Narratives are currently in beta

Key Takeaways

- Anticipated decline in new pool starts and increased expenses could negatively impact growth, compress margins, and pressure net income.

- Strategic acquisitions and investments may impede short-term earnings despite positioning for future growth amidst uncertain markets.

- Latham Group's strategic focus and successful cost management, bolstered by key acquisitions and investments, position it for revenue growth and enhanced market share.

Catalysts

About Latham Group- Designs, manufactures, and markets in-ground residential swimming pools in North America, Australia, and New Zealand.

- Latham's anticipated decline in new pool starts by approximately 15% in 2024 indicates a challenging revenue environment and reduced demand, potentially impacting future growth and revenues negatively.

- Despite current successes in cost reductions, market conditions mean the company might face compressed net margins as the costs of raw materials could stabilize or increase modestly, which impacts profitability.

- The company's net income is likely to remain pressured as increased SG&A expenses take effect, driven by strategic investments in sales and marketing initiatives aimed at future growth amidst uncertain market recoveries.

- While the acquisition of Coverstar Central is expected to expand revenue by $20 million annually and improve margins, integration and revenue synergy initiatives may require additional time and resources, affecting short-term earnings improvement.

- Continued investments in sales, marketing, and expanding the product portfolio, although positioning the company for future gains, constitute a near-term financial burden that might suppress earnings if market recovery is slower than expected.

Latham Group Future Earnings and Revenue Growth

Assumptions

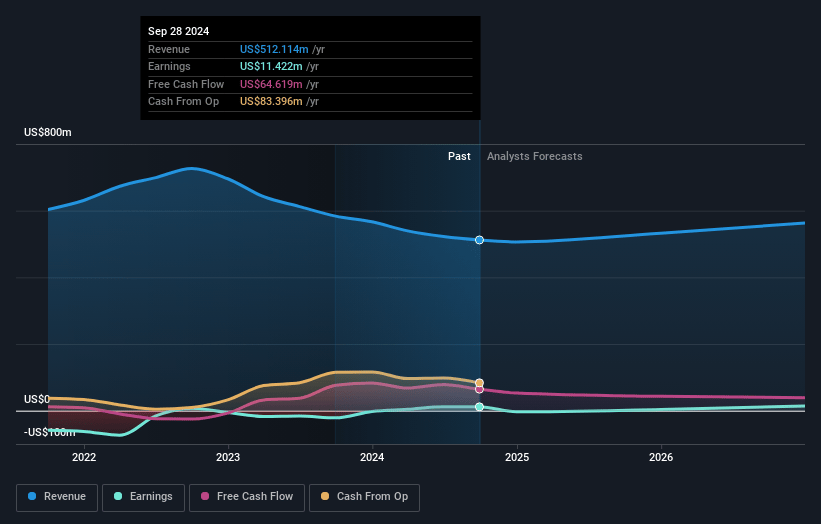

How have these above catalysts been quantified?- Analysts are assuming Latham Group's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 2.2% today to 1.8% in 3 years time.

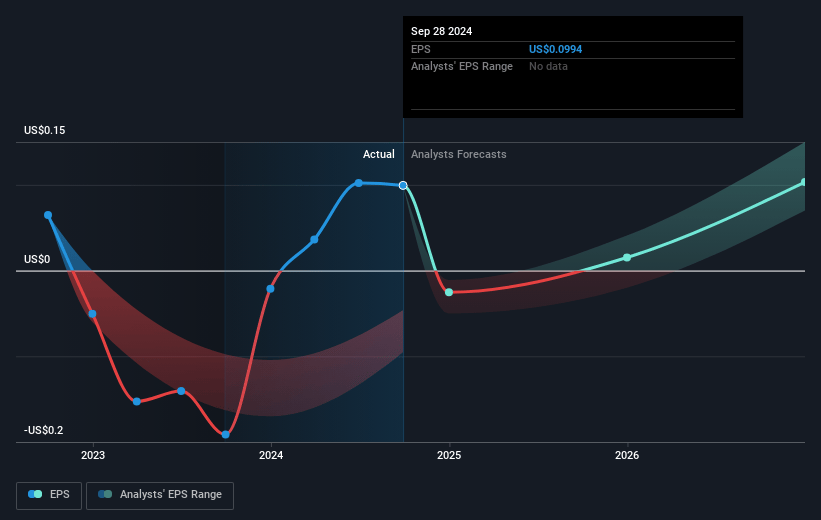

- Analysts expect earnings to reach $10.4 million (and earnings per share of $0.09) by about November 2027, down from $11.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 76.1x on those 2027 earnings, up from 65.1x today. This future PE is greater than the current PE for the US Leisure industry at 18.5x.

- Analysts expect the number of shares outstanding to grow by 0.16% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.35%, as per the Simply Wall St company report.

Latham Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Latham Group's resilience and strategic focus on fiberglass pools and automatic safety covers could drive revenue growth as these products are compelling, cost-efficient, and increasingly popular, indicating potential for a stronger market position and customer base.

- The company's successful implementation of lean manufacturing and value engineering programs has resulted in significant cost reductions, which have stabilized gross profits and expanded gross margins despite lower sales, suggesting potential for improved net margins.

- Latham Group's acquisition of Coverstar Central is expected to provide revenue synergies and expand adjusted EBITDA margins, indicating a strategic move that could enhance earnings.

- The company's strong financial position, characterized by substantial cash reserves and strategic use of debt, provides the flexibility to pursue further accretive acquisitions, which could support revenue and earnings growth.

- Strategic investments in sales, marketing, and product development, particularly focused on underrepresented markets like the Sand States, could enhance market share and revenue growth as the economic environment improves.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.53 for Latham Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $591.0 million, earnings will come to $10.4 million, and it would be trading on a PE ratio of 76.1x, assuming you use a discount rate of 7.4%.

- Given the current share price of $6.58, the analyst's price target of $5.53 is 18.9% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives