Key Takeaways

- LegalZoom focuses on reaccelerating subscription growth with high-value customers and leveraging AI for efficient, high-value service delivery to enhance margins and revenue predictability.

- Strategic acquisitions and optimized brand spending aim to boost high-value customer acquisition and sustainable revenue growth through enhanced product offerings and partnerships.

- LegalZoom's shift to subscriptions and partnership reliance involves execution and integration risks, potentially impacting revenue growth, profitability, and operational efficiency.

Catalysts

About LegalZoom.com- Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

- LegalZoom is focusing on driving sustainable results by reaccelerating subscription revenue growth, particularly by shifting to higher-value customers and maintaining a strong technology platform, which is expected to improve revenue predictability and increase overall revenue.

- The introduction of quality share over sheer market share, focusing on high-intent customers who purchase more expensive initial packages, aims to strengthen LegalZoom's brand and customer lifetime value, enhancing longer-term earnings.

- By leveraging AI and its vast proprietary data and network of attorneys, LegalZoom intends to improve service efficiency and deliver high-value solutions, enhancing net margins through increased efficiencies and customer value delivery.

- LegalZoom's recent acquisition of Formation Nation is expected to contribute positively to adjusted EBITDA in the first year, enhancing net margins through synergies and expanded product offerings.

- The company's new strategy of increasing brand spend without expanding the budget by optimizing its marketing mix, along with partnership models (like the one with 1-800 Accountants), aims to boost high-value customer acquisition, supporting consistent and sustainable revenue growth.

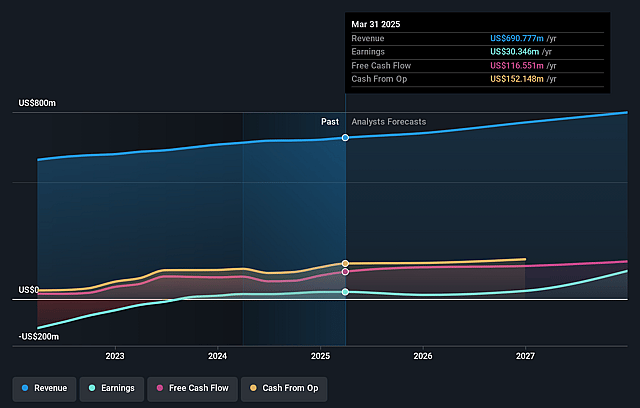

LegalZoom.com Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LegalZoom.com's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 9.4% in 3 years time.

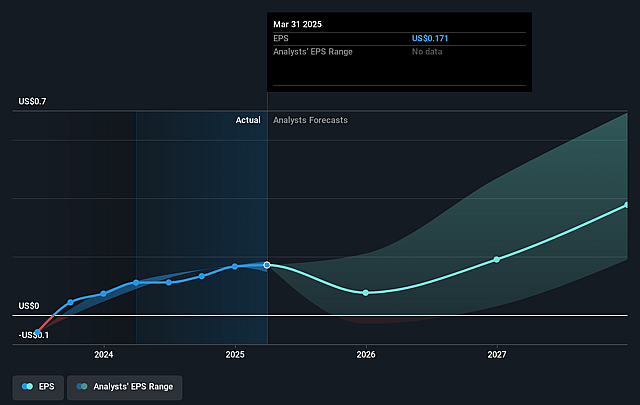

- Analysts expect earnings to reach $75.8 million (and earnings per share of $0.33) by about July 2028, up from $30.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.9x on those 2028 earnings, down from 53.4x today. This future PE is greater than the current PE for the US Professional Services industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 3.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.57%, as per the Simply Wall St company report.

LegalZoom.com Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- LegalZoom's strategic focus on quality share over market share might result in fewer client acquisitions, potentially impacting overall revenue growth if high-value customer conversion does not meet expectations.

- With the legal environment for beneficial ownership filings remaining volatile, unpredictable changes in compliance requirements could cause fluctuations in transaction volumes, directly affecting revenue from such services.

- LegalZoom's pricing strategy, which includes aligning pricing with perceived value, may face challenges if customer demand proves to be price sensitive, impacting revenue and overall profitability.

- The transition away from transactional revenue towards a subscription-based model may experience execution risks, which could affect both short-term revenue and long-term sustainability.

- LegalZoom's reliance on partnership and M&A efforts, like the Formation Nation acquisition, to bolster growth and diversify offerings carries integration risks and could deter focus from its core subscription services, potentially affecting operational efficiencies and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.786 for LegalZoom.com based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $807.2 million, earnings will come to $75.8 million, and it would be trading on a PE ratio of 30.9x, assuming you use a discount rate of 6.6%.

- Given the current share price of $8.94, the analyst price target of $9.79 is 8.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.