Narratives are currently in beta

Key Takeaways

- Strategic mortgage rate buydowns and strong land position bolster future revenue and sales stability despite challenging interest rates.

- Diversification strategy across home types and geographies supports adaptability to market conditions and potential revenue growth.

- Rising mortgage rates and increased competition are pressuring M/I Homes' margins, with significant reliance on the Southern region posing revenue risks.

Catalysts

About M/I Homes- Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

- M/I Homes plans to grow its community count by approximately 5% in 2025, which has the potential to increase future revenue by expanding its market presence.

- The company holds a strong land position, with ownership and control over 52,000 single-family lots, equating to about a 5.5-year supply, which positions it well for sustained growth and could positively impact future revenue and earnings.

- M/I Homes has implemented a strategy of using mortgage rate buydowns to drive traffic and sales, enhancing the company's ability to maintain sales volume even in a challenging interest rate environment, which could stabilize or increase future revenues despite potential margin compression.

- The company has a robust balance sheet with significant cash reserves and no borrowings under its credit facility, providing financial flexibility to capitalize on strategic opportunities, potentially improving future earnings through investment or share buybacks.

- The company's diversification strategy, focusing on both entry-level and move-up homes as well as geographic diversity, allows M/I Homes to adapt to market conditions and capture demand across different segments, providing potential stability and growth in revenue and earnings.

M/I Homes Future Earnings and Revenue Growth

Assumptions

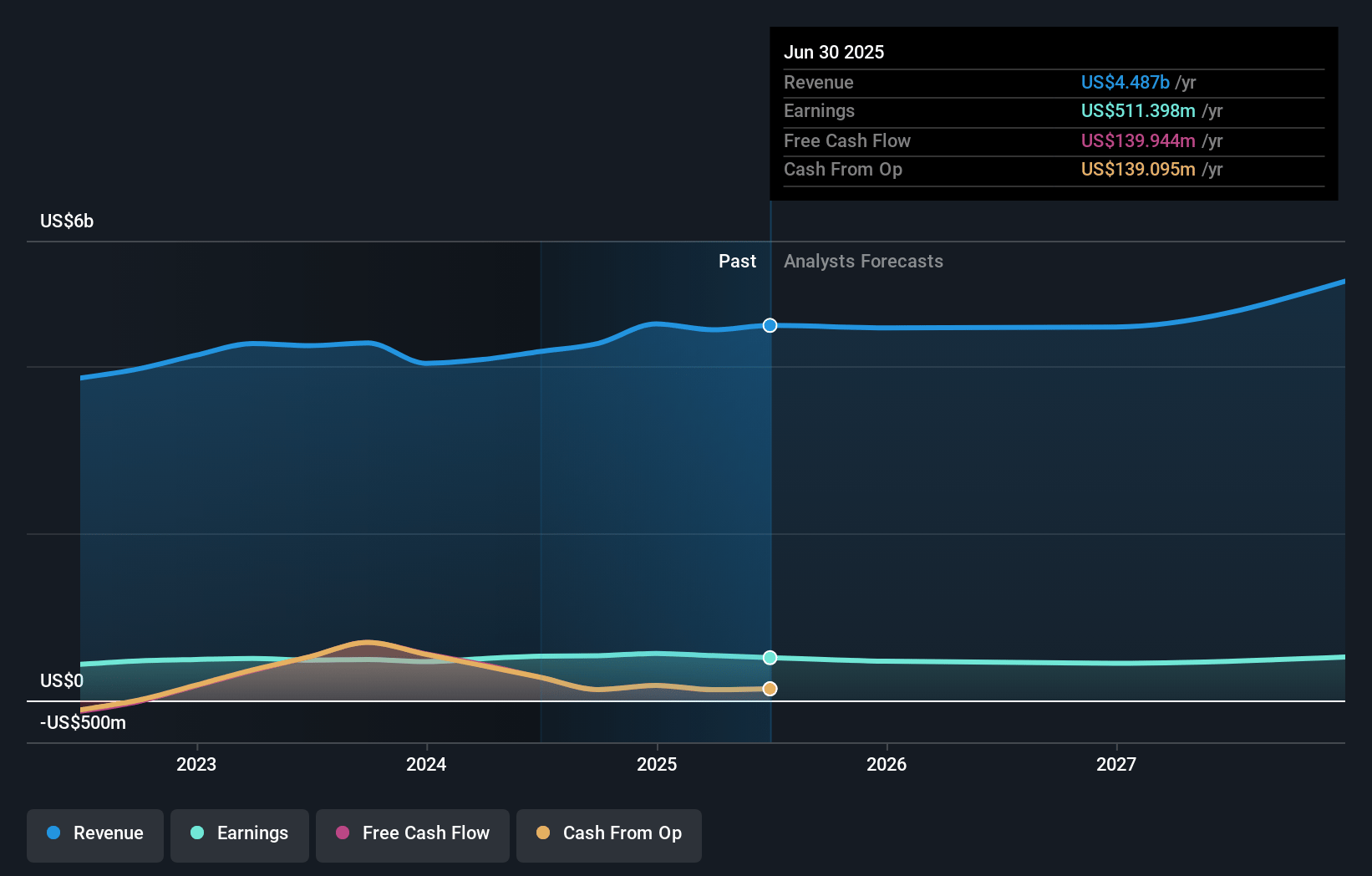

How have these above catalysts been quantified?- Analysts are assuming M/I Homes's revenue will grow by 7.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.5% today to 12.3% in 3 years time.

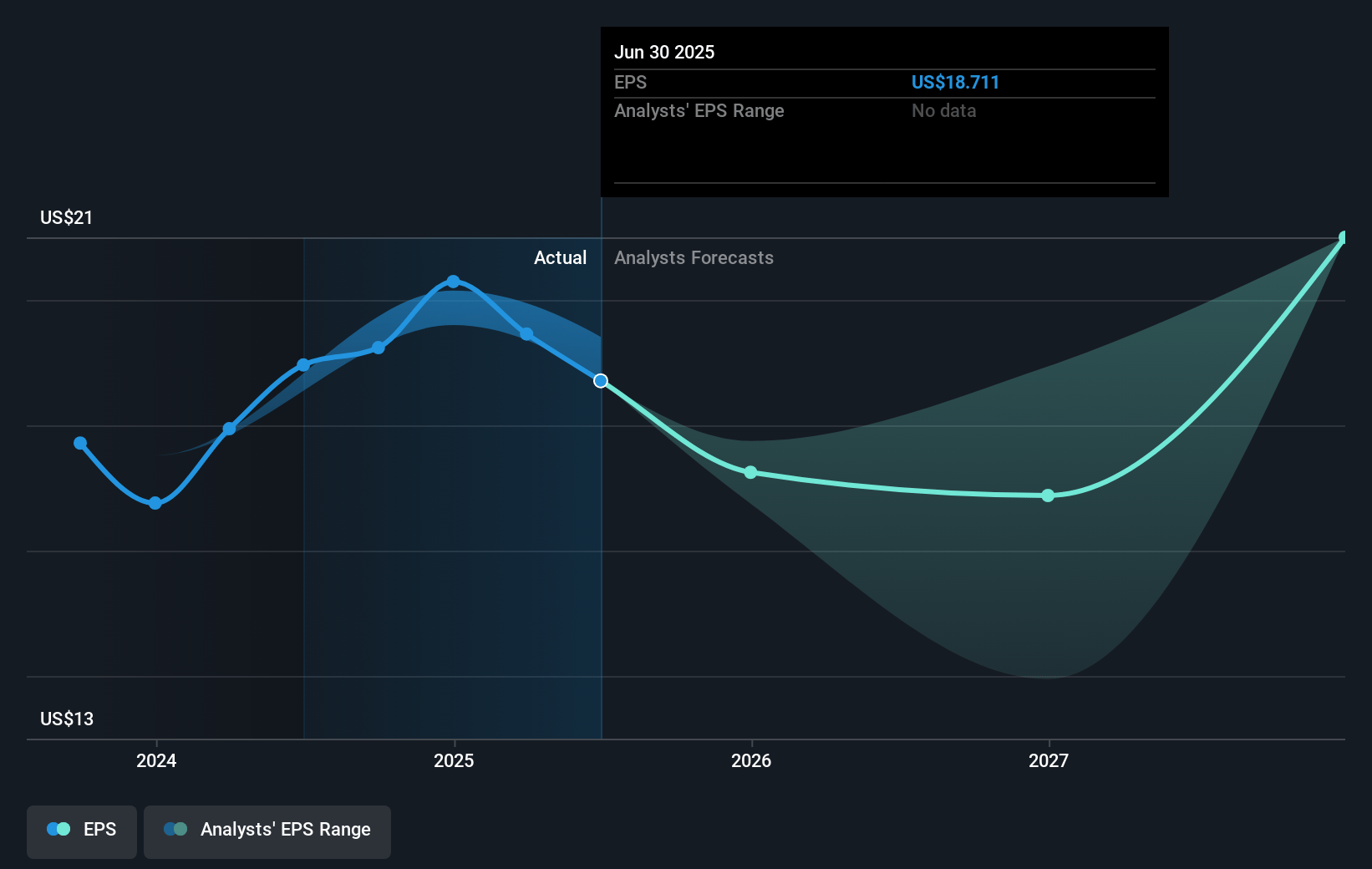

- Analysts expect earnings to reach $647.0 million (and earnings per share of $25.01) by about January 2028, up from $535.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, up from 6.9x today. This future PE is lower than the current PE for the US Consumer Durables industry at 11.3x.

- Analysts expect the number of shares outstanding to decline by 1.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.52%, as per the Simply Wall St company report.

M/I Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising mortgage rates have required M/I Homes to use rate buydowns to generate demand, which is impacting gross margins and may compress net margins if this persists.

- The cost of rate buydowns is increasing, affecting gross margins by decreasing 50 basis points year-over-year and 250 basis points from Q3 to Q4, potentially impacting profitability.

- Demand appears to be choppy and challenging in key markets like Tampa and parts of Florida; this market softening could impact revenue growth.

- There is significant reliance on the Southern region for growth, making the company vulnerable to market-specific risks, potentially affecting overall revenue and earnings.

- Increased competition and rising land costs for prime locations could pressure margins and affect future earnings if costs are not effectively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $197.5 for M/I Homes based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $647.0 million, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 8.5%.

- Given the current share price of $135.26, the analyst's price target of $197.5 is 31.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives