Last Update07 May 25Fair value Increased 0.20%

Key Takeaways

- Expansion into global markets and digital sales channels drives brand growth, diversification, and reduces reliance on wholesale distribution for sustained revenue gains.

- Operational scalability, product innovation, and strategic focus on personalization support strong margins, brand loyalty, and long-term earnings stability.

- Heavy reliance on clogs, environmental pressures, digital competition, rising operating expenses, and regulatory risks all threaten sustainable profitability and future growth.

Catalysts

About Crocs- Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

- Strong global expansion prospects driven by rising consumer acceptance of casual wear and athleisure, especially as Crocs reports 19% international growth in 2024 and highlights opportunities to grow market share in major global markets such as China, India, Southeast Asia, and Western Europe—supporting a high-single-digit to low-double-digit revenue growth trajectory over the medium term.

- Continued acceleration in e-commerce and direct-to-consumer (DTC) channels, with DTC revenue up 11% for the Crocs brand and up 7% for HEYDUDE in Q4, and focused investment in digital and owned retail initiatives, enabling increased customer engagement and higher gross margins by reducing dependency on wholesale distribution.

- Ongoing product and market diversification, including an expanding range of sandals, boots, slippers, and the growing success of the HEYDUDE brand, which reduces the company’s reliance on core clog products and drives incremental revenue streams, potentially boosting total revenues and supporting sustained earnings growth.

- Strategic emphasis on personalization through Jibbitz and digital innovation, leveraging global footwear trends toward customization, as evidenced by 6% Jibbitz growth and expanded fixtures—driving higher repeat purchase rates, brand loyalty, and margin enhancement.

- Robust operational scalability thanks to investments in supply chain efficiency, scalable marketing (including high-profile collaborations), and a commitment to maintaining operating margins at or above 24%, with a proven record of above-industry margin performance—underpinning the potential for outsized earnings and strong cash flow generation going forward.

