Catalysts

About Concentrix

Concentrix provides technology enabled customer experience and IT services, integrating AI platforms with global delivery to support large enterprises.

What are the underlying business or industry changes driving this perspective?

- Although client surveys indicate a clear shift toward larger scale outsourcing partners to implement AI in customer operations, Concentrix could struggle to fully convert consolidation opportunities into profitable long term contracts if excess capacity with a handful of large clients persists. This could limit operating margin expansion and earnings growth.

- While demand for practical AI that augments human agents is rising and Hero is gaining traction on a per seat SaaS model, the slow commercialization of fully autonomous solutions like Hello and the prevalence of gain share constructs may delay high margin software revenue. This could mute the uplift to net margins and EPS.

- Although management expects multi quarter normalization of tariff related volume disruptions and is maintaining trained capacity to protect strategic accounts, a longer than anticipated recovery in global trade flows and client supply chains could keep utilization below optimal levels. This would weigh on non GAAP operating income and cash generation.

- While enterprises increasingly seek integrated CX, AI and IT transformation from a single partner, elongated decision cycles and regulatory scrutiny in sectors such as banking and health care could push out project ramps. This could suppress constant currency revenue growth and defer the operating leverage needed to improve margins.

- Although Concentrix is shifting away from low complexity, commoditized work into higher value adjacent services and AI enablement, intensified competition from both traditional CX providers and pure play AI vendors could compress pricing power. This may limit long term revenue growth and constrain adjusted EBITDA margin recovery.

Assumptions

This narrative explores a more pessimistic perspective on Concentrix compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

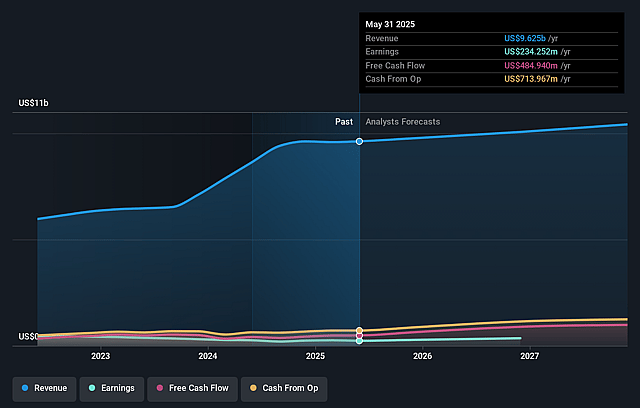

- The bearish analysts are assuming Concentrix's revenue will grow by 3.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 3.1% today to 3.0% in 3 years time.

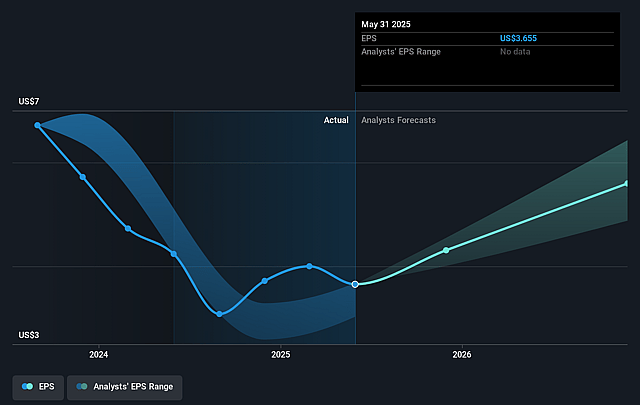

- The bearish analysts expect earnings to reach $327.7 million (and earnings per share of $5.75) by about December 2028, up from $301.8 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $388.3 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, up from 8.1x today. This future PE is lower than the current PE for the US Professional Services industry at 24.6x.

- The bearish analysts expect the number of shares outstanding to decline by 3.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.57%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Structurally weaker utilization from prolonged excess capacity with tariff impacted clients could persist if global trade flows and supply chains normalize more slowly than management anticipates. This would anchor non GAAP operating margins below target levels and restrain earnings growth over several years.

- The long term shift toward AI driven automation may not translate into the expected high margin software mix if clients continue favoring bundled pricing, gain share constructs and gradual adoption of fully autonomous solutions like Hello. This would limit the contribution of iX platforms to net margins and non GAAP EPS.

- Secular consolidation that pushes enterprises to rely on fewer large CX and IT partners could backfire if Concentrix becomes overly concentrated in a small set of sophisticated global accounts that aggressively negotiate pricing and timing of transformation. This could compress revenue growth and adjusted EBITDA margins during downturns or client specific disruptions.

- The company’s elevated net debt of approximately 4.5 billion dollars combined with rising dividends and ongoing share repurchases could constrain balance sheet flexibility if growth slows or margins fail to recover as planned. This would increase the burden of non GAAP interest expense and limit free cash flow available for reinvestment.

- Heightened competitive intensity from both traditional CX outsourcers and specialist AI vendors as generative AI matures may erode Concentrix’s current win rates and pricing power. This would cap constant currency revenue growth and reduce the operating leverage needed to expand non GAAP operating income over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Concentrix is $54.0, which represents up to two standard deviations below the consensus price target of $64.8. This valuation is based on what can be assumed as the expectations of Concentrix's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $54.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $10.8 billion, earnings will come to $327.7 million, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 11.6%.

- Given the current share price of $39.45, the analyst price target of $54.0 is 26.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Concentrix?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.