Key Takeaways

- Strategic initiatives and partnerships, including AMP productivity and collaboration with Lowe's, aim to drive innovation, growth, and improved net margins.

- Expansion in underground construction and the launch of autonomous products are aligned with market trends, enhancing revenue and earnings stability.

- Uncertainty in revenue growth is driven by macroeconomic caution, elevated order backlog, rising costs, and dependence on volatile markets like snow management.

Catalysts

About Toro- Designs, manufactures, markets, and sells professional turf maintenance equipment and services.

- The successful execution of the AMP productivity initiative, which is expected to deliver $100 million in annualized run-rate savings by fiscal 2027, with a plan to reinvest savings to drive innovation and growth. This could lead to improved net margins over time as efficiency gains are realized.

- The strategic partnership with Lowe's for zero-turn mowers in the Residential segment is off to a strong start, potentially increasing revenue as this relationship matures and expands.

- Expansion and innovation in the underground construction and golf and grounds segments, which maintain strong order backlogs and are projected to have continued demand due to infrastructure spending. This is likely to positively impact revenue and earnings stability.

- Launches of autonomous products across residential, commercial, and golf markets, such as the Toro Haven robotic mower, which align with market growth trends and productivity needs, could enhance future revenue streams and improve margins through technological leadership.

- The strategic initiative AMP It Up, aimed at achieving a total company adjusted operating earnings margin of at least 14% by fiscal 2026, indicates a focus on long-term profitability and operational excellence, likely improving net margins progressively.

Toro Future Earnings and Revenue Growth

Assumptions

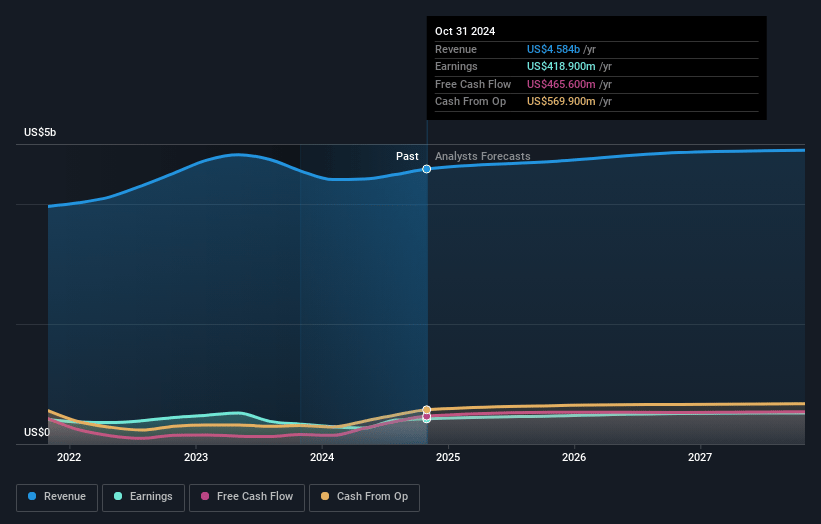

How have these above catalysts been quantified?- Analysts are assuming Toro's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.1% today to 10.7% in 3 years time.

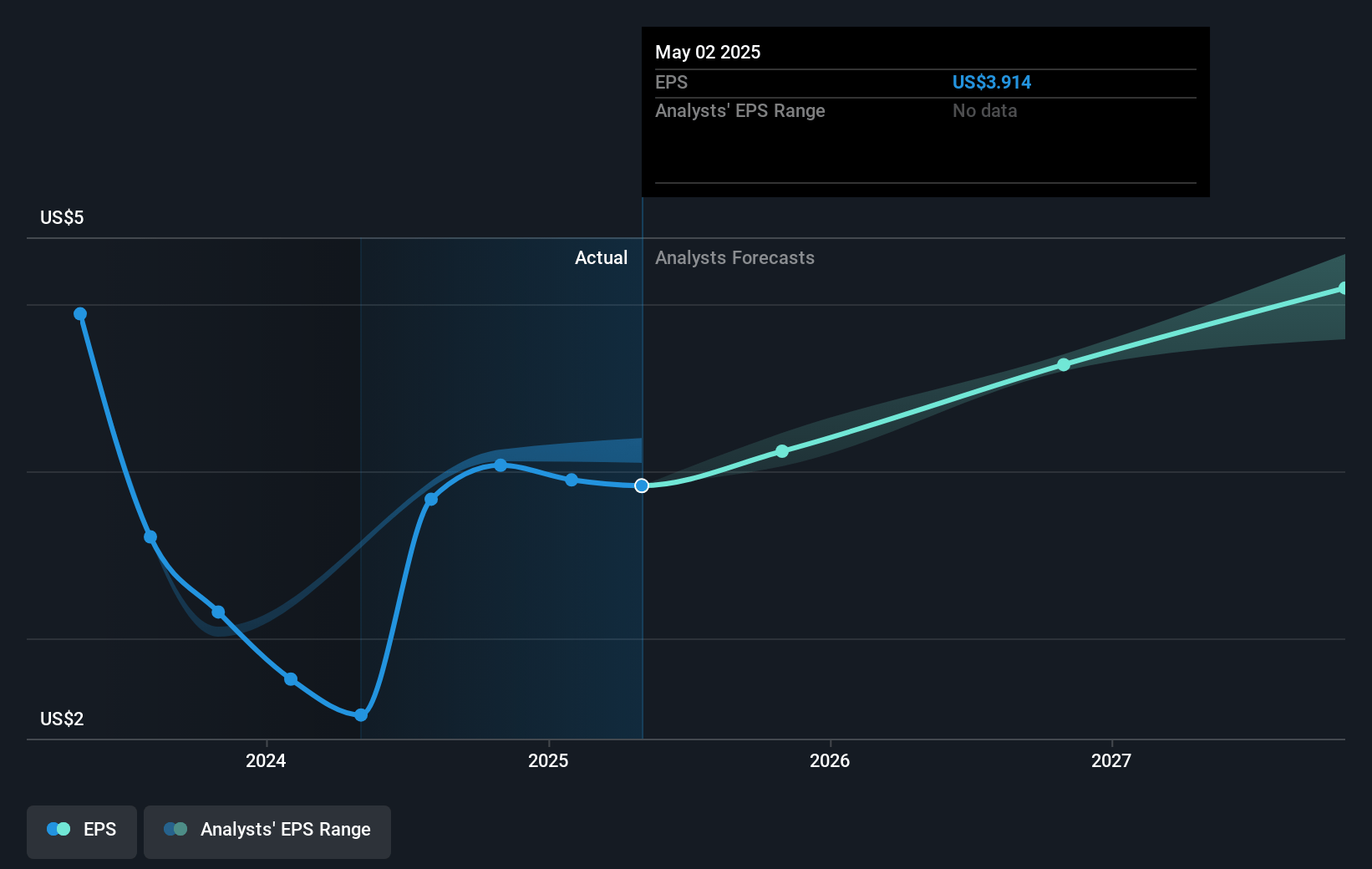

- Analysts expect earnings to reach $524.0 million (and earnings per share of $5.15) by about January 2028, up from $418.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.0x on those 2028 earnings, up from 21.0x today. This future PE is lower than the current PE for the US Machinery industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.03%, as per the Simply Wall St company report.

Toro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The post-pandemic correction and macro caution affecting lawn care products in the dealer channel and two consecutive seasons of below-average snowfall could lead to decreased revenue and earnings, particularly within the snow and ice management and Residential segments.

- Elevated order backlog, especially in underground construction and golf and grounds products could mask potential demand fluctuations, leading to uncertainty in future revenue growth.

- Higher material and freight costs, as well as product mix issues that emphasize lower-margin products, could continue to pressure net margins and potentially impact earnings negatively.

- The ongoing rebalancing required to normalize field inventory levels, particularly for lawn care and snow products, could cause short-term disruptions in revenue and impact net earnings during the transitional phase.

- The reliance on key markets such as homeowners, landscape contractor customers, and unpredictable snow patterns could contribute to volatility in revenue and pose a risk to consistent earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $93.2 for Toro based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.9 billion, earnings will come to $524.0 million, and it would be trading on a PE ratio of 22.0x, assuming you use a discount rate of 7.0%.

- Given the current share price of $86.81, the analyst's price target of $93.2 is 6.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives