Key Takeaways

- Strong demand driven by data center, AI, grid modernization, and renewable trends, with expansion, new products, and acquisitions positioning nVent for market outperformance.

- Operational efficiencies, increased recurring revenue, and strategic capital allocation enhance earnings quality, margin growth, and support nVent’s role as a leading consolidator.

- Weak organic growth, margin pressures, and shifting industry trends threaten profitability while supply chain risks and distributor consolidation increase vulnerability to pricing and trade shocks.

Catalysts

About nVent Electric- Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

- nVent is set to benefit substantially from the massive growth in data centers and the accelerating adoption of AI, as these trends require advanced electrical infrastructure and liquid cooling solutions. The company's investment in expanding capacity, backlogs in data solutions and power utilities, and robust new product launches (over 75 planned in 2025) are likely to drive sustained double-digit revenue growth, particularly in infrastructure verticals tied directly to electrification and digitalization.

- With grid modernization, aging infrastructure replacement, and the megatrend towards renewable energy and distributed energy resources, demand is rising sharply for grid expansion, power distribution, and protection solutions. nVent’s strengthened portfolio—including the Trachte acquisition with its fast-growing control buildings business—positions it to consistently outpace market growth and supports strong visibility into future backlog-driven sales.

- Company-wide operational efficiency initiatives, including supply chain optimization, product simplification, digitalized internal processes, and productivity programs, are improving return on sales and helping to offset inflation. These efforts are expected to incrementally raise net margins over time, particularly as volume leverage from high-growth verticals takes effect.

- The move toward an increased mix of value-added products and recurring revenue streams, such as services, aftermarket sales, and integrated solutions, is improving earnings quality and stability. This shift not only enhances the potential for earnings growth, but also sets the stage for possible multiple expansion as the business becomes less cyclical and more predictable.

- The balance sheet transformation following the Thermal Management divestiture leaves nVent with nearly $2 billion in capital for disciplined acquisitions and share repurchases. The company’s proven M&A track record, combined with heightened focus on high-growth, high-margin electrical markets, provides a catalyst for outsized future earnings per share growth and positions nVent as a consolidator in a fragmented industry.

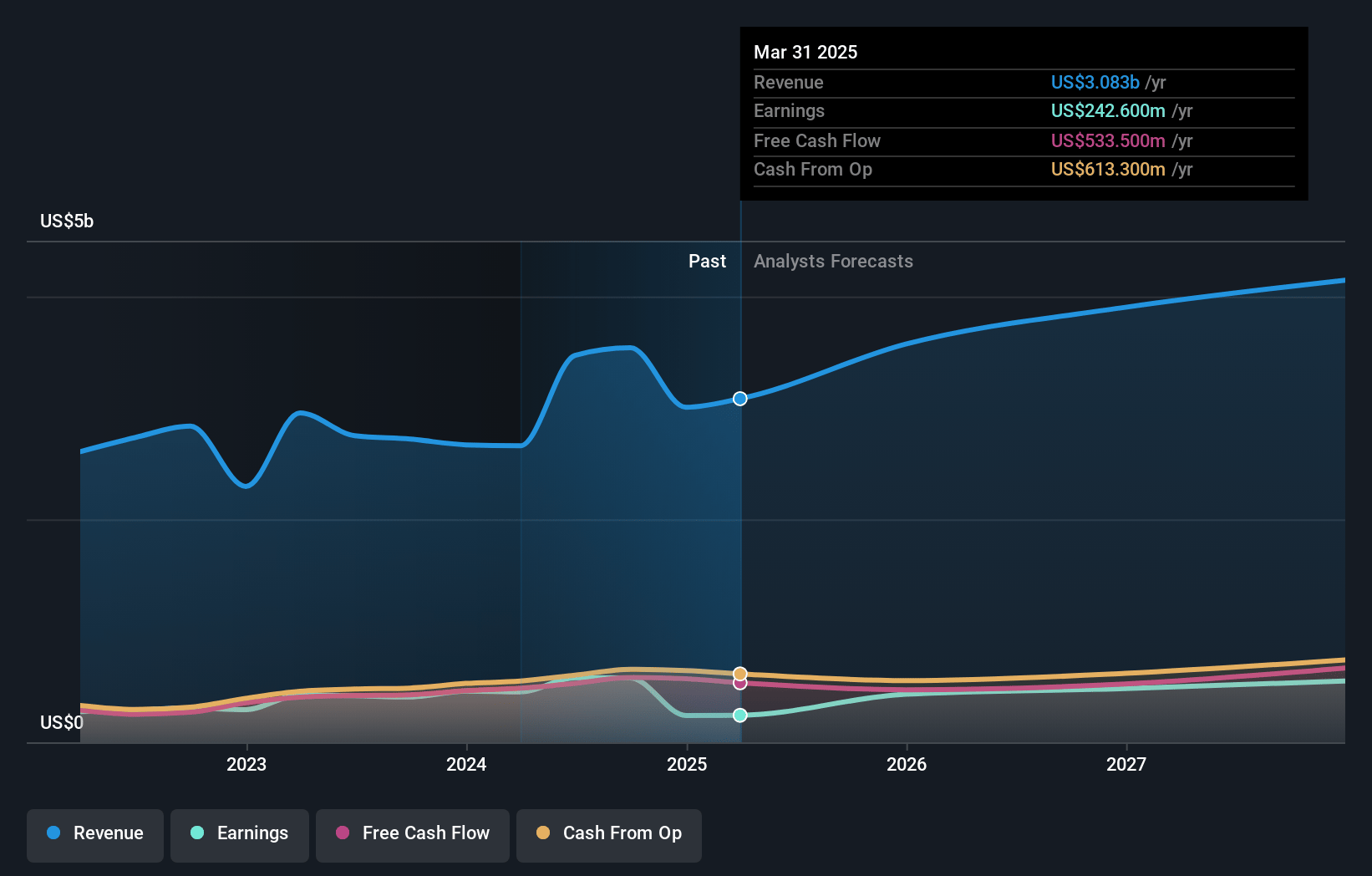

nVent Electric Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on nVent Electric compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming nVent Electric's revenue will grow by 12.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.9% today to 14.0% in 3 years time.

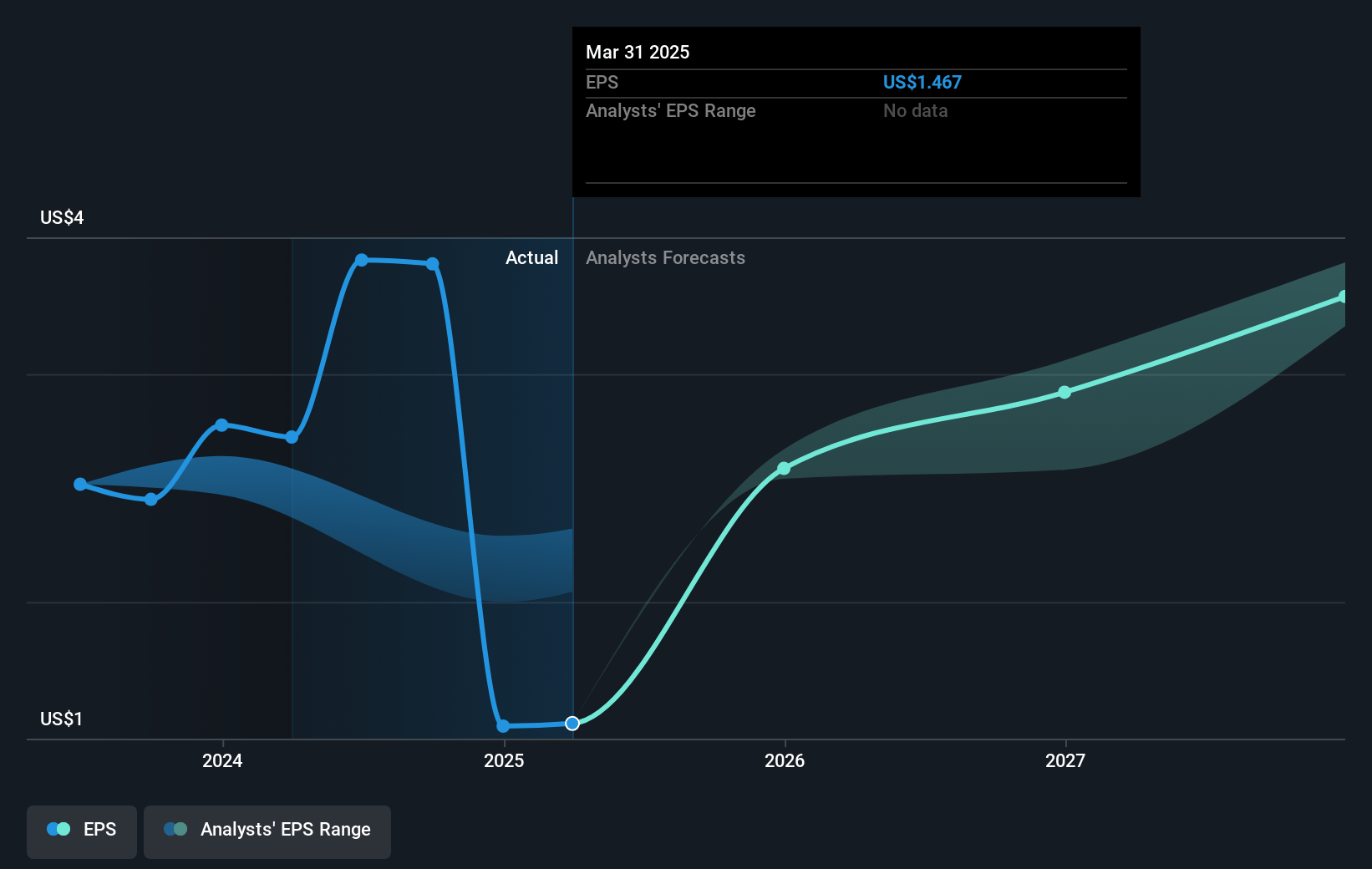

- The bullish analysts expect earnings to reach $622.0 million (and earnings per share of $3.69) by about July 2028, up from $242.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.2x on those 2028 earnings, down from 50.6x today. This future PE is greater than the current PE for the US Electrical industry at 28.7x.

- Analysts expect the number of shares outstanding to decline by 0.95% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.46%, as per the Simply Wall St company report.

nVent Electric Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s organic sales growth remains weak outside of acquisitions, with Q4 2024 showing flat to slightly negative organic growth, driven largely by temporary inventory management at distributors and heavy reliance on infrastructure verticals, indicating potentially sluggish revenue growth if broader industrial and commercial markets do not recover.

- Rising input costs from metals, materials, and ongoing inflation, combined with persistent competitive pricing pressure, exert downward force on operating and net profit margins, as acknowledged by continued inflationary expectations and softness in pricing power in some segments.

- The ongoing industry shift toward automation, IoT, and digital solutions may reduce the need for nVent's traditional enclosure and electrical infrastructure products, threatening long-term revenue streams and necessitating significant investment to remain relevant.

- Heightened geopolitical risks, tariffs, and global supply chain disruptions pose a material risk to cost structures and timely delivery; while current import exposure to China is low, over 10% of cost of goods sold is exposed to Mexico, which could become a larger concern if new trade barriers are imposed.

- Consolidation among electrical equipment distributors and growing customer bargaining power can lead to lower average selling prices and tighter gross margins, as seen in the recent excess channel inventory management and negative organic sales in key markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for nVent Electric is $96.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of nVent Electric's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $96.0, and the most bearish reporting a price target of just $62.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.4 billion, earnings will come to $622.0 million, and it would be trading on a PE ratio of 32.2x, assuming you use a discount rate of 9.5%.

- Given the current share price of $74.63, the bullish analyst price target of $96.0 is 22.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.