Key Takeaways

- Regulatory changes and market trends towards energy-efficient systems and electrification are expected to drive revenue growth and expand margins.

- Investments in digital platforms and OEM collaborations are anticipated to enhance market share and profitability through improved efficiency and market penetration.

- Strong sales growth, technological innovation, and strategic investments position Watsco for future success in a promising geographical and regulatory environment.

Catalysts

About Watsco- Engages in the distribution of air conditioning, heating, refrigeration equipment, and related parts and supplies in the United States and internationally.

- The transition to A2L systems starting in 2025 is seen as a growth opportunity due to regulatory changes, which historically have been beneficial for Watsco. This could impact future revenue positively as new systems tend to be sold at higher prices due to increased regulatory requirements.

- Investments in e-commerce and digital platforms like OnCall Air, which have expanded significantly, are expected to contribute to revenue growth by driving market share gains and enhancing efficiency for HVAC contractors.

- The trend towards electrification from fossil fuel heating is boosting sales of high-efficiency heat pump systems, which are sold at higher average unit prices than conventional systems, potentially increasing future revenue and margins.

- Ongoing investments and collaborations with primary OEMs aim to regain business and expand the customer base, which may enhance future revenue and profitability through increased scale and improved market penetration.

- The industry’s shift towards more energy-efficient ductless HVAC systems is contributing to growth, offering potential for higher margins due to increased adoption by homeowners and businesses seeking energy efficiency, impacting future earnings positively.

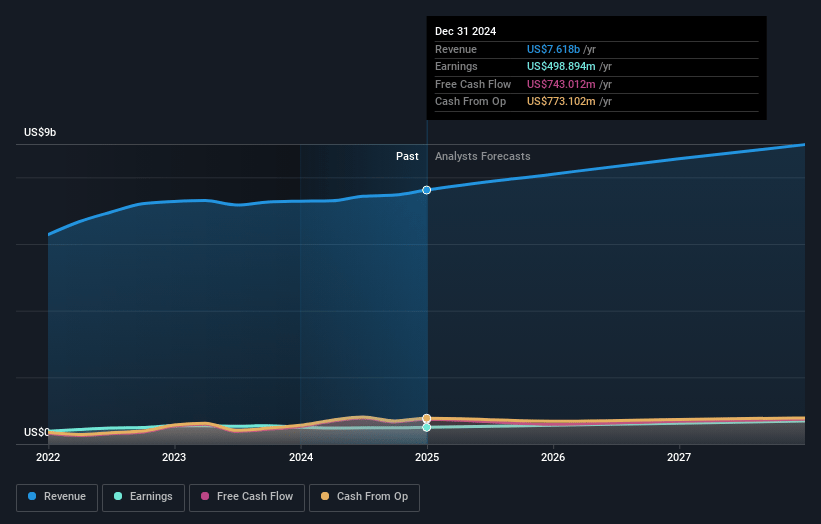

Watsco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Watsco's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.5% today to 7.8% in 3 years time.

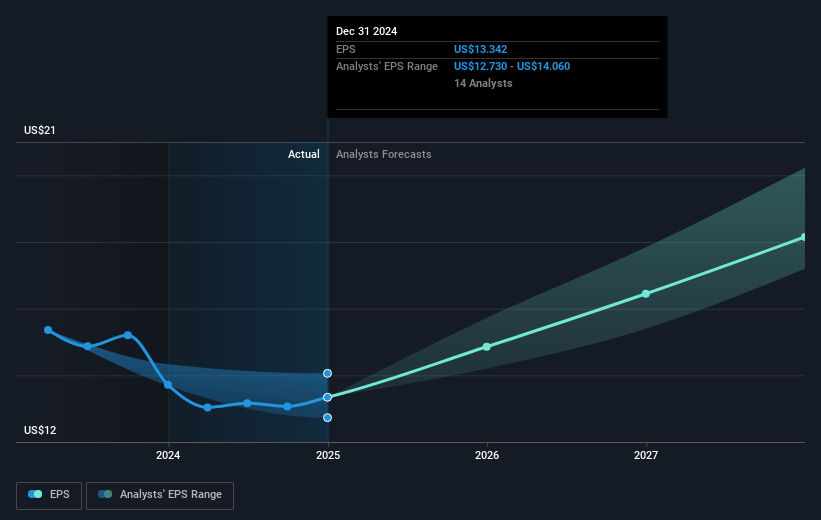

- Analysts expect earnings to reach $710.5 million (and earnings per share of $18.41) by about December 2027, up from $485.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $592.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.0x on those 2027 earnings, down from 39.9x today. This future PE is greater than the current PE for the US Trade Distributors industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.88%, as per the Simply Wall St company report.

Watsco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Watsco has consistently generated record sales and net income, with mid-single-digit sales growth and meaningful unit growth reported, suggesting strong future revenue potential.

- The company demonstrates a proven ability to leverage technological innovations and platforms for HVAC contractors, supporting ongoing revenue growth and potentially improving net margins.

- Watsco has a stable and strong balance sheet with no debt, enabling strategic investments in growth, which could lead to improved earnings and financial stability over the coming years.

- The shift towards energy-efficient products and regulatory changes, including the A2L transition, could drive increased sales and higher average unit prices, positively impacting revenue and gross margins.

- The company operates within attractive geographical markets, leveraging scale, product diversity, and entrepreneurial culture, which could sustain or improve earnings and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $474.56 for Watsco based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $550.0, and the most bearish reporting a price target of just $325.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $9.1 billion, earnings will come to $710.5 million, and it would be trading on a PE ratio of 31.0x, assuming you use a discount rate of 6.9%.

- Given the current share price of $514.1, the analyst's price target of $474.56 is 8.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives