Key Takeaways

- Shifting industry trends and technology adoption are shrinking demand for Manitowoc's cranes, threatening long-term growth and sustained profitability.

- Rising input costs and stronger competition from international manufacturers are expected to erode market share and exert ongoing pressure on margins.

- Diversifying into high-margin services and innovative products positions Manitowoc for stable growth and resilience despite construction sector cycles.

Catalysts

About Manitowoc Company- Provides engineered lifting solutions in the Americas, Europe, Africa, the Middle East, the Asia Pacific, and internationally.

- Persistent global shifts toward renewable energy and decarbonization are diverting capital from traditional construction and infrastructure projects that drive core demand for Manitowoc's cranes, threatening a structural, long-term contraction in its addressable market and pressuring future revenue growth over the next decade.

- The acceleration of automation and robotics in construction processes is steadily reducing reliance on traditional crane solutions, which is expected to erode market share and weaken pricing power, ultimately compressing long-term margins.

- Manitowoc's high dependence on cyclical construction and energy end-markets exposes earnings and cash flow to pronounced volatility; if global infrastructure spending broadens away from large-scale commercial and industrial projects, the long-term outlook for recurring revenue and net income deteriorates.

- Persistent cost inflation in steel, aluminum, and imported components-compounded by tariffs and limited ability to pass full cost increases onto customers-signals chronic margin pressure and weaker gross profit generation over time.

- Intensifying competition from lower-cost international manufacturers, particularly from China and Japan, will likely undermine Manitowoc's global market position and further drive down average selling prices, resulting in steady downward pressure on revenue, margins, and earnings power.

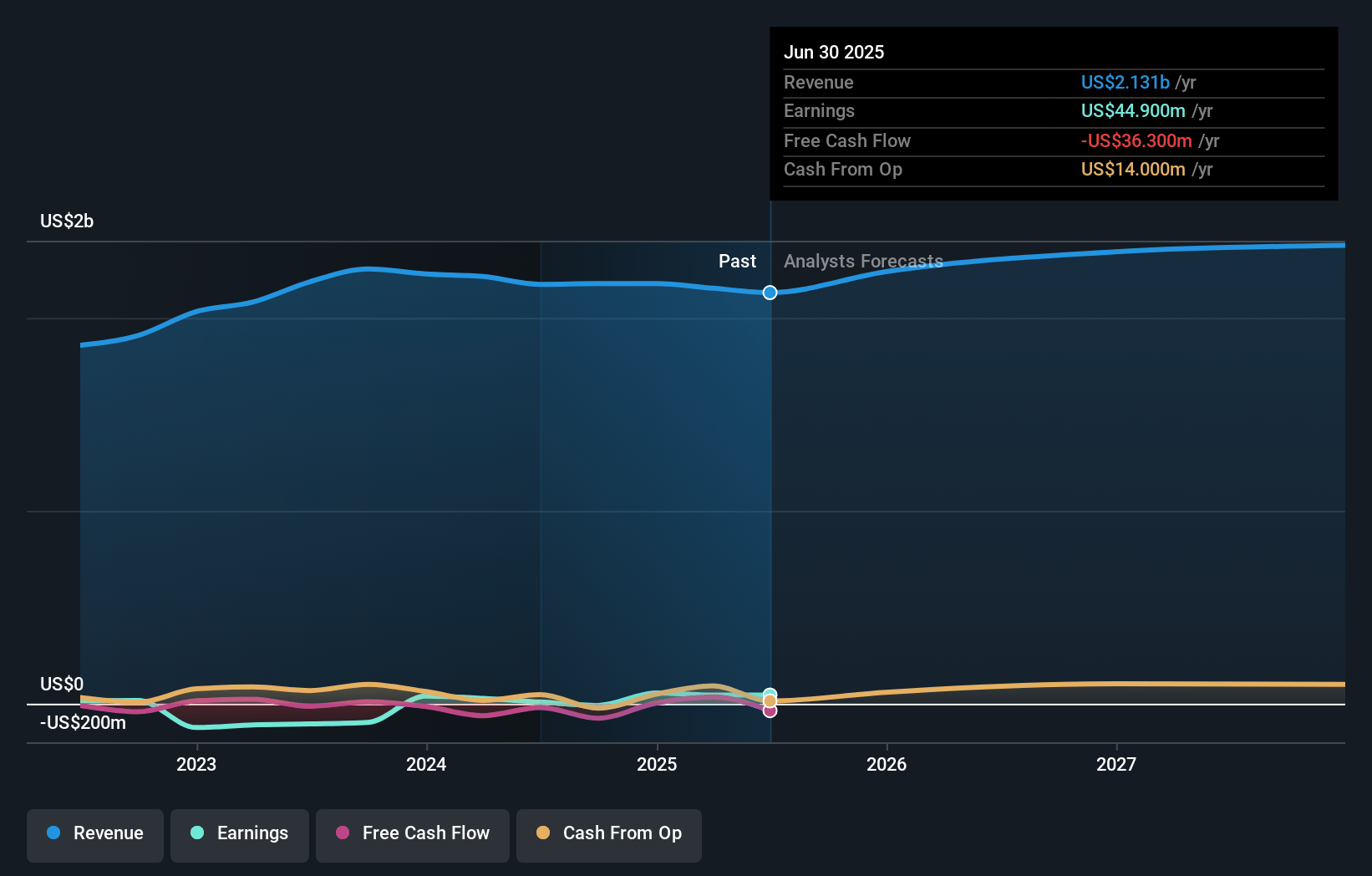

Manitowoc Company Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Manitowoc Company compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Manitowoc Company's revenue will grow by 4.0% annually over the next 3 years.

- The bearish analysts are assuming Manitowoc Company's profit margins will remain the same at 2.1% over the next 3 years.

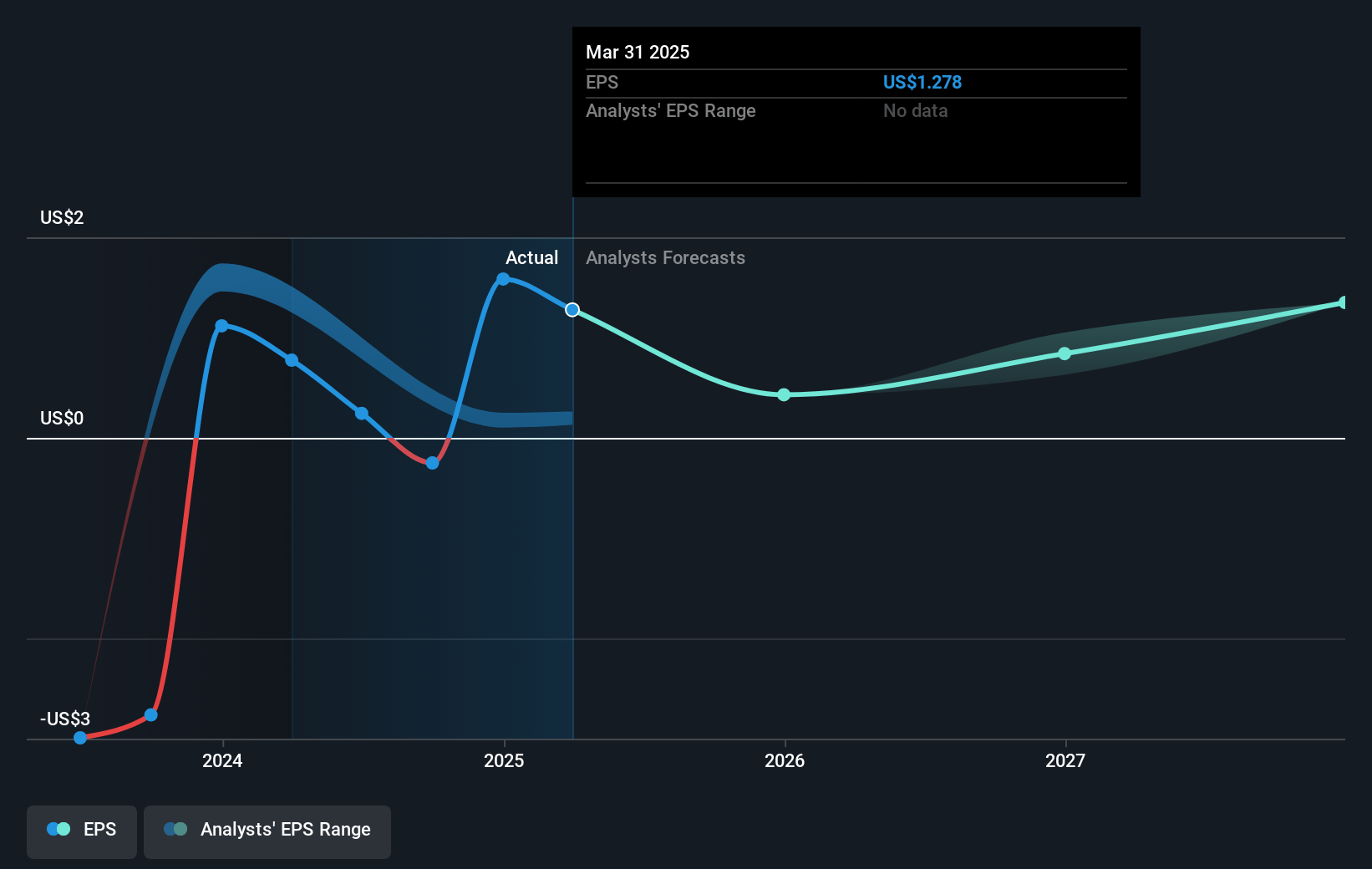

- The bearish analysts expect earnings to reach $50.8 million (and earnings per share of $1.34) by about July 2028, up from $45.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 10.4x today. This future PE is lower than the current PE for the US Machinery industry at 22.9x.

- Analysts expect the number of shares outstanding to grow by 0.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.02%, as per the Simply Wall St company report.

Manitowoc Company Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global infrastructure investment and government stimulus-such as Germany's EUR 500 billion infrastructure fund-are driving renewed order momentum in key markets, which can support strong revenue growth and backlog expansion for Manitowoc over the long term.

- Record-setting and resilient growth in aftermarket and non-new machine sales, with trailing 12 months reaching $645 million, demonstrate Manitowoc's successful diversification from cyclical new machine sales toward more stable, higher-margin recurring revenue streams, bolstering both net margins and earnings visibility.

- Manitowoc's strategic investments in product innovation, including launching the only hybrid all-terrain crane and expanding tailored solutions for mega-projects in the Middle East, position the company to outpace competitors and capture premium pricing, positively supporting long-term revenue and profit margins.

- Historically low dealer inventories, particularly in European tower cranes, and aggressive fleet replenishment by crane rental houses in North America point toward a potential order rebound, which can translate into future top-line growth and improved operating leverage.

- The company is executing a broad international aftermarket and service expansion, doubling its global field service technician base and making targeted acquisitions to increase service footprint, setting the foundation for higher customer retention and sustained revenue growth through economic cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Manitowoc Company is $9.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Manitowoc Company's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $50.8 million, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 10.0%.

- Given the current share price of $13.22, the bearish analyst price target of $9.0 is 46.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.