Narratives are currently in beta

Key Takeaways

- Emphasis on innovation and strategic military focus position Titan for market share gains and potential revenue growth.

- Supply chain improvements and Carlstar integration expected to enhance efficiency, diversification, and stabilize earnings.

- Titan faces revenue pressure from agricultural market downturns, high interest rates, and weak demand, with reliance on innovation critical for maintaining margins.

Catalysts

About Titan International- Manufactures and sells wheels, tires, and undercarriage systems and components for off-highway vehicles in the United States and internationally.

- Titan's emphasis on innovative products, such as their LSW tires and VPO Technology, positions them to capture more market share in both existing and new segments, potentially boosting revenue and margins as these products are expanded into midsized tractors and consumer applications.

- Titan's strategic focus on regaining its presence in the military market could serve as a significant revenue driver, leveraging new technologies and tapping into previously lost sales channels, which would be accretive to earnings.

- The company expects significant supply chain improvements through its destocking strategy. This could lead to a rebound in OEM sales, thereby driving revenue growth and improving margins once the destocking cycle concludes.

- The integration of Carlstar is expected to bring significant synergies and diversification, leading to improved cost efficiencies and enhanced revenue streams across the consumer segment, potentially stabilizing overall earnings despite cyclical downturns in the agricultural market.

- Titan's strategic supplier partnerships and expansion into more diverse size ranges and product categories aim to optimize their product portfolio, driving incremental revenue and earnings through increased market penetration and customer wallet share.

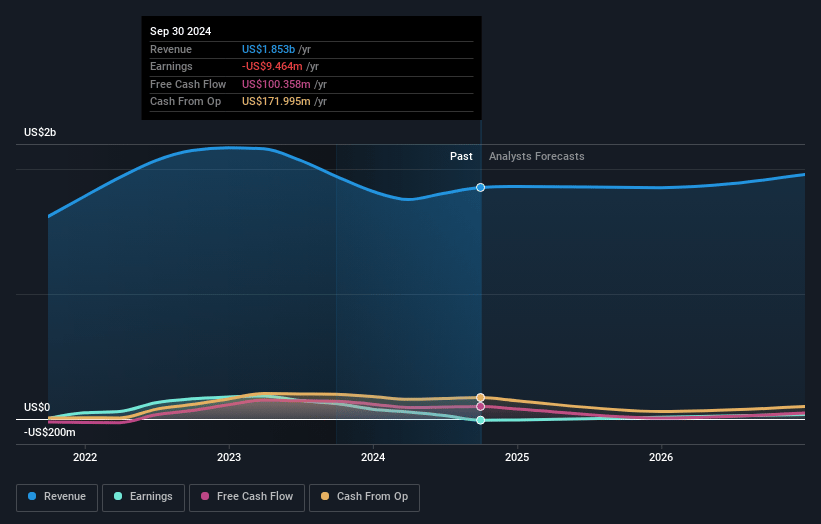

Titan International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Titan International's revenue will grow by 1.1% annually over the next 3 years.

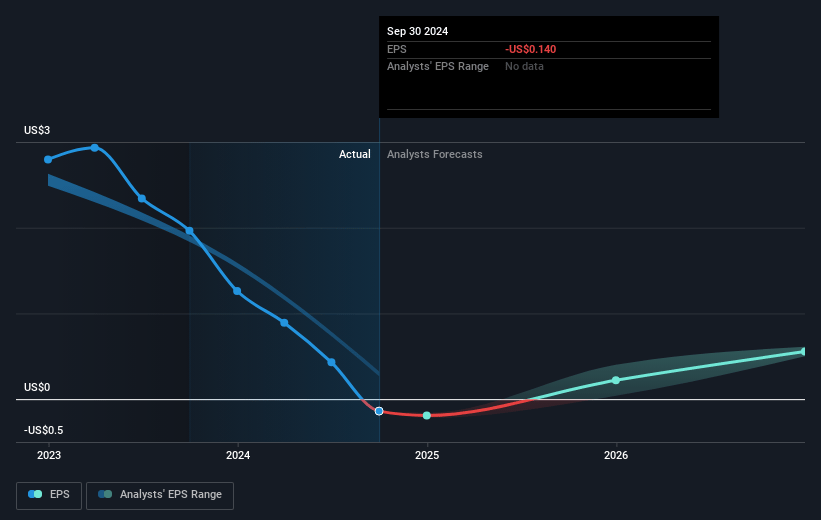

- Analysts assume that profit margins will increase from -0.5% today to 3.2% in 3 years time.

- Analysts expect earnings to reach $60.6 million (and earnings per share of $0.92) by about January 2028, up from $-9.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.1x on those 2028 earnings, up from -56.4x today. This future PE is lower than the current PE for the US Machinery industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 1.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.42%, as per the Simply Wall St company report.

Titan International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The current cyclical agricultural market downturn is one of the deepest in many years, which could pressure Titan's revenue and lead to continued challenges in maintaining margins if recovery is slow.

- High interest rates are impacting purchasing decisions and channel inventory levels, adding pressure to sales and creating uncertainty in the timing of market recovery, which could affect Titan's revenue growth in the near term.

- The ongoing movement towards lean inventory among OEMs, spurred by interest rates and post-pandemic effects, may result in reduced sales and lower fixed cost absorption, negatively impacting Titan's earnings.

- Weak farmer incomes and economic uncertainty, exacerbated by potential policy shifts post-election, imply potential continued demand softness for agricultural products, risking further revenue pressure for Titan.

- The company's heavy reliance on its aftermarket business and innovation for sales growth indicates vulnerability if innovation fails to compensate for declines in OEM demand, potentially affecting net margins and future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.0 for Titan International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $60.6 million, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 9.4%.

- Given the current share price of $8.46, the analyst's price target of $12.0 is 29.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives