Key Takeaways

- Strategic restructuring and recent acquisition synergies aim to drive growth and improve margins, enhancing operational efficiency and revenue.

- Selling low-margin businesses and anticipating industry demand recovery to optimize margins and increase revenue.

- Geopolitical uncertainties, high costs, and a leveraged acquisition may hinder Quanex's revenue and profitability, with strategic challenges in maintaining market position.

Catalysts

About Quanex Building Products- Provides components for the fenestration industry in the United States, rest of Europe, Canada, Asia, the United Kingdom, and internationally.

- The restructuring of operating segments into global-oriented divisions (hardware solutions, extruded solutions, and custom solutions) is designed to leverage synergies and best practices, potentially leading to growth in both existing and new markets. This could positively impact future revenue and margin expansion.

- Integration and synergy realization from the recent Tyman acquisition are ahead of schedule, with expectations to achieve $30 million in synergies, enhancing operational efficiency and potentially improving net margins and earnings.

- The sale of low-margin businesses, like the Richmond facility and North American vinyl fencing, is part of Quanex's strategic focus on margin optimization, which could improve net margins by aligning the portfolio with higher-margin segments.

- The anticipated rebound in construction and R&R (renovation and remodeling) activity in the second half of fiscal 2025 could drive a significant increase in demand, positively affecting future revenue.

- Debt reduction efforts following the Tyman acquisition are prioritizing balance sheet health, with plans to further lower interest expenses, contributing to improved net earnings over time.

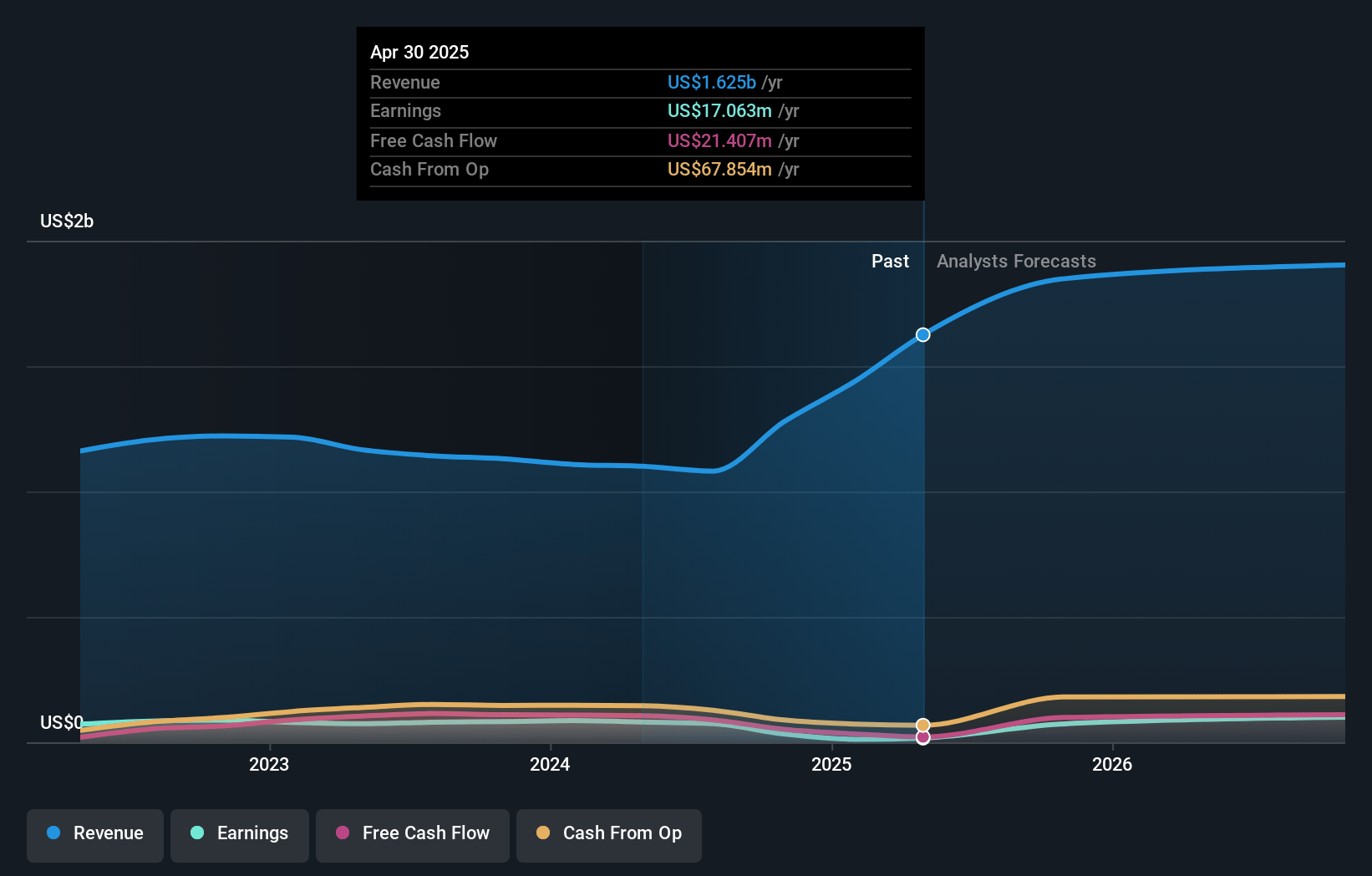

Quanex Building Products Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Quanex Building Products's revenue will grow by 21.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.6% today to 7.2% in 3 years time.

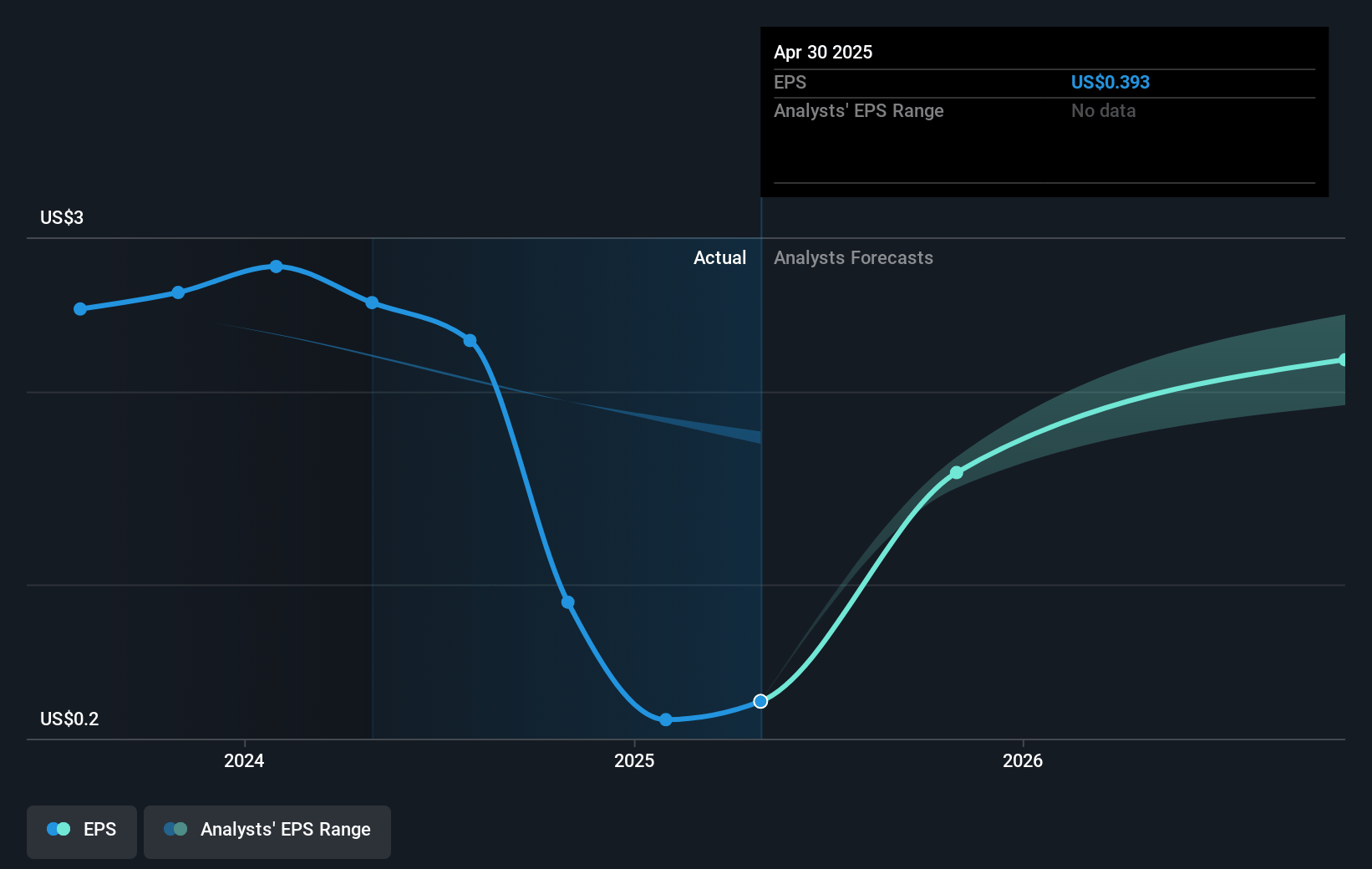

- Analysts expect earnings to reach $165.3 million (and earnings per share of $3.34) by about January 2028, up from $33.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, down from 32.1x today. This future PE is lower than the current PE for the US Building industry at 20.5x.

- Analysts expect the number of shares outstanding to grow by 1.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.3%, as per the Simply Wall St company report.

Quanex Building Products Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued geopolitical uncertainties and high energy costs impacting markets worldwide may dampen demand, affecting Quanex's revenue growth prospects.

- Weakened consumer confidence, along with high-interest rates and inflation concerns, could lead to sluggish demand during the holiday and winter months, negatively impacting revenue forecasts.

- The acquisition of Tyman, while strategic, has resulted in a $13.9 million net loss during the fourth quarter of 2024 compared to a net income in the same period of 2023, impacting net earnings.

- Lower sales volumes and the need for continual price adjustments in segments like North American Fenestration and Cabinet Components suggest ongoing challenges in maintaining and growing revenue.

- High leverage due to borrowing $770 million for the Tyman acquisition could strain the company's financial flexibility and increase interest expenses, impacting net margins and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.33 for Quanex Building Products based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $165.3 million, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 9.3%.

- Given the current share price of $22.55, the analyst's price target of $36.33 is 37.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives