margin moderation is expected into Q3 and likely Q4, and that the cadence of gross margins could remain pressured by continued incentive offers and spec mix, which could undermine consensus expectations for stable or rising profitability.

- The company is prioritizing capital efficiency and returns over volume growth for the near term and plans a slower pace of land acquisition and new community starts-even as it invests in technological tools and digitalization-indicating that operational expansion driven by secular housing demand may be capped, limiting upside to revenue and earnings growth.

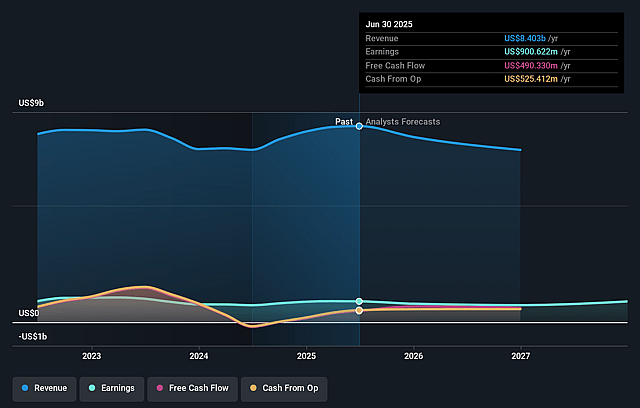

Taylor Morrison Home Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Taylor Morrison Home's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 10.8% today to 10.6% in 3 years time.

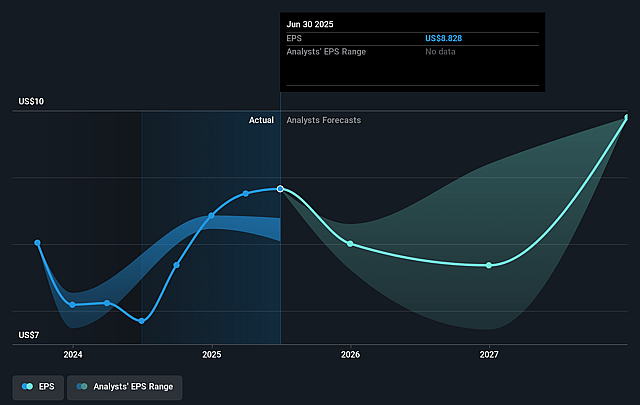

- Analysts expect earnings to reach $874.5 million (and earnings per share of $10.12) by about July 2028, down from $906.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, up from 7.4x today. This future PE is lower than the current PE for the US Consumer Durables industry at 10.4x.

- Analysts expect the number of shares outstanding to decline by 3.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

Taylor Morrison Home Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Taylor Morrison's resilient gross margin performance, which has stayed in the 23–25% range for over two years and is expected to remain in the low-mid 20% range even through elevated incentives and mix shifts, indicates pricing power and operational efficiency that could sustain net margins and earnings.

- The company's well-diversified product portfolio (entry-level, move-up, resort lifestyle/Esplanade, and build-to-rent), focused in core submarkets, positions it to capitalize on broad consumer trends and migration/demographic shifts, supporting stable or growing revenue streams.

- Significant investment in digital sales environments, cost controls, and operational/data analytics is driving SG&A leverage and reducing costs, supporting continued improvement in profit margins and return on equity over time.

- The newly secured $3 billion finance facility with Kennedy Lewis increases financial flexibility, improves balance sheet optionality, and enables Taylor Morrison to optimize returns, hedging against industry cyclicality and supporting long-term earnings growth.

- Underlying housing demand remains fundamentally supported by migration patterns, persistent supply shortages, and favorable demographics (including affluent active adult buyers), suggesting the revenue base and buyer pool are likely to remain robust as confidence returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $72.516 for Taylor Morrison Home based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.3 billion, earnings will come to $874.5 million, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 8.4%.

- Given the current share price of $66.82, the analyst price target of $72.52 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Taylor Morrison Home?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.