Key Takeaways

- Accelerating AI adoption and digital transformation position Concentrix for stronger-than-expected growth, margin expansion, and high-value recurring revenue streams.

- Strategic integration, cross-selling, and industry consolidation enhance market share, pricing power, and long-term earnings, supported by operational efficiencies and automation.

- Rapid AI adoption, client concentration, integration challenges, intense competition, and rising regulatory costs threaten Concentrix's profitability, margins, and revenue stability.

Catalysts

About Concentrix- Designs, builds, and runs integrated customer experience (CX) solutions worldwide.

- Analyst consensus expects meaningful revenue and margin uplift from GenAI integration, but these forecasts may underestimate Concentrix's true earnings potential-client demand for proven, scalable AI deployments and the rapid transformation of pilot projects into full-scale, recurring revenue contracts could accelerate growth trajectories well above current estimates, significantly boosting both revenue and net margins.

- Analysts broadly agree that Webhelp integration will add margin synergies, yet this likely understates longer-term margin expansion and earnings power; Concentrix's ongoing cross-selling of higher-value, digitally enabled services post-acquisition, coupled with realization of further operational efficiencies, sets the stage for sustained net margin expansion and stronger free cash flow growth than currently modeled.

- The enterprise shift to large-scale digital transformation, still in its early innings, is creating multi-year outsourcing opportunities for partners with global reach and deep digital capabilities-Concentrix has already demonstrated a high win rate in this environment, positioning it for accelerated revenue growth and a scaling base of sticky, recurring enterprise contracts.

- With more than half of its client base already utilizing GenAI-enabled solutions and rapid uptake of commercialized AI products like iX Hello, Concentrix is uniquely well-placed to capture the next wave of enterprise AI and automation spend, opening up significant new revenue streams and supporting above-consensus margin improvement through automation-led efficiency.

- Tightening global data privacy standards and the move toward remote, omni-channel customer engagement are likely to accelerate industry consolidation in Concentrix's favor, catalyzing higher market share, improved pricing power, and durable long-term margin and earnings growth.

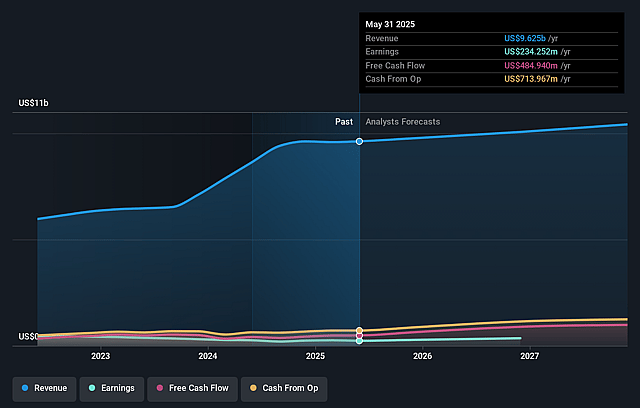

Concentrix Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Concentrix compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Concentrix's revenue will grow by 1.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.7% today to 6.3% in 3 years time.

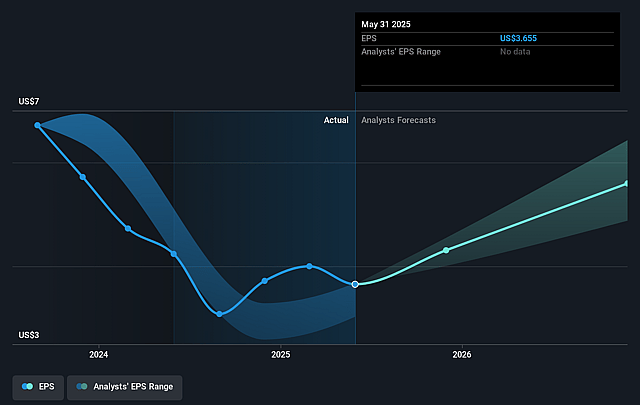

- The bullish analysts expect earnings to reach $630.0 million (and earnings per share of $10.2) by about June 2028, up from $258.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, down from 13.8x today. This future PE is lower than the current PE for the US Professional Services industry at 22.6x.

- Analysts expect the number of shares outstanding to decline by 2.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.37%, as per the Simply Wall St company report.

Concentrix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The aggressive adoption of AI and automation carries a risk that the demand for human-driven customer service solutions-historically Concentrix's core revenue base-will decline, potentially outpacing Concentrix's shift to new AI offerings and threatening both revenue growth and long-term earnings if AI cannibalizes existing service lines faster than new AI revenues scale.

- Heavy client concentration is evident, with top 25 clients driving higher-than-average growth compared to the rest of the business, which could expose Concentrix to revenue volatility and margin pressure if any major client chooses to insource operations, consolidate with competitors, or reduce spending in the face of increasing automation options.

- Persistent integration and execution risks such as the ongoing Webhelp and ServiceSource integrations may create operational disruptions and delayed synergy realization, raising integration costs and pressuring net margins and future earnings, particularly if cost savings take longer to materialize or clients churn during transitions.

- The broader commoditization of BPO services and increased competition from tech-enabled and automation-first entrants is likely to drive price-based competition and margin compression, especially as Concentrix's own revenue guidance points only to muted-constant currency growth of 0 percent to 1.5 percent for 2025-with the risk that margins could erode further if the company fails to significantly differentiate its technology offerings.

- As global data privacy regulations tighten and operational costs rise-including compliance costs, offshoring risks from geopolitical instability, and heightened ESG requirements-Concentrix will likely face upward pressure on its fixed cost base, threatening profitability and reducing net margins even if revenues are maintained or grow slowly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Concentrix is $80.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Concentrix's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $54.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $10.1 billion, earnings will come to $630.0 million, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 9.4%.

- Given the current share price of $55.63, the bullish analyst price target of $80.0 is 30.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Concentrix?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.