Key Takeaways

- Intensifying competition from AI, free templates, and specialized providers is eroding LegalZoom’s pricing power, margins, and customer value.

- Rising advertising and compliance costs, alongside digital transformation and privacy concerns, are compressing margins and hindering sustainable growth.

- Transition to higher-value subscriptions, technology investments, and flexible operations position LegalZoom for increased profitability, stable earnings, and resilience against economic challenges.

Catalysts

About LegalZoom.com- Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

- The expanding availability and sophistication of free or low-cost legal templates and the integration of AI document generation threaten to commoditize LegalZoom’s core services, making it increasingly difficult for the company to maintain current pricing and ARPU levels. Over time, this is likely to erode both revenue and gross margins as customers shift to alternatives that deliver similar utility at a fraction of the cost.

- LegalZoom’s heavy reliance on paid advertising for customer acquisition risks diminishing returns as digital advertising channels become more competitive and expensive. As the company notes that sales and marketing costs have been rising, this upward pressure on customer acquisition costs is likely to outpace revenue growth, resulting in ongoing margin compression and weakening earnings power.

- The rapid digital transformation of the legal industry, including traditional law firms scaling their own online offerings, poses a significant threat to LegalZoom’s future market share. As incumbent providers lower prices and offer increasingly robust digital legal solutions, LegalZoom is likely to face sustained competitive pressure, leading to slower customer growth and reduced pricing power, which will negatively impact future revenues and net income.

- Continued concerns over cybersecurity and data privacy may increasingly deter small businesses and consumers from entrusting sensitive legal data to online platforms. As data breaches and regulatory scrutiny become more prevalent, LegalZoom could face higher compliance costs, potential legal liabilities, and a decline in new customer acquisition, ultimately constraining top-line growth.

- Ongoing fragmentation and specialization within professional services mean more customers are turning to niche providers instead of broad, one-size-fits-all platforms like LegalZoom. As a result, the company’s cross-sell and up-sell opportunities are likely to decline, leading to lower long-term customer value and impeding efforts to expand average revenue per user, thereby limiting growth in recurring revenues and overall profitability.

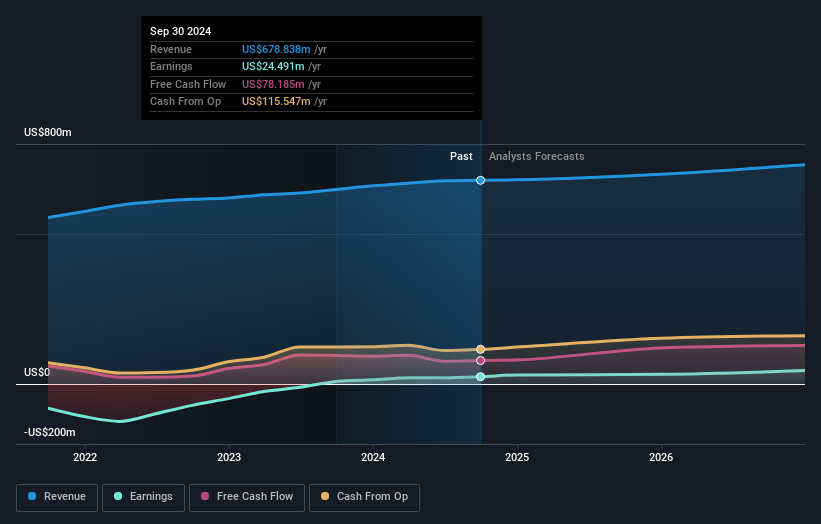

LegalZoom.com Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on LegalZoom.com compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming LegalZoom.com's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.4% today to 20.1% in 3 years time.

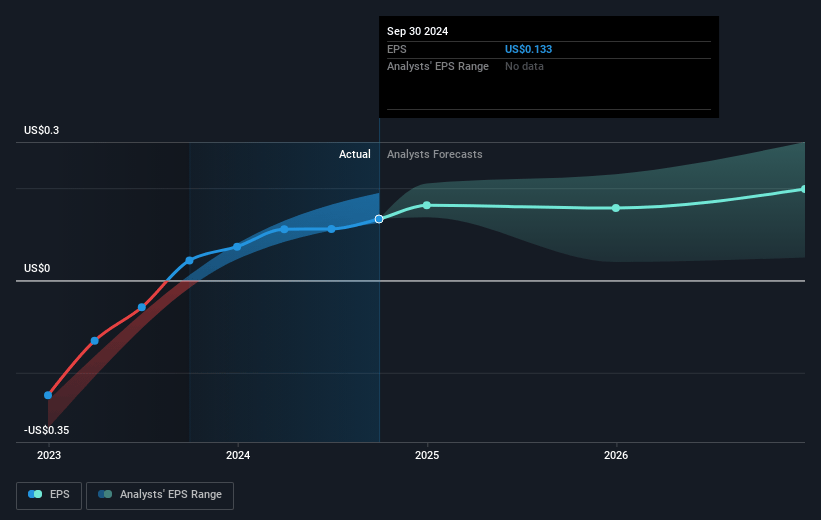

- The bearish analysts expect earnings to reach $141.4 million (and earnings per share of $0.22) by about July 2028, up from $30.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, down from 53.9x today. This future PE is lower than the current PE for the US Professional Services industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 3.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

LegalZoom.com Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- LegalZoom's continued growth in subscription revenues, now more than 60 percent of total revenue with 90 percent of recurring customers on annual plans, provides a strong base of predictable and recurring revenue, which could drive long-term increases in earnings and valuation.

- Strategic progress in shifting the business model away from low-margin formation transactions towards higher-value bundled subscriptions, cross-selling, and value-based pricing could increase average revenue per user and improve net margins over time.

- The successful integration and marketing spend increase at Formation Nation allows LegalZoom to segment and serve different customer profiles more efficiently, preserving profitability by sending cost-sensitive or low-intent customers to a separate brand while positioning LegalZoom as a premium provider, potentially stabilizing or increasing overall revenue.

- Ongoing investments in artificial intelligence, automation, and platform enhancements allow LegalZoom to scale operationally, lower delivery costs, and further improve gross and EBITDA margins, supporting sustainable long-term earnings growth.

- Strong cash generation, debt-free balance sheet, and a flexible, mostly variable cost structure provide LegalZoom with resilience against macroeconomic downturns and capital to pursue synergistic M&A, share repurchases, and new growth opportunities, all of which could drive shareholder value higher over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for LegalZoom.com is $8.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of LegalZoom.com's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $704.1 million, earnings will come to $141.4 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 6.6%.

- Given the current share price of $9.04, the bearish analyst price target of $8.0 is 12.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.