Key Takeaways

- Accelerated adoption of digital and AI tools, along with enhanced subscription models, positions the company for scalable margin expansion and compounding growth in recurring revenue.

- Strategic investments in digital infrastructure and education, combined with industry consolidation opportunities, are driving diversification, premium pricing, and long-term market share gains.

- Failure to accelerate digital transformation amid shifting customer preferences and sector vulnerabilities threatens Franklin Covey's revenue stability, pricing power, and long-term earnings growth.

Catalysts

About Franklin Covey- Provides training and consulting services in the areas of execution, sales performance, productivity, customer loyalty, leadership, and educational improvement for organizations and individuals worldwide.

- Analyst consensus recognizes strong early adoption of digital and AI-driven coaching tools, but there is a clear path for further penetration and monetization-if AI tools progress from the current 43% client adoption to full enterprise-wide deployment, Franklin Covey could unlock a step-change in subscription adoption and achieve outsized margin expansion as delivery becomes increasingly automated and scalable.

- While analysts broadly agree that the new sales force structure drives higher new client wins and average contract values, they may be underestimating the flywheel effect: as new logo wins combine with a rising attach rate of subscription services (60% currently), an accelerating expansion within large enterprise clients and multiyear deals could produce compounding growth in deferred and recurring revenue, supporting significantly faster top-line growth and operating leverage over the next several years.

- The intensifying corporate focus on organizational culture, employee engagement, and leadership as core strategic levers-amid rapid workplace change and global hybrid work adoption-positions Franklin Covey's proprietary, outcome-based solutions for sustained pricing power and premium contract wins, supporting both revenue growth and structurally higher net margins.

- Franklin Covey's substantial investments in digital delivery infrastructure and data analytics are creating a differentiated ecosystem that is increasingly attractive for potential bolt-on acquisitions of smaller content or technology firms in the fragmented learning space, paving the way for transformative M&A that could accelerate market share gains and earnings accretion.

- As global education systems and enterprises direct larger budgets into measurable upskilling and leadership outcomes, the company's rapidly scaling Education business-with nearly 8,000 schools globally and growing district/statewide contracts-creates a powerful recurring revenue stream that over time will materially diversify revenue, reduce cyclicality, and drive a re-rating of forward earnings multiples.

Franklin Covey Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Franklin Covey compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Franklin Covey's revenue will grow by 2.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.8% today to 7.3% in 3 years time.

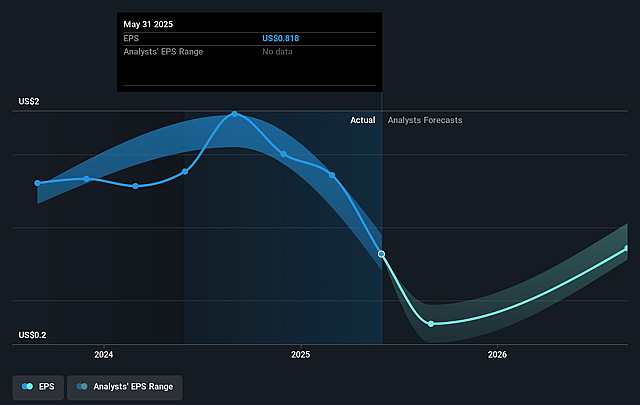

- The bullish analysts expect earnings to reach $22.3 million (and earnings per share of $1.62) by about September 2028, up from $10.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.1x on those 2028 earnings, down from 22.3x today. This future PE is lower than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to decline by 4.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.0%, as per the Simply Wall St company report.

Franklin Covey Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of digital and AI-powered learning tools across the industry could diminish the value proposition of Franklin Covey's traditional in-person and workshop-based offerings, which if not offset by effective digital transformation, may erode future revenues and reduce earnings potential.

- Prolonged economic uncertainty, government budget cuts, and sunset of education stimulus funds are causing key clients to scrutinize and delay discretionary spending on professional development and training, as evidenced by deferred contract wins and a downward revision in revenue guidance, posing ongoing risks to top-line revenue and cash flow.

- Continued heavy reliance on recurring subscription revenue from the All Access Pass leaves Franklin Covey exposed to risks from client downsizing, lower renewal dollar values, and potential inability to upsell or retain large customers, which could directly pressure future recurring revenue growth and net margins.

- Increasing customer preference for customizable, on-demand, and self-paced digital learning-offered by more agile, digitally native competitors-may lead to commoditization of standardized workshop-centric solutions, undermining Franklin Covey's pricing power and compressing earnings over the long term.

- Sector concentration in both the education and enterprise segments, along with high exposure to government contracts, makes Franklin Covey vulnerable to sector-specific downturns, policy shifts, and major client losses, which may introduce volatility and instability in quarterly earnings and long-term revenue visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Franklin Covey is $35.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Franklin Covey's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $305.3 million, earnings will come to $22.3 million, and it would be trading on a PE ratio of 21.1x, assuming you use a discount rate of 7.0%.

- Given the current share price of $18.79, the bullish analyst price target of $35.0 is 46.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.