Narratives are currently in beta

Key Takeaways

- International expansion and proactive sales strategies could significantly boost customer acquisition and revenue, especially in untapped markets like Asia.

- Innovations and investments, including new product launches and strategic partnerships, aim to enhance consumer experience and operational efficiency.

- Challenges with promotional timing, rising fulfillment costs, and increased marketing expenses are impacting FIGS' revenue growth, profitability, and financial performance.

Catalysts

About FIGS- Operates as a direct-to-consumer healthcare apparel and lifestyle company in the United States and internationally.

- FIGS plans to capitalize on international growth opportunities, particularly in Asia, where the healthcare professional market is largely untapped. This expansion could significantly increase revenue by capturing new international customers.

- The company is building a more proactive outbound sales team for its teams business segment, which could enhance customer acquisition and drive revenue growth by serving large organizations and institutions.

- Investment in a $25 million minority stake in AUG, a multidisciplinary education platform for healthcare professionals, offers potential future benefits in marketing, community engagement, data, and AI, which could improve customer experience and potentially boost earnings.

- FIGS is focused on innovation with new product launches, such as the partnership with New Balance for specialized footwear for healthcare professionals and improving fit standards for apparel, which could drive increased consumer spending and improve net margins.

- The opening of new fulfillment centers, like the facility in Arizona and a planned center in Canada, is expected to enhance operational efficiency and reduce costs over time, which could contribute to improved net margins and earnings.

FIGS Future Earnings and Revenue Growth

Assumptions

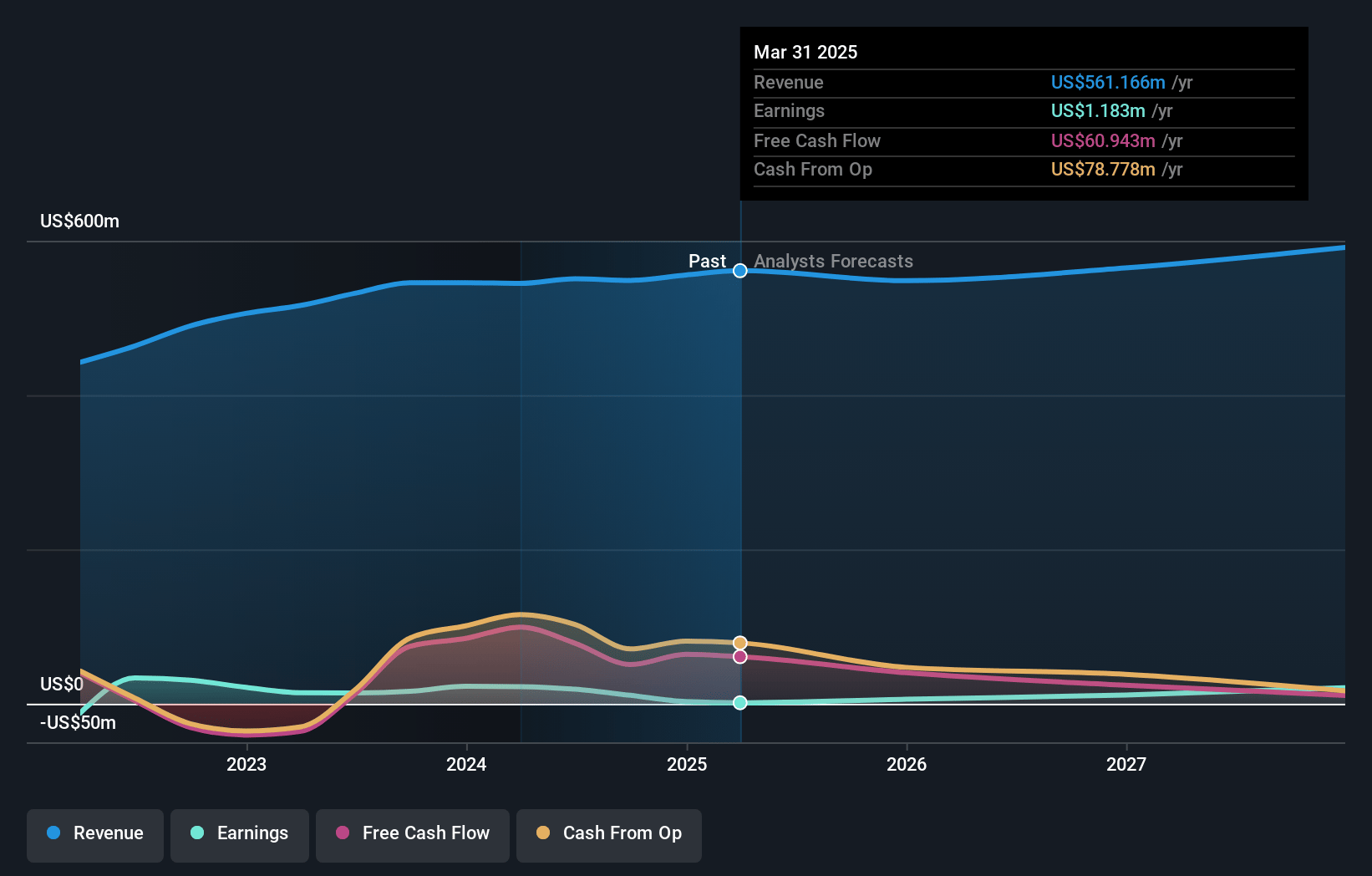

How have these above catalysts been quantified?- Analysts are assuming FIGS's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.0% today to 4.2% in 3 years time.

