Key Takeaways

- Tariff pressures, sustainability demands, and shifting consumer preferences threaten profitability and relevance, especially as core categories risk becoming outdated.

- Increased competition from digital-native brands and warmer climate trends heighten market share risks and sales volatility for Columbia’s traditional outdoor wear focus.

- Global supply chain flexibility, strategic international growth, brand investment, cost-saving initiatives, and focus on innovation position Columbia for resilient revenue and margin expansion.

Catalysts

About Columbia Sportswear- Designs, develops, markets, and distributes outdoor, active, and lifestyle products in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada.

- Intensifying tariff pressures and unprecedented U.S. trade policy uncertainty are expected to significantly increase input costs, with management projecting a $40 million to $45 million hit to cost of goods sold in the back half of 2025, which will lead to immediate and possibly prolonged gross margin compression in the world’s most important apparel market.

- Ongoing global shifts in consumer preferences towards athleisure and casual lifestyle brands may reduce demand for traditional outdoor wear, leaving Columbia increasingly exposed to revenue stagnation or long-term declines as core categories lose relevance despite their history of innovation.

- Heightened consumer emphasis on sustainability is likely to force Columbia to bear higher compliance costs for synthetic materials and complex supply chains, further eroding profitability in a long-term industry environment that penalizes brands not seen as leaders in environmental responsibility.

- Further fragmentation and direct-to-consumer brand proliferation in apparel sharply increases market share risk for Columbia, whose value-oriented outdoor positioning and legacy wholesale distribution will face increasing headwinds from upstart digitally native brands, threatening long-term revenue growth and brand relevance.

- Dependence on cold weather and outerwear categories makes Columbia acutely vulnerable to climate change and the trend of warmer winters, driving pronounced sales volatility and increasing risk of inventory buildups, markdowns, and further net earnings erosion in future years.

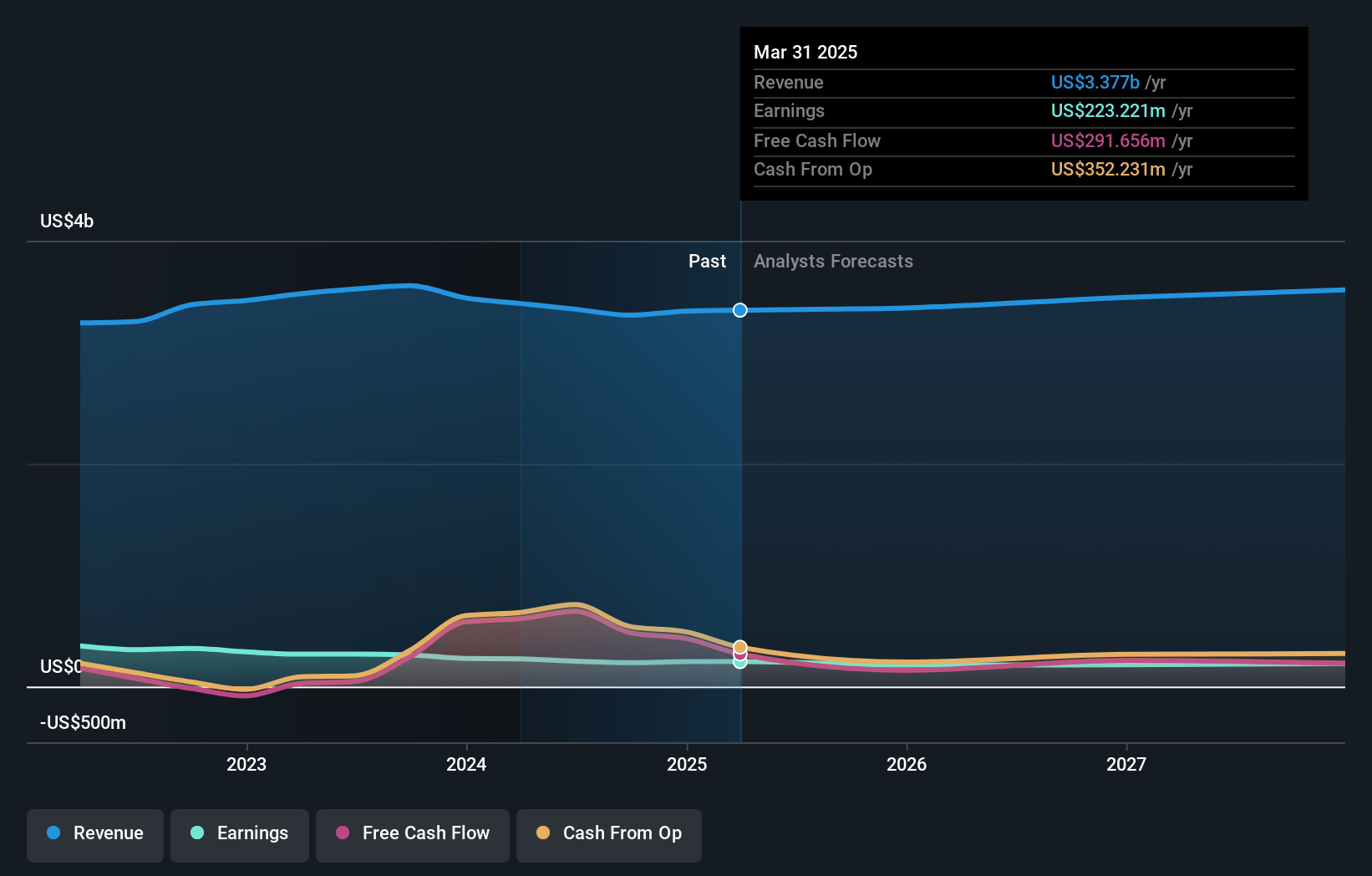

Columbia Sportswear Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Columbia Sportswear compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Columbia Sportswear's revenue will decrease by 0.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 6.6% today to 6.1% in 3 years time.

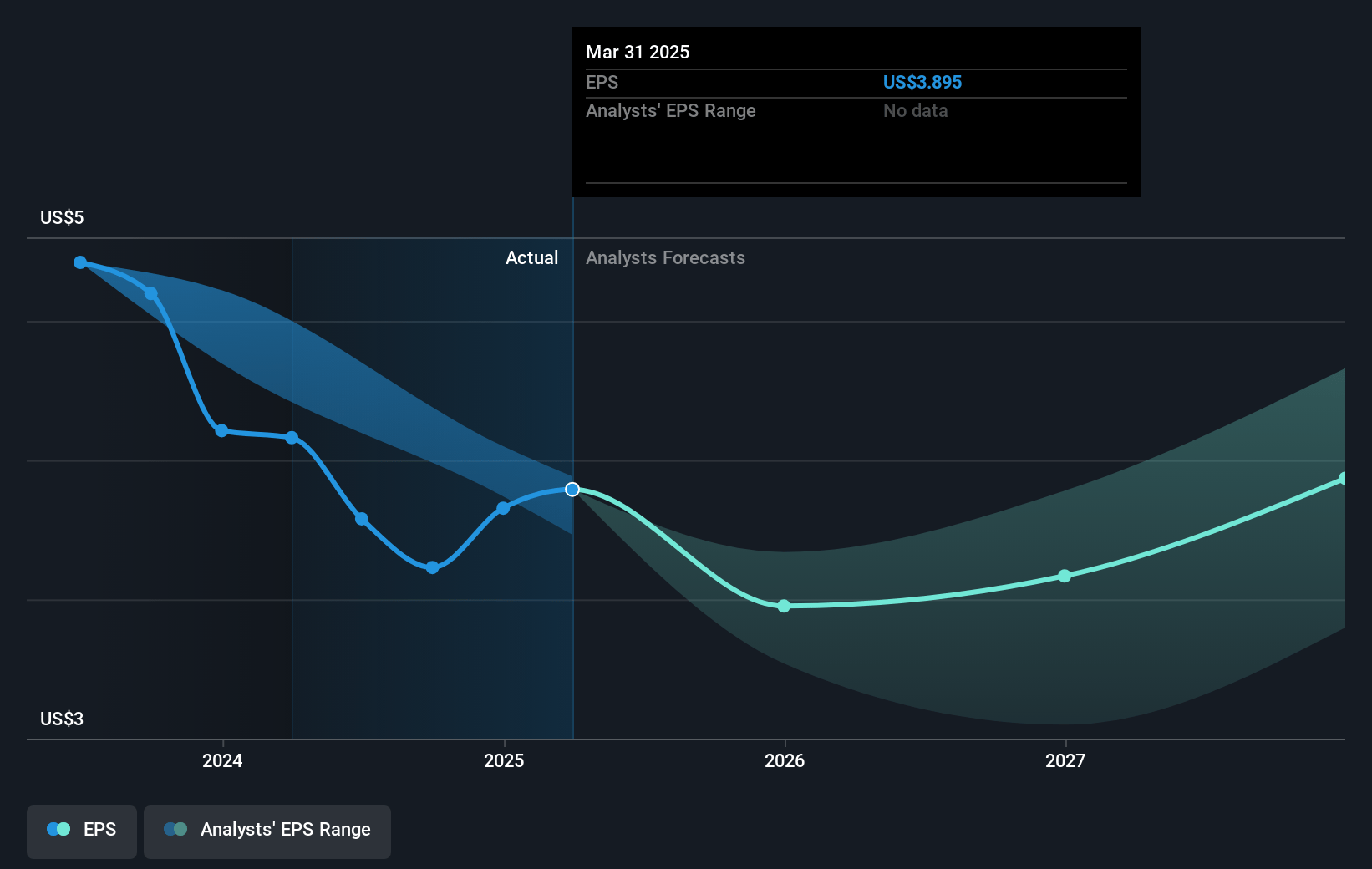

- The bearish analysts expect earnings to reach $203.0 million (and earnings per share of $3.79) by about May 2028, down from $223.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, down from 15.6x today. This future PE is lower than the current PE for the US Luxury industry at 15.6x.

- Analysts expect the number of shares outstanding to decline by 5.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

Columbia Sportswear Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Columbia’s diversified global supply chain and minimal direct China exposure enable flexibility, reducing vulnerability to tariff shocks and supporting stable gross margins and earnings even during trade uncertainty.

- The company’s international business, representing approximately 40% of annual sales and showing strong double-digit and high-single-digit growth in Asia-Pacific and EMEA regions, offsets U.S. market headwinds and supports overall revenue growth.

- Columbia is investing heavily in brand-building and innovative marketing campaigns, especially in key international growth markets like China, Japan, and Europe, which can drive long-term demand creation and reinforce pricing power, providing resilience to top-line revenue and market share.

- Ongoing operational cost savings initiatives, including a three-year profit improvement plan aiming for at least $150 million in annualized cost savings and enhanced supply chain efficiencies, are positioning Columbia to expand operating margins over time.

- The company’s long-term focus on proprietary product technologies, localizing offerings for younger and premium-seeking consumers (especially in China), and expanding direct-to-consumer and digital channels are well aligned with secular industry trends and may support sustained revenue growth and higher net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Columbia Sportswear is $51.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Columbia Sportswear's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $84.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $203.0 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of $63.21, the bearish analyst price target of $51.0 is 23.9% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.