Narratives are currently in beta

Key Takeaways

- Strategic focus on high-growth verticals and global expansion is likely to drive future revenue and earnings growth.

- Capital allocation strategy and investments in capacity and innovation support enhancing shareholder value and offset inflation impacts.

- Focus on core business by selling Thermal Management may hurt revenue stability, with inflation and market softness posing further risks to growth and margins.

Catalysts

About nVent Electric- Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

- The portfolio transformation, including the sale of the Thermal Management business and the integration of Trachte, is expected to make nVent a more focused, higher growth leader in electrical connection and protection, which could drive higher future revenue and earnings growth.

- The expansion in the Data Solutions segment, particularly in liquid cooling for data centers, positions nVent to capitalize on growing demand in high-performance computing environments, potentially boosting revenue growth.

- The company's focus on high-growth verticals such as infrastructure, data solutions, and power utilities, alongside global expansion and 77 new product launches, is likely to drive future revenue growth.

- The continued investments in capacity, new products, digital initiatives, and productivity enhancements are expected to offset inflation and support further growth in adjusted operating income and margins.

- The robust free cash flow generation and a well-positioned capital allocation strategy, including potential M&A activity and share repurchases, could drive enhanced earnings and shareholder value.

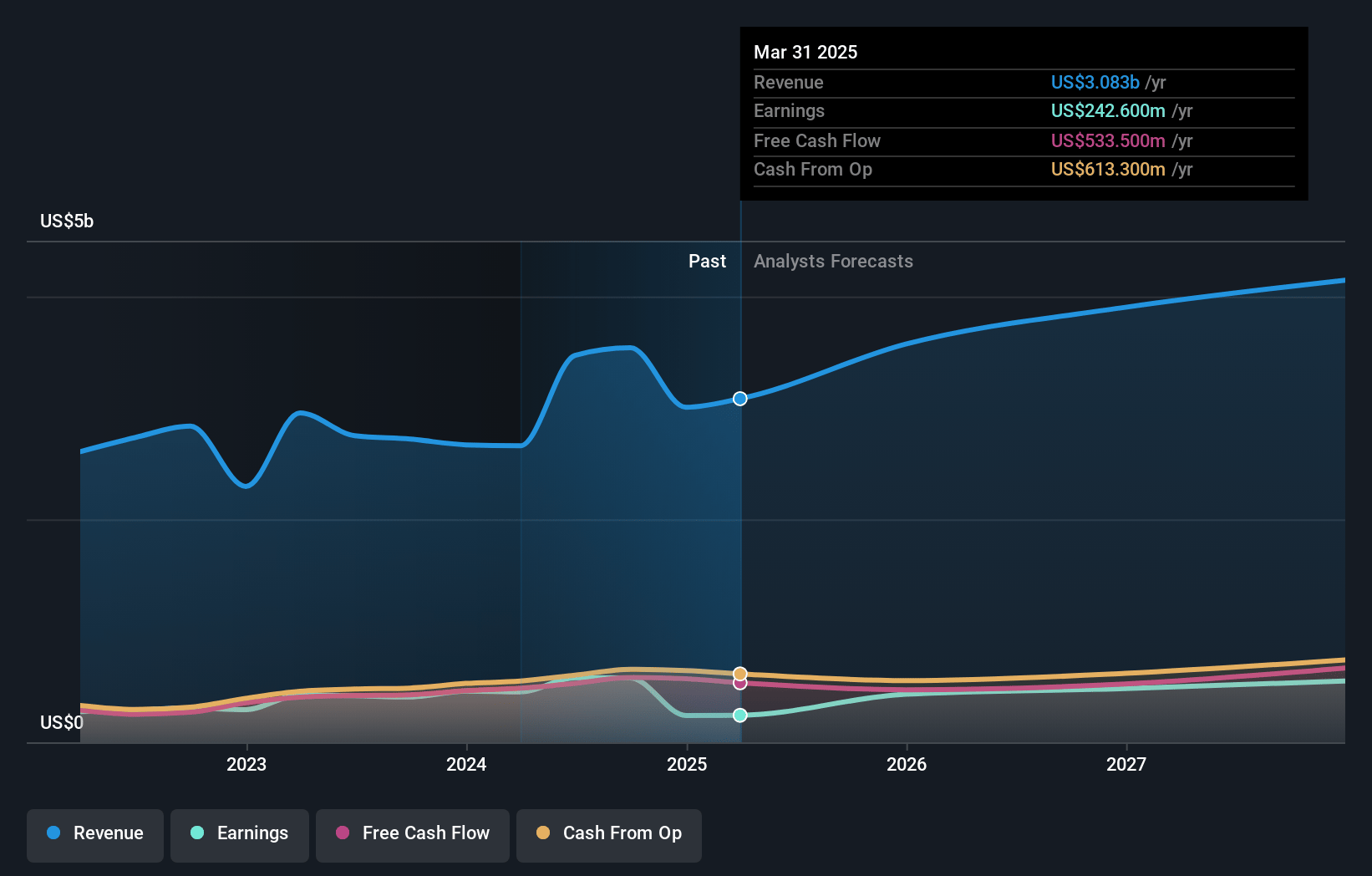

nVent Electric Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming nVent Electric's revenue will decrease by 0.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.3% today to 13.5% in 3 years time.

