Key Takeaways

- Backlog growth, new contract wins, and global defense spending are set to drive sustained long-term revenue and support gradual earnings stability.

- Cost-control measures, workforce cuts, and improved balance sheet position the company for stronger profitability as higher-margin orders are fulfilled.

- Execution risks, supply chain delays, concentrated customer reliance, and capital pressures create ongoing uncertainty around growth prospects, profitability, and competitive strength.

Catalysts

About Air Industries Group- Engages in the design, manufacture, and sale of precision components and assemblies for defense and aerospace industry in the United States.

- A record backlog-currently at historically high, fully funded levels exceeding $120 million-positions the company for a significant increase in future revenue as elongated lead times begin converting into sales starting in late 2026 and 2027.

- Sustained and rising global defense expenditures, driven by new U.S. military programs (such as the F-47, F/A-XX, and expanded legacy aircraft support), are expected to create prolonged demand for Air Industries Group's precision aerospace components, contributing to long-term revenue growth.

- Increased investments in new and legacy military aircraft platforms (e.g., B-52, CH-53K, F-35) bolster the necessity for both OEM and aftermarket aerospace components, validating recent contract wins and supporting future sales and free cash flow.

- Strategic moves to diversify the customer base, expand content on new high-growth platforms, and penetrate aftermarket channels are likely to reduce revenue volatility and improve earnings stability over time.

- Cost-control initiatives and workforce reductions, coupled with a stronger balance sheet after the recent capital raise, are expected to support improved net margins and profitability as higher-margin backlog begins to be recognized in results.

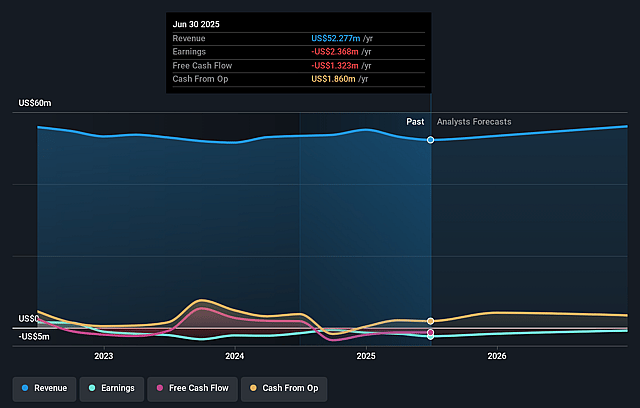

Air Industries Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Air Industries Group's revenue will grow by 2.6% annually over the next 3 years.

- Analysts are not forecasting that Air Industries Group will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Air Industries Group's profit margin will increase from -3.1% to the average US Aerospace & Defense industry of 8.2% in 3 years.

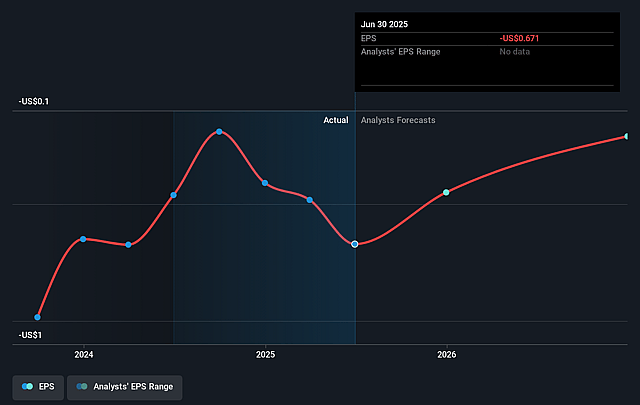

- If Air Industries Group's profit margin were to converge on the industry average, you could expect earnings to reach $4.7 million (and earnings per share of $1.18) by about August 2028, up from $-1.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, up from -6.6x today. This future PE is lower than the current PE for the US Aerospace & Defense industry at 33.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Air Industries Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent sales stagnation or declines, despite record backlog, highlight ongoing execution risk in converting orders into actual revenue, raising concerns about long-term revenue growth and earnings realization.

- Extended and unpredictable lead times for both raw materials and customer approvals cause significant delays in revenue recognition, increasing the risk of ongoing revenue volatility and working capital pressures.

- Recent workforce reductions and cost-cutting may support short-term profitability, but could constrain operating leverage and undermine the company's ability to invest in future growth and next-generation manufacturing, potentially impacting net margins and competitive positioning.

- Heavy reliance on a small group of large OEM and government clients, with a material portion of future sales tied to long-term defense programs, exposes Air Industries Group to revenue disruption if key contracts are cancelled, downsized, or delayed, intensifying earnings uncertainty.

- Ongoing necessity to raise capital-evidenced by the recent $4 million share offering-signals potential balance sheet strain and may dilute shareholders if revenue and cash flows remain inconsistent, directly limiting future earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.5 for Air Industries Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $57.5 million, earnings will come to $4.7 million, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 12.3%.

- Given the current share price of $2.9, the analyst price target of $6.5 is 55.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.