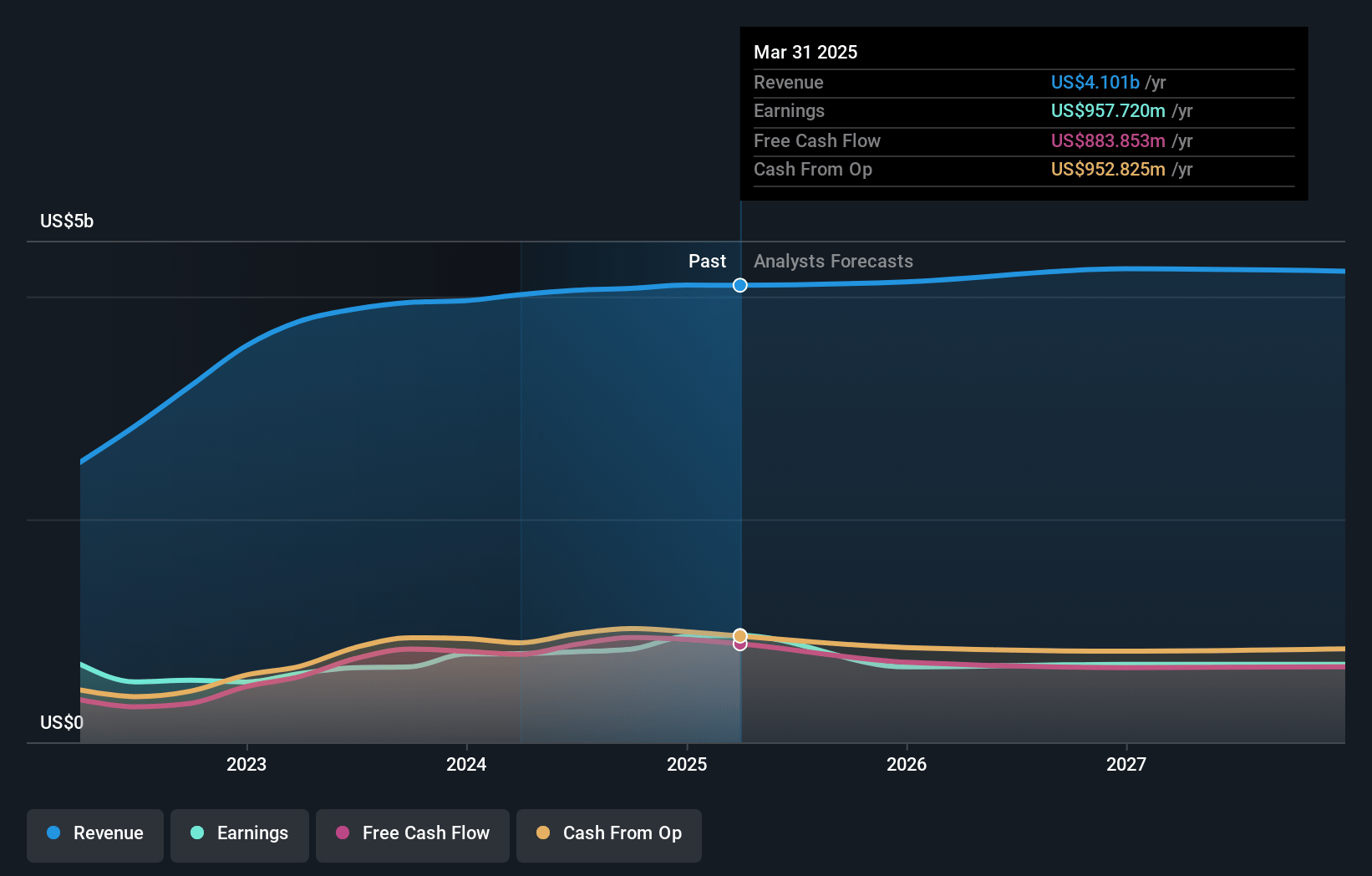

Crocs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Crocs compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Crocs's revenue will grow by 3.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 23.2% today to 18.8% in 3 years time.

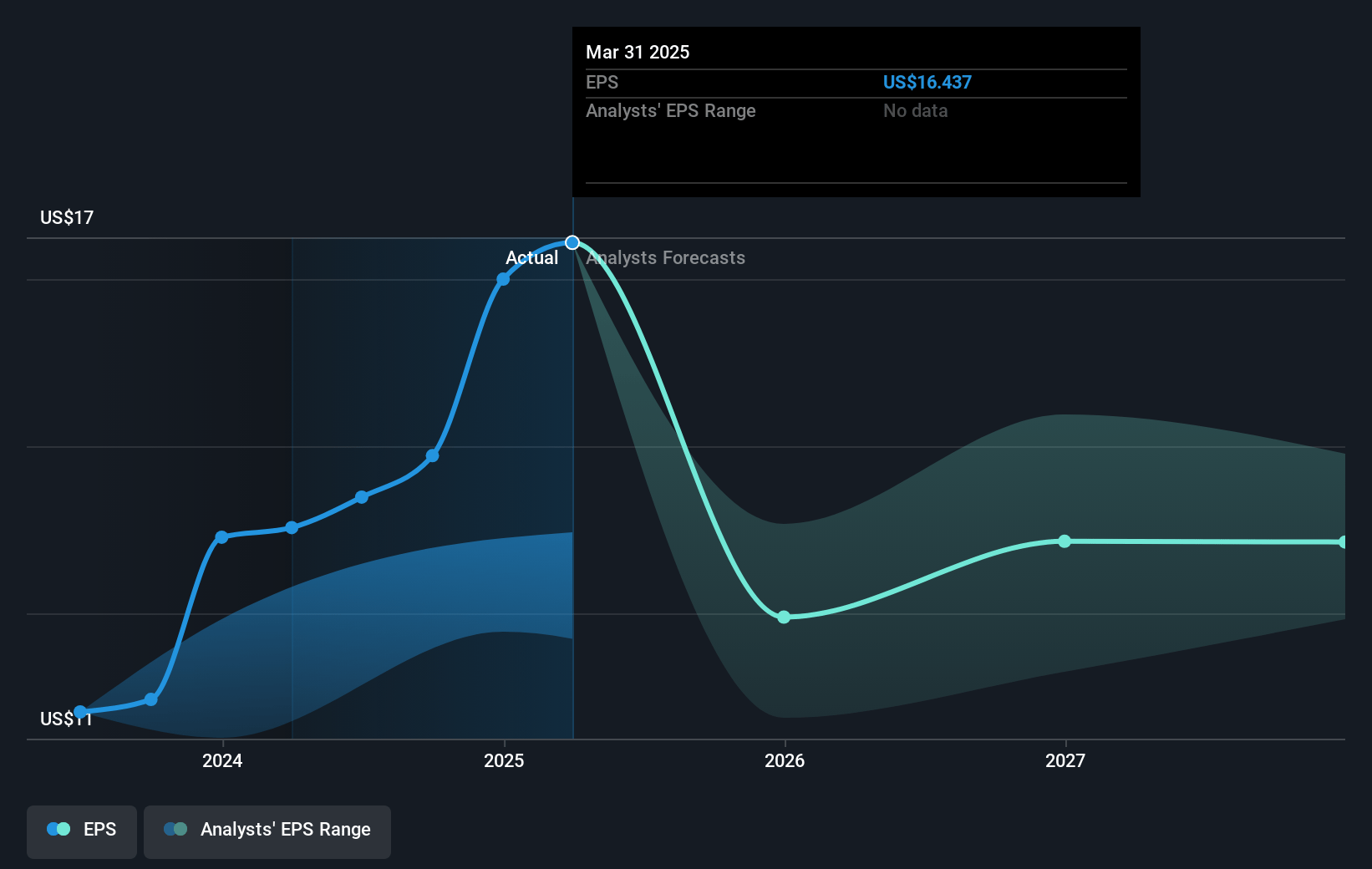

- The bullish analysts expect earnings to reach $848.1 million (and earnings per share of $14.62) by about May 2028, down from $950.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.3x on those 2028 earnings, up from 5.8x today. This future PE is lower than the current PE for the US Luxury industry at 15.6x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.42%, as per the Simply Wall St company report.

Crocs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company remains highly dependent on its core clog product, which made up 75 percent of its sales mix during the year, meaning that if consumer preferences shift away from clogs or fashion cycles change, revenue and earnings could experience significant volatility and stagnation.

- Crocs faces mounting sustainability and environmental risks due to the heavy use of plastic-based materials in its products, and as regulatory and consumer pressures toward eco-friendly alternatives increase, this could drive up input costs, require expensive redesigns, or damage brand reputation, ultimately compressing net margins and impacting long-term profitability.

- The casual footwear market is transitioning rapidly toward digital-native, direct-to-consumer brands and dynamic e-commerce models, exposing Crocs to intensifying competition and necessitating sustained increases in marketing and SG&A spending, which may erode operating margins over time.

- Repeated investments in talent, DTC infrastructure, and increased marketing—reflected in a 20 percent year-over-year growth in SG&A and ongoing guidance for mid-teens SG&A growth in the first half—indicate possible diminishing SG&A leverage, challenging the company’s ability to maintain industry-leading profitability and supporting only modest operating margin targets.

- The industry is exposed to growing regulatory risks related to tariffs and potential future restrictions on plastics or petroleum-based materials, which the company noted led to a projected $11 million headwind to gross profit and a multi-quarter drag on gross margins, and similar future pressures could directly curtail net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Crocs is $153.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Crocs's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $153.0, and the most bearish reporting a price target of just $83.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.5 billion, earnings will come to $848.1 million, and it would be trading on a PE ratio of 10.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of $98.78, the bullish analyst price target of $153.0 is 35.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.