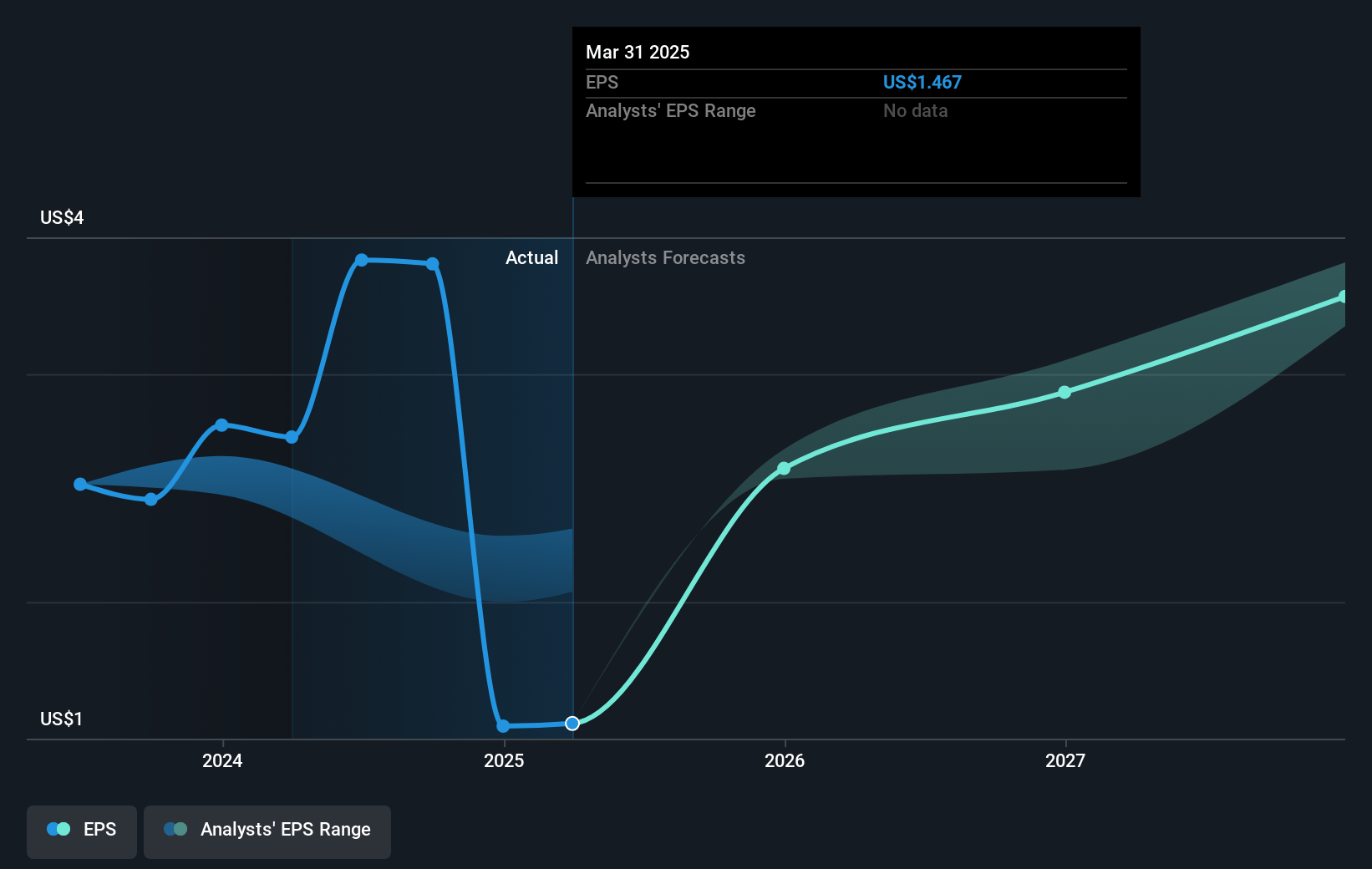

- Analysts expect earnings to reach $488.5 million (and earnings per share of $2.9) by about January 2028, down from $577.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.1x on those 2028 earnings, up from 18.0x today. This future PE is greater than the current PE for the US Electrical industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.67%, as per the Simply Wall St company report.

nVent Electric Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of the Thermal Management business, while intended to focus the company, could reduce overall revenue diversification and stability, potentially impacting future sales and earnings negatively.

- Pressure from inflation, as outlined with the $25 million impact in Q3, adds risks to maintaining net margins if price and productivity efforts cannot fully offset these increases.

- Continued softness in the commercial/residential markets could limit organic growth prospects, particularly if macroeconomic uncertainties such as elections and high interest rates persist, directly affecting revenue.

- Trachte's acquisition integration may pose risks—despite a good start, maintaining its high growth will require effective management, or it could adversely impact net margins and earnings.

- Distributors managing inventory cautiously could lead to lower-than-expected demand fulfillment, impacting quarterly revenues and cash flows as macro uncertainties linger.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $81.8 for nVent Electric based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $92.0, and the most bearish reporting a price target of just $60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $488.5 million, and it would be trading on a PE ratio of 36.1x, assuming you use a discount rate of 8.7%.

- Given the current share price of $63.16, the analyst's price target of $81.8 is 22.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives