Last Update 08 Dec 25

LZ: Share Repurchases Will Drive Future Upside Potential

Analysts have modestly adjusted their price target on LegalZoom.com to reflect incremental improvements in the discount rate and in long-term profitability and growth assumptions. This has resulted in a slightly higher implied valuation per share in the low to mid teens dollar range.

What's in the News

- Renewed and expanded its partnership with Defy Ventures to fund national growth of mental well being and post release entrepreneurship programs, including Real Talk support groups and a new tech focused bootcamp for formerly incarcerated entrepreneurs (Client Announcements)

- Launched an embedded legal services flow, enabling partners like Wix, BusinessLoans.com, and Design.com to integrate LegalZoom services directly into their platforms, improving conversion rates by about 30% compared with the prior referral model (Product Related Announcements)

- Partnered with Design.com to integrate an AI powered logo generator into LegalZoom's platform, letting small businesses design logos and access trademark protection services in a single workflow (Client Announcements)

- Raised full year 2025 revenue guidance to a range of $748 million to $752 million, implying roughly 10% year over year growth at the midpoint (Corporate Guidance Raised)

- Provided fourth quarter 2025 revenue guidance of $182 million to $186 million, implying around 14% year over year growth at the midpoint, and reported additional share repurchases totaling $17.57 million in the latest tranche under its existing buyback program (Corporate Guidance New/Confirmed, Buyback Tranche Update)

Valuation Changes

- Discount Rate decreased slightly from 7.17% to 7.15%, modestly lifting the present value of projected cash flows

- Revenue Growth remained effectively unchanged at approximately 7.71%, indicating stable long term top line assumptions

- Net Profit Margin was effectively unchanged at approximately 12.13%, reflecting steady expectations for long term profitability

- Future P/E edged down slightly from 24.82x to 24.80x, signaling a marginally lower multiple applied to forward earnings

- Fair Value remained unchanged at approximately $12.36 per share, as small parameter tweaks largely offset one another

Key Takeaways

- AI partnerships and automation are expanding LegalZoom's market reach, boosting brand visibility, operating efficiency, and supporting scalable delivery of services.

- Growth in high-margin subscription products, bundled solutions, and successful acquisitions is increasing predictable revenues, customer retention, and driving strategic investment flexibility.

- Advances in AI, increased competition, cost pressures, declining retention, and regulatory risks collectively threaten LegalZoom's growth, margins, and long-term market position.

Catalysts

About LegalZoom.com- Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

- Accelerating adoption of online legal and compliance services, supported by strong partnerships with AI leaders like OpenAI and Perplexity, is rapidly expanding LegalZoom's addressable market and improving brand visibility, which is set to increase future revenue growth.

- Strong momentum in high-margin, recurring subscription offerings-especially within compliance and concierge do-it-for-me products-signals continued growth in predictable revenues and improved customer retention, directly supporting higher net margins and earnings stability.

- Enhanced automation and AI deployment throughout the business is driving operating efficiency gains and enabling scalable delivery of higher-touch services, underpinning continued EBITDA margin expansion and reduced cost structure.

- Ongoing investment in upmarket and bundled solutions, coupled with successful integration and upsell cross-sell opportunities from acquisitions like Formation Nation, is broadening LegalZoom's product suite, targeting higher-LTV customers and increasing wallet share, which will benefit both revenue and gross margins.

- Robust free cash flow generation and a strengthened balance sheet provide LegalZoom with flexibility to strategically invest in growth initiatives and pursue further M&A, supporting long-term earnings growth.

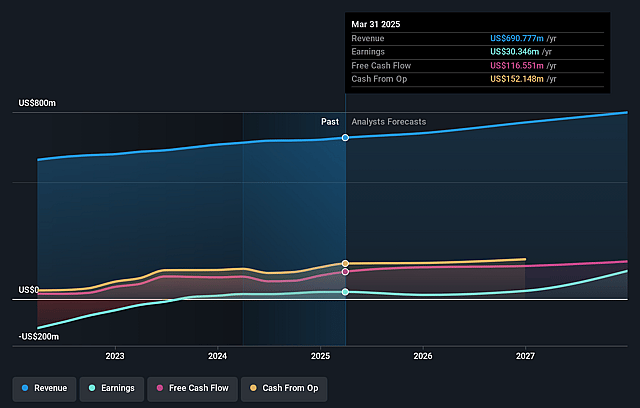

LegalZoom.com Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LegalZoom.com's revenue will grow by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.1% today to 8.2% in 3 years time.

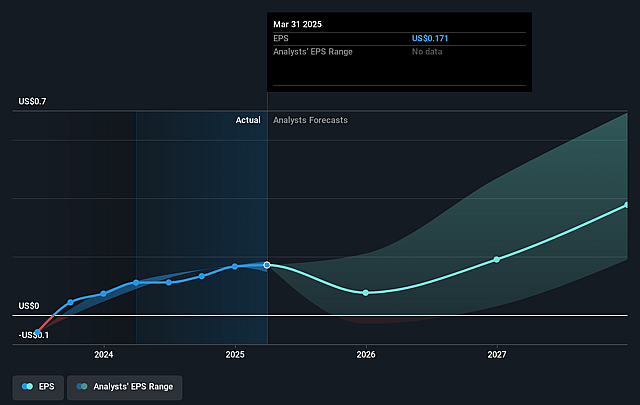

- Analysts expect earnings to reach $72.3 million (and earnings per share of $0.35) by about September 2028, up from $28.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $90.0 million in earnings, and the most bearish expecting $62.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.3x on those 2028 earnings, down from 65.0x today. This future PE is greater than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to grow by 4.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

LegalZoom.com Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid advancement of generative AI and commoditization of legal documents could enable consumers and new competitors to easily replicate core formation and compliance services at lower costs, putting sustained downward pressure on LegalZoom's revenues and market share over the long term.

- Bundling lower-priced, lower-retention products (such as forms, eSignature, and bookkeeping) into its premium SKUs has led to a decrease in aggregate subscription retention rates (currently at 59%, down from 60%), elevating customer churn risk and threatening the predictability and growth of recurring revenues.

- Increased investment in hands-on "do-it-for-me" (DIFM) offerings and newly acquired sales teams introduces sizable cost pressures at scale, and until automation fully offsets these expenses, margin expansion and net earnings growth may be constrained.

- Intensifying price competition from both established law firms moving online and proliferating lower-cost or open-source alternatives may erode LegalZoom's brand differentiation, forcing continued sales and marketing spend, which could weigh on gross margins and profitability.

- Ongoing regulatory scrutiny and potential allegations around the unauthorized practice of law, especially as LegalZoom expands its service suite or geographic footprint, may result in costly legal defenses, regulatory restrictions, or settlements, impacting operating income and overall financial health.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.643 for LegalZoom.com based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $8.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $876.4 million, earnings will come to $72.3 million, and it would be trading on a PE ratio of 40.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of $10.37, the analyst price target of $11.64 is 10.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on LegalZoom.com?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.