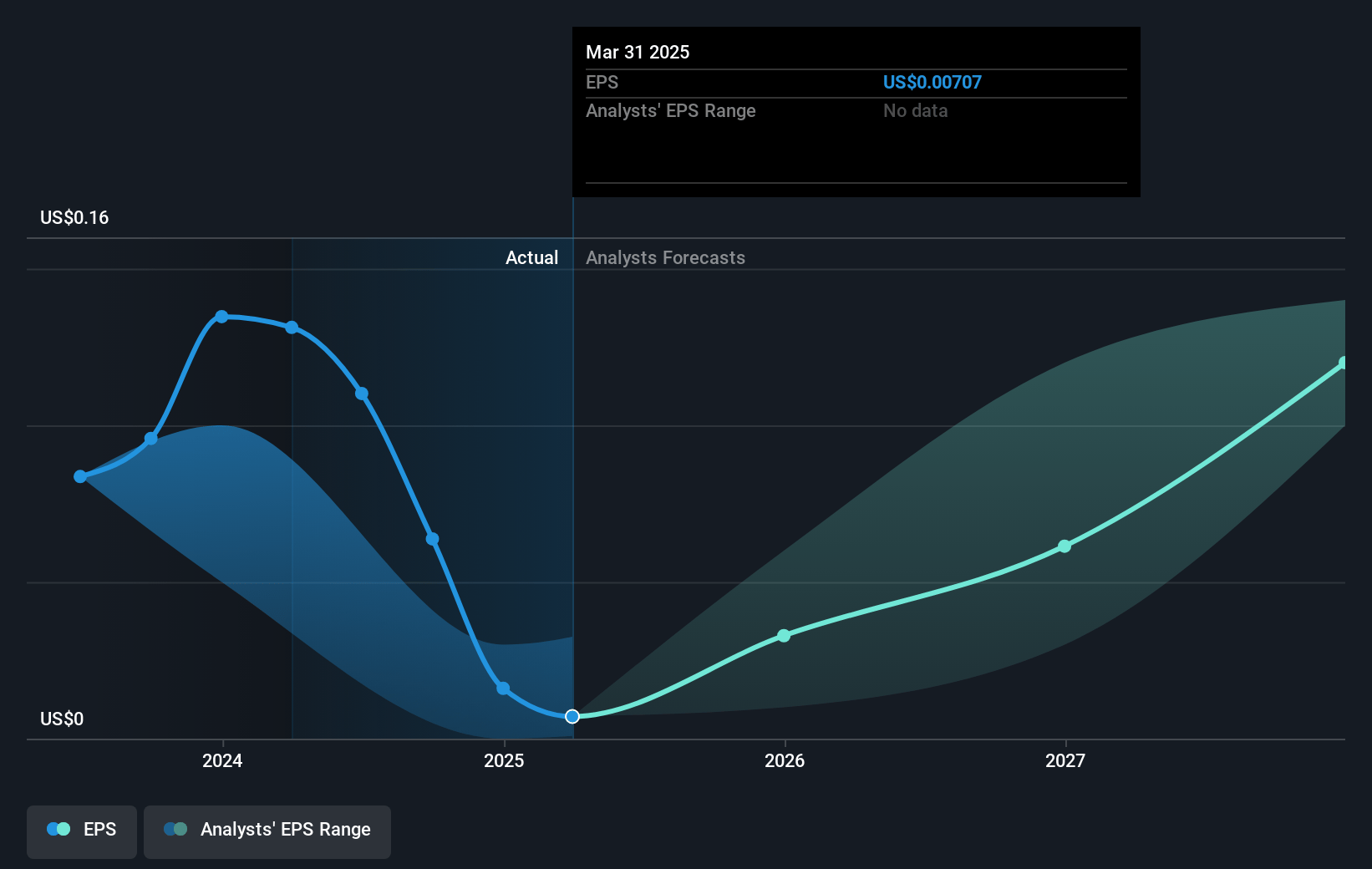

- Analysts expect earnings to reach $26.2 million (and earnings per share of $0.15) by about January 2028, up from $10.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $5.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.8x on those 2028 earnings, down from 90.9x today. This future PE is greater than the current PE for the US Luxury industry at 18.6x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.25%, as per the Simply Wall St company report.

FIGS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faced challenges with its promotional timing and stock-outs in the footwear category, leading to lower revenues and impacting the top line performance. This could affect future revenue growth if not addressed.

- The company experienced higher than expected fulfillment transition costs and shipping expenses, which affected their adjusted EBITDA margin, presenting risks to their net margins and profitability.

- Marketing expenses increased significantly due to their Olympic investment, leading to higher operating costs and impacting net income. This raises concerns about efficient allocation of marketing resources affecting earnings.

- There is inconsistency in price elasticity and promotional impacts, especially during peak periods. This could pressure average order values (AOV) and overall revenue if not mitigated.

- The company relies heavily on top-of-funnel marketing and long-term campaigns for brand awareness, which may introduce risks if they do not translate to immediate sales growth and stabilize financial performance in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.72 for FIGS based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $615.9 million, earnings will come to $26.2 million, and it would be trading on a PE ratio of 45.8x, assuming you use a discount rate of 7.2%.

- Given the current share price of $5.8, the analyst's price target of $5.72 is 1.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

JU

julio

Community Contributor

Figs valuation

REVIEW Sales are growing and the business is reinvesting in its operations. Has decreased its current liabilities to 14% of total assets.

View narrativeUS$6.69

FV

20.5% undervalued intrinsic discount8.00%

Revenue growth p.a.

8users have liked this narrative

0users have commented on this narrative

13users have followed this narrative

about 1 month ago author updated this narrative