Last Update 19 Dec 25

Fair value Decreased 19%FC: Share Repurchases Will Support Future Earnings Power And Upside Potential

Analysts have revised their price target for Franklin Covey from 27.00 dollars to 22.00 dollars, reflecting a higher required discount rate and a lower valuation multiple, despite slightly stronger expectations for revenue growth and profit margins.

What's in the News

- Franklin Covey completed the repurchase of 750,651 shares, representing 5.74% of outstanding stock, for 22.13 million dollars under its April 18, 2024 buyback authorization (Key Developments).

- From August 13 to August 31, 2025, the company repurchased an additional 167,753 shares, or 1.33% of outstanding shares, for 3.34 million dollars under a new buyback announced on August 13, 2025 (Key Developments).

- The company issued fiscal 2026 guidance, projecting total revenue between 265 million and 275 million dollars, citing momentum across Enterprise and Education despite macroeconomic uncertainty (Key Developments).

- Franklin Covey launched a new leadership course titled “Disrupt Everything: Innovate for Impact,” aimed at helping leaders navigate constant disruption and leverage team strengths through a structured framework, available via the All Access Pass Plus (Key Developments).

- The firm also introduced “Writing for Results,” a course designed to improve organizational writing effectiveness and optionally integrate AI tools, offered in live and on demand formats through the Franklin Covey All Access Pass (Key Developments).

Valuation Changes

- Fair Value Estimate: Reduced from 27.00 dollars to 22.00 dollars, a significant downward adjustment in the target valuation.

- Discount Rate: Increased slightly from 7.00 percent to approximately 7.21 percent, reflecting a modestly higher required return.

- Revenue Growth: Nudged higher from about 2.93 percent to roughly 3.12 percent, indicating slightly stronger long term growth expectations.

- Net Profit Margin: Raised markedly from about 5.54 percent to around 8.99 percent, implying a meaningfully improved long term profitability outlook.

- Future P/E: Lowered significantly from roughly 21.52 times to about 9.27 times, signaling a substantial compression in the valuation multiple applied to future earnings.

Key Takeaways

- Increased adoption of AI and shifting buyer preferences toward analytics-driven solutions may limit high-margin services growth and make client retention more difficult.

- Escalating data privacy regulations, pricing pressures, and market saturation could compress margins and require costly investments to sustain international and digital expansion.

- Revenue growth and profit margins are at risk from macroeconomic uncertainty, rising costs, education sector headwinds, shrinking subscriptions, and intensifying digital competition.

Catalysts

About Franklin Covey- Provides training and consulting services in the areas of execution, sales performance, productivity, customer loyalty, leadership, and educational improvement for organizations and individuals worldwide.

- While Franklin Covey continues to see robust new client wins and strong trends in multi-year contract adoption-both of which could underpin future revenue growth-the ongoing adoption of AI-powered learning tools by corporate clients may reduce reliance on traditional human-led training and coaching, potentially capping future expansion of high-margin services revenue.

- Despite the company's increased investment in digital delivery platforms and growing attachment rates for subscription services, escalating global data privacy regulations could restrict Franklin Covey's ability to personalize content and upsell effectively, thereby creating operational inefficiencies and compressing net margins over the long term.

- Although management has executed cost reductions to maintain adjusted EBITDA and expects these actions to drive margin expansion in fiscal 2026, persistent pricing pressure from low-cost digital entrants and commoditized training solutions may force further investment in research and development or price concessions, ultimately weighing on net earnings and margin improvement.

- While international and education segments are showing pockets of growth with expansion into new schools and districts, these are partially offset by potential saturation and downsizing within core North American markets, which could limit top-line growth and require increasingly costly efforts to generate meaningful international revenue.

- Even as Franklin Covey invests in product innovation and benefits from consolidating its position as a trusted provider for enterprise clients, the shift of enterprise buyers toward outcome-based, analytics-driven solutions intensifies the challenge of demonstrating measurable ROI, potentially hampering client retention and future revenue scalability.

Franklin Covey Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Franklin Covey compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Franklin Covey's revenue will grow by 2.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.8% today to 5.5% in 3 years time.

- The bearish analysts expect earnings to reach $16.9 million (and earnings per share of $1.23) by about September 2028, up from $10.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.5x on those 2028 earnings, down from 21.9x today. This future PE is lower than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to decline by 4.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.0%, as per the Simply Wall St company report.

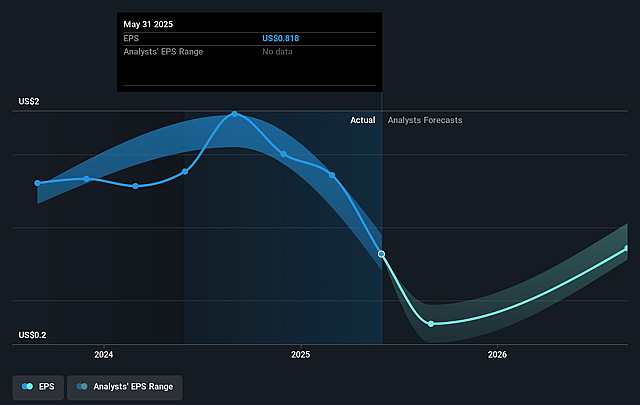

Franklin Covey Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained macroeconomic uncertainty, geopolitical risk, and government actions such as tariffs and federal contract cancellations continue to create unpredictability in client decision-making and delay investments, which could suppress Franklin Covey's revenue growth and earnings over the long term.

- The company's year-over-year decline in subscription revenue invoices, despite a stable client base and higher new client wins, suggests that client expansions are smaller in scale and some customers are downsizing their subscriptions, potentially leading to stagnant or shrinking recurring revenue streams and impacting net margins.

- Heavier investment in sales and marketing transformation, along with restructuring costs, has driven increased operating expenses, which-if not matched by a reacceleration in growth-could pressure net margins and earnings for several quarters.

- Ongoing uncertainty in the U.S. Education sector due to the sunsetting of ESSER funds and significant cuts to the Department of Education introduces risk to a substantial portion of Franklin Covey's business, potentially leading to lower-than-expected education revenue and greater volatility in reported top-line results.

- While Franklin Covey is investing in AI-enabled coaching to modernize its offerings, the company faces increasing competition from lower-cost, scalable digital learning platforms, and a risk of commoditization in training content, which could drive down pricing power and limit margin expansion or even erode existing revenue in the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Franklin Covey is $27.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Franklin Covey's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $305.3 million, earnings will come to $16.9 million, and it would be trading on a PE ratio of 21.5x, assuming you use a discount rate of 7.0%.

- Given the current share price of $18.49, the bearish analyst price target of $27.0 is 31.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Franklin Covey?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.