Last Update 01 May 25

We Will Drive Our Project Development With Brookfield And ArcelorMittal

Key Takeaways

- Transition from licensing to owning and financing projects allows LanzaTech to capture more value, driving revenues and profitability through technological advancements.

- Strong partnerships and unique agreements like those with Brookfield and ArcelorMittal bolster project execution, stability, and access to new market opportunities.

- Dependence on sublicense agreements and large-scale projects introduces revenue timing, geopolitical risks, and potential liquidity strains, affecting overall financial stability.

Catalysts

About LanzaTech Global- Operates as a nature-based carbon refining company in the United States and internationally.

- LanzaTech's shift from a licensing-only model to developing and financing its own projects aims to capture more value and control over timing, which could drive higher revenues and profitability as they gain more from the upside of their technology.

- The partnership with Brookfield Asset Management, which has committed $500 million for LanzaTech projects, reflects a strong capital backing to develop new projects, potentially boosting future earnings through increased project execution and ownership.

- The exclusivity and financing agreement for Project Drake and similar initiatives are expected to provide significant income, supporting a meaningful uplift in 2025 financial performance, positively impacting earnings and cash flow.

- The first long-term ethanol offtake agreement with ArcelorMittal enhances access to products, potentially leading to greater revenue stability and growth through CarbonSmart, and improves profit margins by enabling more substantial customer commitments.

- LanzaTech's capability to produce LanzaTech Nutritional Protein taps into the rapidly growing alternative protein market, which is expected to significantly boost revenue streams as it targets an estimated $1 trillion market opportunity.

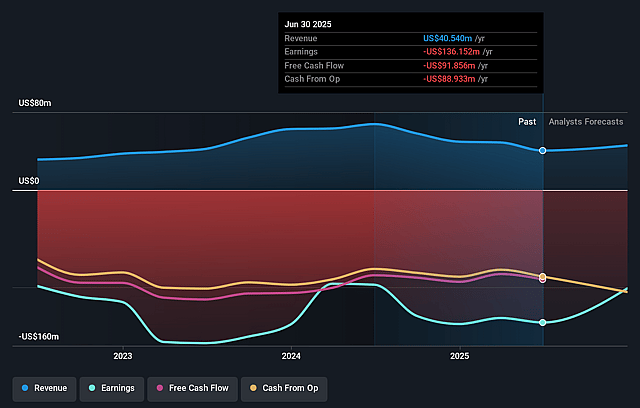

LanzaTech Global Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LanzaTech Global's revenue will grow by 57.9% annually over the next 3 years.

- Analysts are not forecasting that LanzaTech Global will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate LanzaTech Global's profit margin will increase from -277.7% to the average US Commercial Services industry of 6.1% in 3 years.

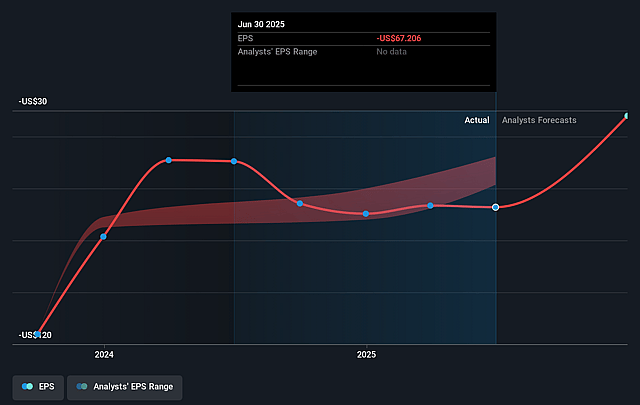

- If LanzaTech Global's profit margin were to converge on the industry average, you could expect earnings to reach $12.0 million (and earnings per share of $0.06) by about May 2028, up from $-137.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.2x on those 2028 earnings, up from -0.3x today. This future PE is greater than the current PE for the US Commercial Services industry at 27.7x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.14%, as per the Simply Wall St company report.

LanzaTech Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on sublicensing agreements with LanzaJet creates uncertainty in revenue timing, affecting potential revenue recognition and cash flow stability.

- Low ethanol prices, particularly in the Chinese market, have reduced CarbonSmart's revenue potential, impacting overall margin and earnings.

- A shift towards developing capital-intensive projects in-house necessitates significant up-front investment which could strain liquidity and impact net margins if returns do not materialize as expected.

- Achieving financial targets is dependent on multiple large-scale infrastructure projects reaching final investment decisions on schedule, posing execution risks to projected revenues and operating income.

- The company's strategy to grow through joint venture and project developments in various global regions involves geopolitical and operational risks that could affect project delivery and financial outcomes.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.0 for LanzaTech Global based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.0, and the most bearish reporting a price target of just $0.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $195.4 million, earnings will come to $12.0 million, and it would be trading on a PE ratio of 44.2x, assuming you use a discount rate of 10.1%.

- Given the current share price of $0.24, the analyst price target of $2.0 is 88.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.