Key Takeaways

- Premium subscription growth, AI-enabled automation, and strategic ecosystem integrations are positioning LegalZoom for sustained margin expansion and accelerated revenue growth.

- Strong execution in acquisitions and a dominant brand amid expanding online legal services fuel potential for outsized market share and compounding subscription gains.

- Advances in AI, rising competition, regulatory challenges, and subscription churn threaten LegalZoom's margins, growth potential, and long-term stability in the online legal services market.

Catalysts

About LegalZoom.com- Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

- Analyst consensus sees LegalZoom's upmarket shift and premium bundling driving steady growth, but initial traction with DIFM (do-it-for-me) concierge offerings and early product cross-sell data suggest premium subscriptions could scale much faster than anticipated, unlocking significantly greater revenue and customer lifetime value as high-value products become the company's default purchase path.

- While analysts broadly expect net margin improvement from technology efficiencies and AI, LegalZoom's uniquely deep proprietary legal data and integrations with leading AI partners (e.g., OpenAI, Perplexity) position it for industry-leading automation and margin expansion, with the likelihood of margins significantly outpacing current expectations as AI-driven personalization penetrates both current and new product lines.

- As the migration of legal and professional services online accelerates, LegalZoom's deepening ecosystem integrations with key platforms such as QuickBooks, Shopify, and 1-800 Accountants make it the de facto digital launchpad for new businesses, unlocking a step-change in addressable market and a durable, growing stream of top-line revenue.

- The rise in entrepreneurship, the gig economy, and widespread business formation-trends still in their early innings-create a multi-year tailwind for affordable, accessible online legal solutions; LegalZoom's dominant brand and predictive, scalable subscription model position it to capture an outsized portion of this secular growth, fueling a compounding acceleration in both revenue and total subscriptions.

- The company's rapid execution in strategic M&A and proven ability to integrate and cross-sell (as seen with Formation Nation) demonstrate a platform that can quickly scale into both acquisition targets and new verticals, making further accretive M&A a realistic lever for meaningfully boosting both revenue growth and earnings per share beyond what is currently reflected in the stock price.

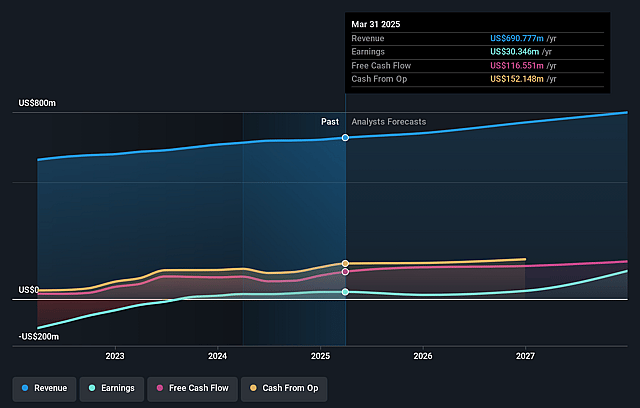

LegalZoom.com Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on LegalZoom.com compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming LegalZoom.com's revenue will grow by 11.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.1% today to 11.5% in 3 years time.

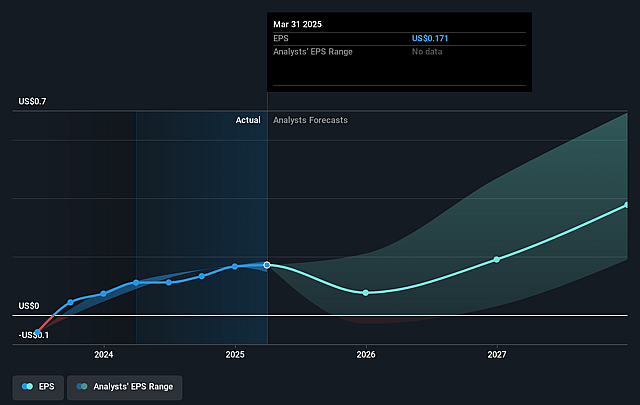

- The bullish analysts expect earnings to reach $111.8 million (and earnings per share of $0.59) by about September 2028, up from $28.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.3x on those 2028 earnings, down from 65.0x today. This future PE is greater than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to grow by 4.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

LegalZoom.com Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid and widespread adoption of generative AI and large language models may enable individuals to generate legal documents and handle basic legal matters themselves, which could significantly erode LegalZoom's market share and reduce its core subscription and transaction revenues over time.

- Customer acquisition costs are likely to keep rising as the online legal services space sees increased competition from both existing companies and agile new AI-based legal startups, which could pressure net margins and diminish LegalZoom's profitability as spend is required to maintain growth.

- Basic legal documents and services are becoming increasingly commoditized due to technological advances and the proliferation of competitors, which will likely compress industry-wide pricing power and place continued downward pressure on LegalZoom's margins and earnings growth potential.

- Retention rates for bundled, lower-priced subscription cohorts remain in decline, and the company's heavy reliance on recurring subscription revenue leaves it exposed to higher churn risk as new automation tools and economic cycles potentially destabilize this revenue stream and increase earnings volatility.

- LegalZoom faces regulatory risk from evolving data privacy requirements, cybersecurity concerns, and potential new rules or legal industry lobbying that could restrict the online legal services providers' scope of offerings, leading to increased compliance costs or a smaller addressable market and negatively impacting future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for LegalZoom.com is $14.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of LegalZoom.com's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $8.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $973.6 million, earnings will come to $111.8 million, and it would be trading on a PE ratio of 31.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of $10.37, the bullish analyst price target of $14.0 is 25.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on LegalZoom.com?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.