Key Takeaways

- Strength in sustainable HVAC, connected services, and aftermarket opportunities position the company for durable growth, increasing margins, and market share gains amid climate policy trends.

- Expansion in digital service offerings and emerging markets diversifies revenue streams and earnings quality, ensuring resilience and outperformance across economic cycles.

- Overreliance on North America, economic and geopolitical headwinds, rising costs, and rapid regulatory change all threaten Trane’s margins and revenue growth.

Catalysts

About Trane Technologies- Designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, and custom and transport refrigeration.

- Trane Technologies is positioned to benefit from the accelerating global momentum behind decarbonization and tightening climate policy, as the company’s leading sustainable HVAC solutions serve customers pursuing net-zero and energy efficiency goals; this trend underpins robust multiyear revenue growth and provides pricing power, thus supporting bullish projections for both top-line expansion and margin improvement.

- The rapid urbanization of global cities and growing investments in smart, digitally integrated buildings are fueling demand for Trane’s advanced, IoT-enabled climate systems; this will capture increased market share in high-value segments while driving recurring revenues from connected services, boosting both total revenue and net earnings quality.

- The vast, aging installed base of HVAC equipment in North America and Europe is creating a powerful tailwind for Trane’s aftermarket and services business, as regulatory compliance and efficiency-driven retrofits unlock high-margin, recurring revenue streams and support long-term earnings growth at higher return on sales.

- The company’s continued expansion of its subscription-based, predictive maintenance and digital service offerings is steadily increasing the mix of high-margin, recurring revenues, which translates to greater net margin stability and higher quality earnings, positioning Trane Technologies to outperform during economic cycles.

- Strategic investments in innovation, disciplined M&A, and a growing footprint in faster-growing emerging markets such as Asia-Pacific provide a platform for diversified, above-market growth, de-risking Trane’s revenue profile and supporting a consistent trajectory of free cash flow generation and double-digit EPS growth.

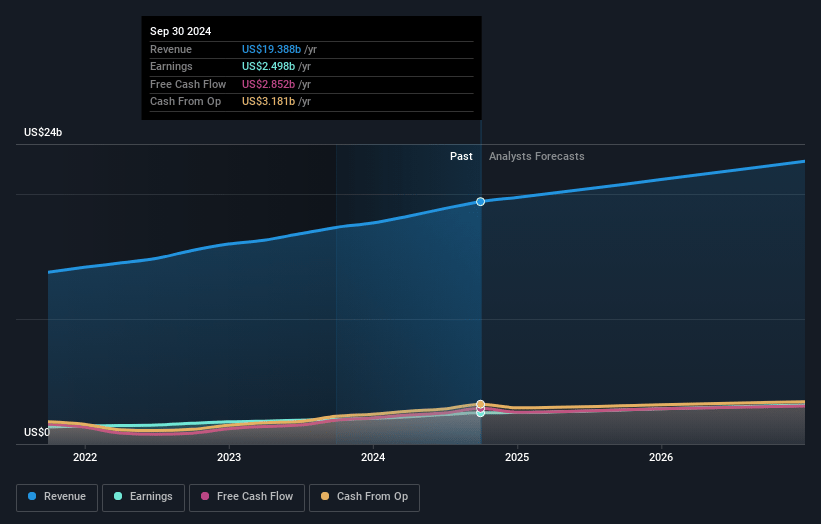

Trane Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Trane Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Trane Technologies's revenue will grow by 7.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.6% today to 14.4% in 3 years time.

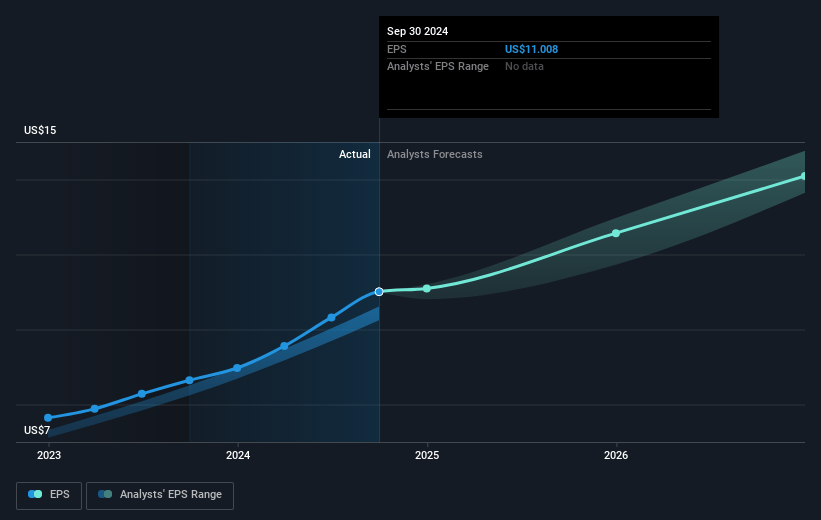

- The bullish analysts expect earnings to reach $3.6 billion (and earnings per share of $16.49) by about May 2028, up from $2.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 35.7x on those 2028 earnings, up from 32.8x today. This future PE is greater than the current PE for the US Building industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 1.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.52%, as per the Simply Wall St company report.

Trane Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Trane’s growth is highly concentrated in North America, exposing the company to risk if the region experiences an economic downturn or adverse regulatory changes, which could negatively impact its revenue and top-line growth.

- Prolonged macroeconomic slowdowns or regional recessions, particularly in China and the transport refrigeration segment, could weaken order volumes and revenue, which is especially concerning given the company’s recent acknowledgment of volatile and declining markets in Asia Pacific and transport refrigeration.

- Heightened geopolitical instability, rising tariffs, and a growing protectionist environment have already led to projected annual cost headwinds of $250 million to $275 million, and although the company aims to offset this through pricing, persistent trade barriers may compress margins and raise input costs, thus diminishing net income.

- Trane’s margins face risk from increased competitive pressures as peers adopt lower-cost or more technologically advanced solutions, creating downward pressure on pricing and demanding heavier investment in innovation, which can erode net margins over time.

- Rapid transition towards electrification and regulatory changes (such as refrigerant phase-outs and stricter climate policies) could outpace Trane’s innovation cycle, driving up R&D and retrofit costs and compelling heavy compliance spending, potentially leading to margin compression and higher capital expenditures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Trane Technologies is $476.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Trane Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $476.0, and the most bearish reporting a price target of just $237.34.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $25.2 billion, earnings will come to $3.6 billion, and it would be trading on a PE ratio of 35.7x, assuming you use a discount rate of 8.5%.

- Given the current share price of $406.68, the bullish analyst price target of $476.0 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.