Narratives are currently in beta

Key Takeaways

- Expansion in software and digital services, along with robust R&D investment, supports long-term growth and market differentiation.

- Cost reduction and project wins in key sectors could improve net margins and bolster revenue growth.

- Challenges in increasing revenue and net margins may persist due to declining sales, customer hesitancy, and significant non-R&D investments.

Catalysts

About Rockwell Automation- Provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

- Increased investment in U.S. manufacturing driven by favorable policies could lead to revenue growth as Rockwell is a market leader in technology that enhances competitiveness.

- Expansion of profitable software and digital service lines, resulting in double-digit annual recurring revenue growth, may drive improved net margins.

- Cost reduction initiatives, including accelerated savings of $110 million in H2 2024 and targeted $250 million in fiscal year '25, could boost net margins by streamlining operations.

- Project wins in sectors like data centers, automotive, and semiconductors may support revenue growth as these industries ramp up investments in new technology and infrastructure.

- Continued investment in research and development, targeting new product launches in fiscal year '25, supports long-term earnings growth as these innovations drive increased market differentiation and customer engagement.

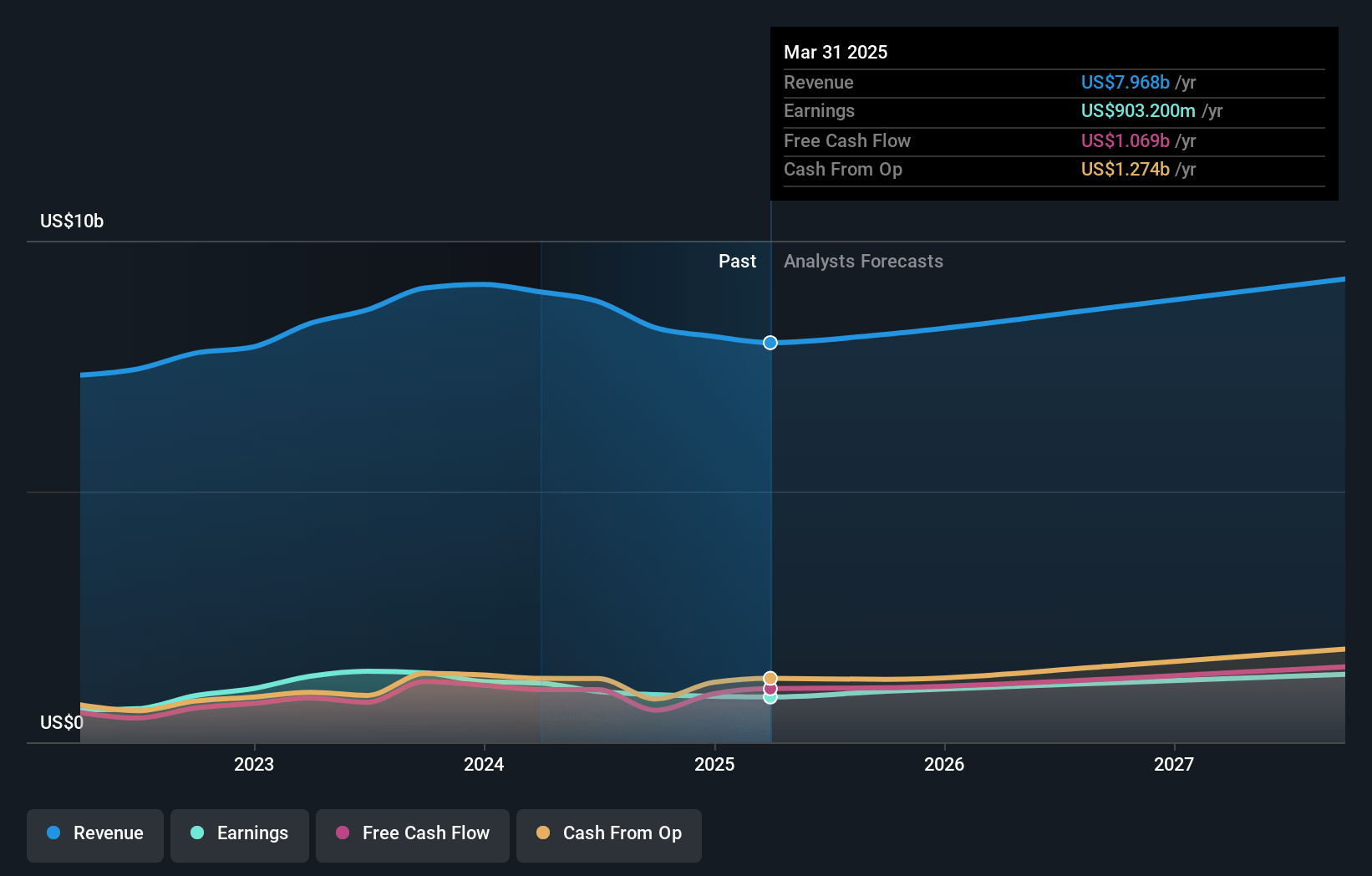

Rockwell Automation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rockwell Automation's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.5% today to 13.8% in 3 years time.

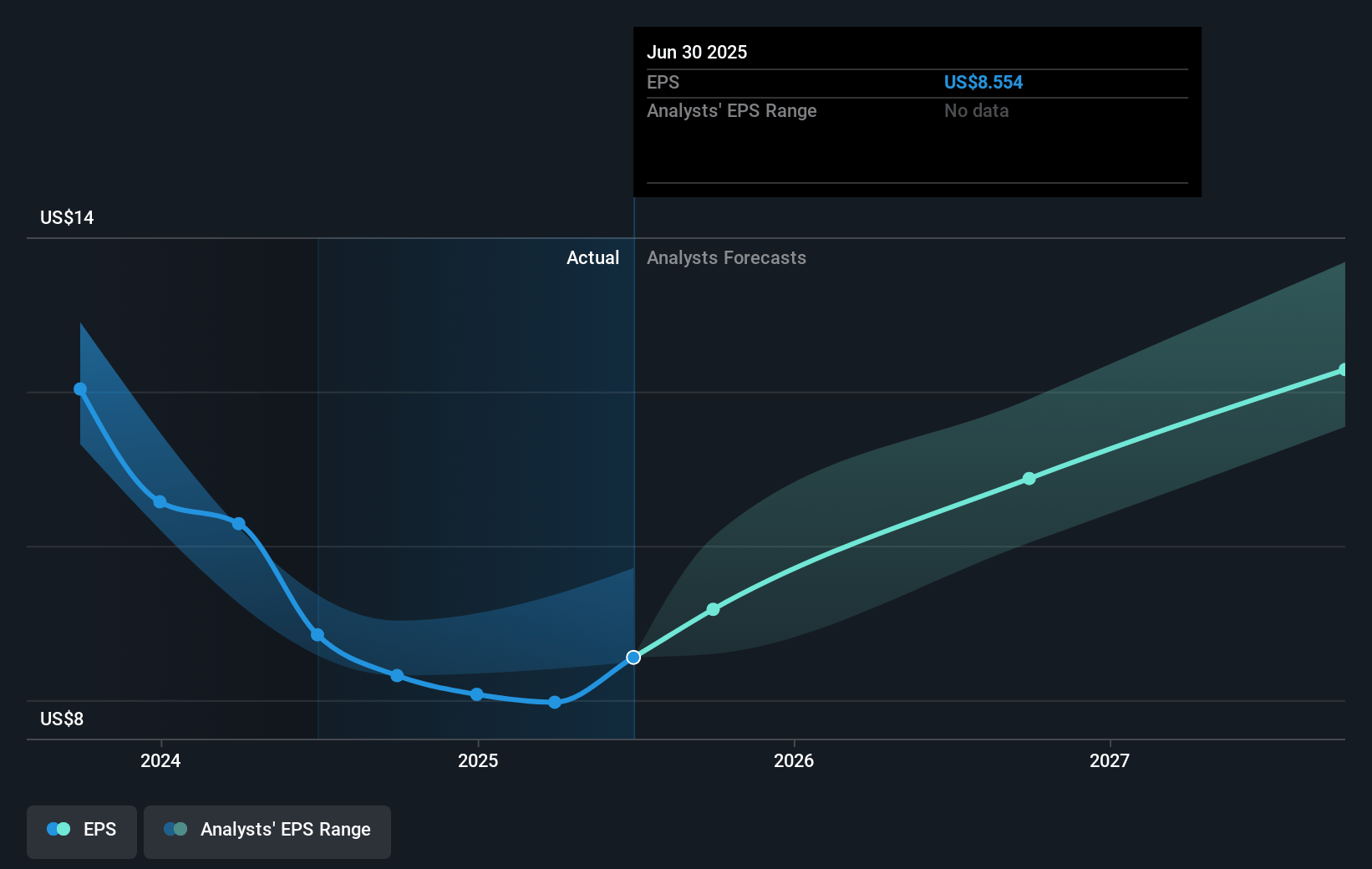

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $12.19) by about January 2028, up from $948.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.0x on those 2028 earnings, down from 33.5x today. This future PE is greater than the current PE for the US Electrical industry at 22.7x.

- Analysts expect the number of shares outstanding to decline by 1.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.54%, as per the Simply Wall St company report.

Rockwell Automation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's guidance for fiscal year 2025 indicates that reported sales could decline, ranging from -4% to +2%, which could signify challenges in increasing revenue.

- Sequential improvement in orders is expected after Q1, but continued customer hesitancy and project delays could impact top-line growth projections.

- The high single-digit decline in Q1 sales, primarily due to typical seasonality and slower Q4 orders, could affect short-term earnings and segment margins.

- The decline of 200 basis points in segment margins in 2024, despite cost reductions, highlights the impact of lower sales volume and unfavorable mix on net margins.

- Significant investment in non-R&D activities, such as facility expansions, may add to operational expenditures without immediate revenue increase, potentially impacting net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $296.27 for Rockwell Automation based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $355.0, and the most bearish reporting a price target of just $215.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.5 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 30.0x, assuming you use a discount rate of 7.5%.

- Given the current share price of $281.31, the analyst's price target of $296.27 is 5.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives