Key Takeaways

- Bundling entry-level services with premium packages and strategic acquisitions are boosting customer engagement, retention, and the growth of high-value, recurring subscriptions.

- Advanced technology and AI investments are driving greater automation, improved efficiency, scalable operations, and higher long-term profitability across LegalZoom’s expanding addressable market.

- Rising competition, commoditization, and regulatory risks threaten LegalZoom’s pricing power, market size, revenue growth, and ability to capture higher-margin, complex legal work.

Catalysts

About LegalZoom.com- Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

- LegalZoom is experiencing accelerating subscription revenue growth, driven by bundling entry-level products like forms, e-signature, and bookkeeping into premium formation packages. This approach familiarizes new business owners with LegalZoom’s ecosystem from day one, increases early engagement, and positions them for upselling and cross-selling into higher-value and higher-margin subscriptions over time, directly supporting future top-line and recurring revenue growth.

- Investments in advanced technology and artificial intelligence are enabling greater automation across LegalZoom’s offerings, improving operational efficiency, lowering customer service and fulfillment costs, and increasing the scalability of the business. As AI further streamlines document creation, compliance, and customer support, this is expected to drive net margin expansion and higher long-term profitability.

- The continued growth of entrepreneurship and the gig economy is structurally expanding the pool of small business owners and independent contractors seeking affordable, technology-enabled legal solutions. This secular tailwind is likely to increase LegalZoom’s addressable market and fuel sustained user acquisition and revenue growth well above macroeconomic trends.

- The strategic acquisition and integration of Formation Nation creates a barbell business model that captures both value-oriented and premium customers, efficiently segregating lower-margin, high-churn transaction customers under Inc Authority while refocusing LegalZoom on higher-value, high-retention subscribers. This integration not only improves average revenue per user and customer lifetime value, but also enables LegalZoom to accelerate monetization across differentiated customer segments, leading to enhanced overall earnings quality.

- LegalZoom’s expanding suite of compliance, estate planning, and virtual mail products – along with price optimization strategies that have shown inelastic demand in critical categories like registered agent services – support sustained increases in subscription adoption, average revenue per subscription, and durability of cash flows. This pricing power and product expansion underpin forecasts for strong future revenue growth and stable or rising operating margins.

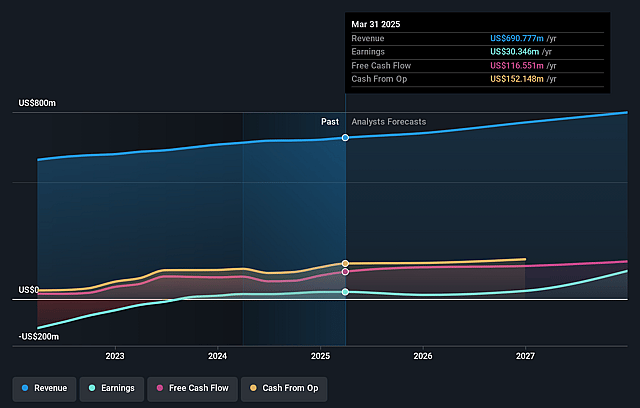

LegalZoom.com Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on LegalZoom.com compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming LegalZoom.com's revenue will grow by 10.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.4% today to 15.2% in 3 years time.

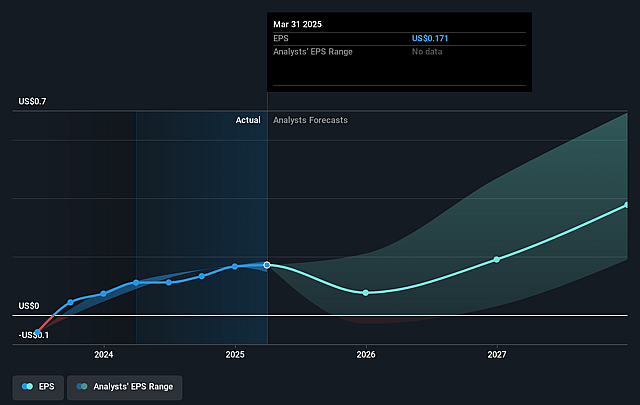

- The bullish analysts expect earnings to reach $141.4 million (and earnings per share of $0.81) by about July 2028, up from $30.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.3x on those 2028 earnings, down from 53.4x today. This future PE is lower than the current PE for the US Professional Services industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 3.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.57%, as per the Simply Wall St company report.

LegalZoom.com Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acceleration of AI-driven document creation and the proliferation of free or open-source templates may erode LegalZoom’s pricing power, particularly in basic legal services, resulting in pressure on both revenue growth and net margins over the long term.

- Persistent declines in business formation volumes and the company’s own shift away from high-volume, low-value (“empty calorie”) customers signal a potential contraction in the addressable market for paid document and formation services, which could negatively affect overall revenue.

- Intensifying competition from both traditional law firms moving online and new tech-first legal startups, combined with LegalZoom’s positioning as a brand for lower-complexity work, may limit the company’s ability to attract higher-margin, complex legal cases, capping margin expansion and long-term earnings.

- LegalZoom’s increasing reliance on upselling bundled and entry-level subscriptions with inherently lower average revenue per user and renewal rates could challenge customer lifetime value and make sustaining top-line growth and recurring revenue more difficult.

- Potential regulatory changes or stepped-up enforcement around the “practice of law” may restrict the range of services LegalZoom is allowed to offer, particularly in lucrative areas requiring licensed advice, thereby creating risk to both future revenue streams and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for LegalZoom.com is $12.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of LegalZoom.com's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $932.7 million, earnings will come to $141.4 million, and it would be trading on a PE ratio of 20.3x, assuming you use a discount rate of 6.6%.

- Given the current share price of $8.94, the bullish analyst price target of $12.0 is 25.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.