Narratives are currently in beta

Key Takeaways

- Operational transformation and supply chain improvements could initially disrupt operations and impact margins before yielding benefits.

- Dependence on R&D and portfolio optimization poses risks to short-term revenue growth due to potential delays and divestiture impacts.

- Strong performance in electronics, improved margins, and increased innovation are driving revenue growth and enhancing financial stability and shareholder returns for 3M.

Catalysts

About 3M- Provides diversified technology services in the United States and internationally.

- The company is in the early stages of a broad operational transformation which includes improving operational equipment efficiency and better utilization of assets. However, with current utilization at only 50%, enhancing this could take time before translating into significant improvement in net margins.

- There is a heavy reliance on improving R&D effectiveness to drive future growth through new product introductions, which is currently at lower levels compared to past performance. The potential delay in seeing tangible results could impact organic revenue growth.

- The drive towards better forecasting and demand planning to improve operational efficiency is in its initial phases. Delays in these improvements could affect inventory levels and the company’s ability to meet customer demand, potentially impacting earnings.

- The company plans to gradually address supply chain inefficiencies including improving on-time performance from suppliers, which has historically been low. This transformation may cause short-term disruptions and impact operating margins.

- 3M's focus on portfolio optimization through possible divestitures and discontinued product lines could initially weigh on sales and, if not managed correctly, may impact overall revenue growth projections.

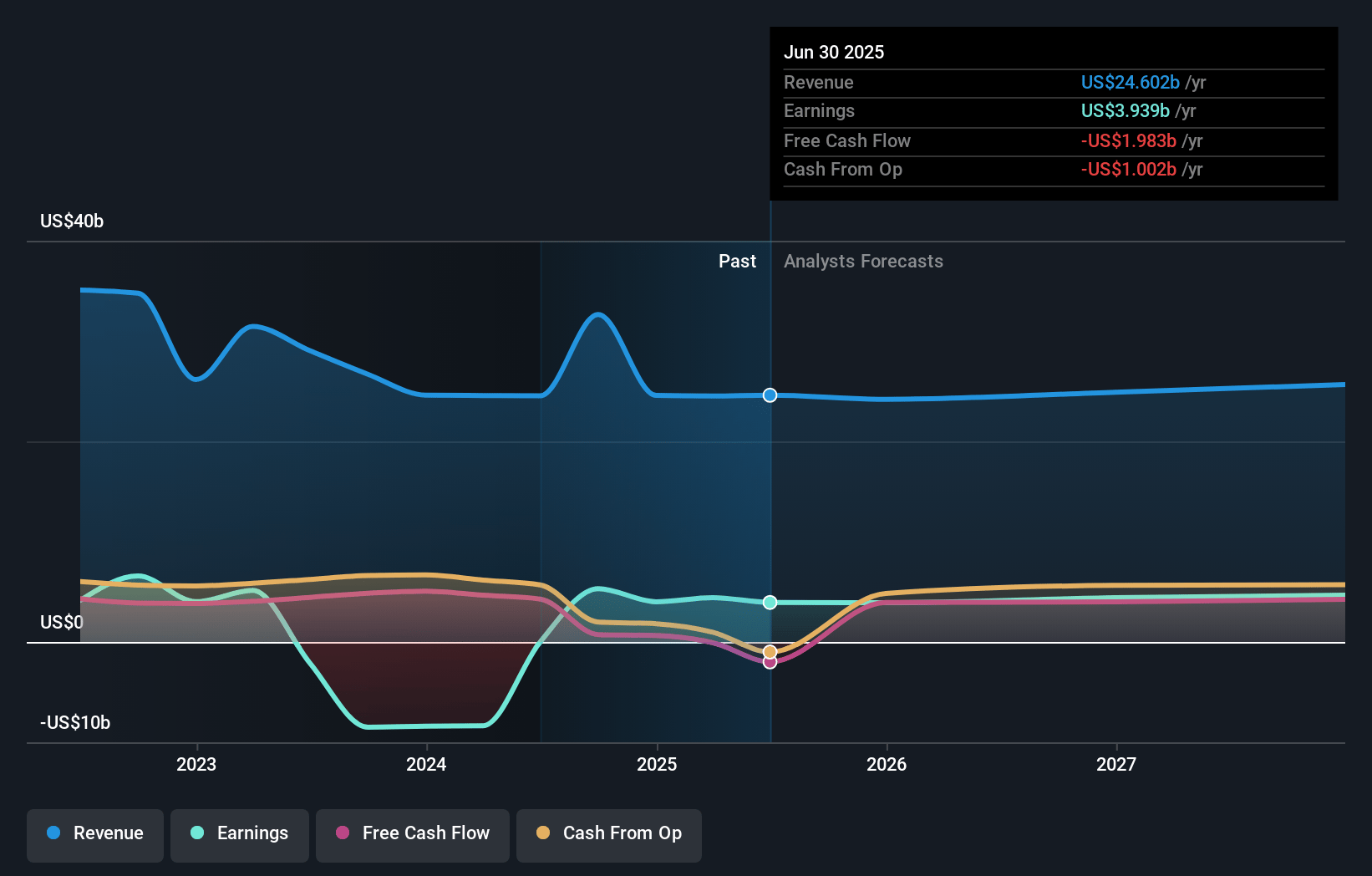

3M Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming 3M's revenue will decrease by -6.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.3% today to 17.8% in 3 years time.

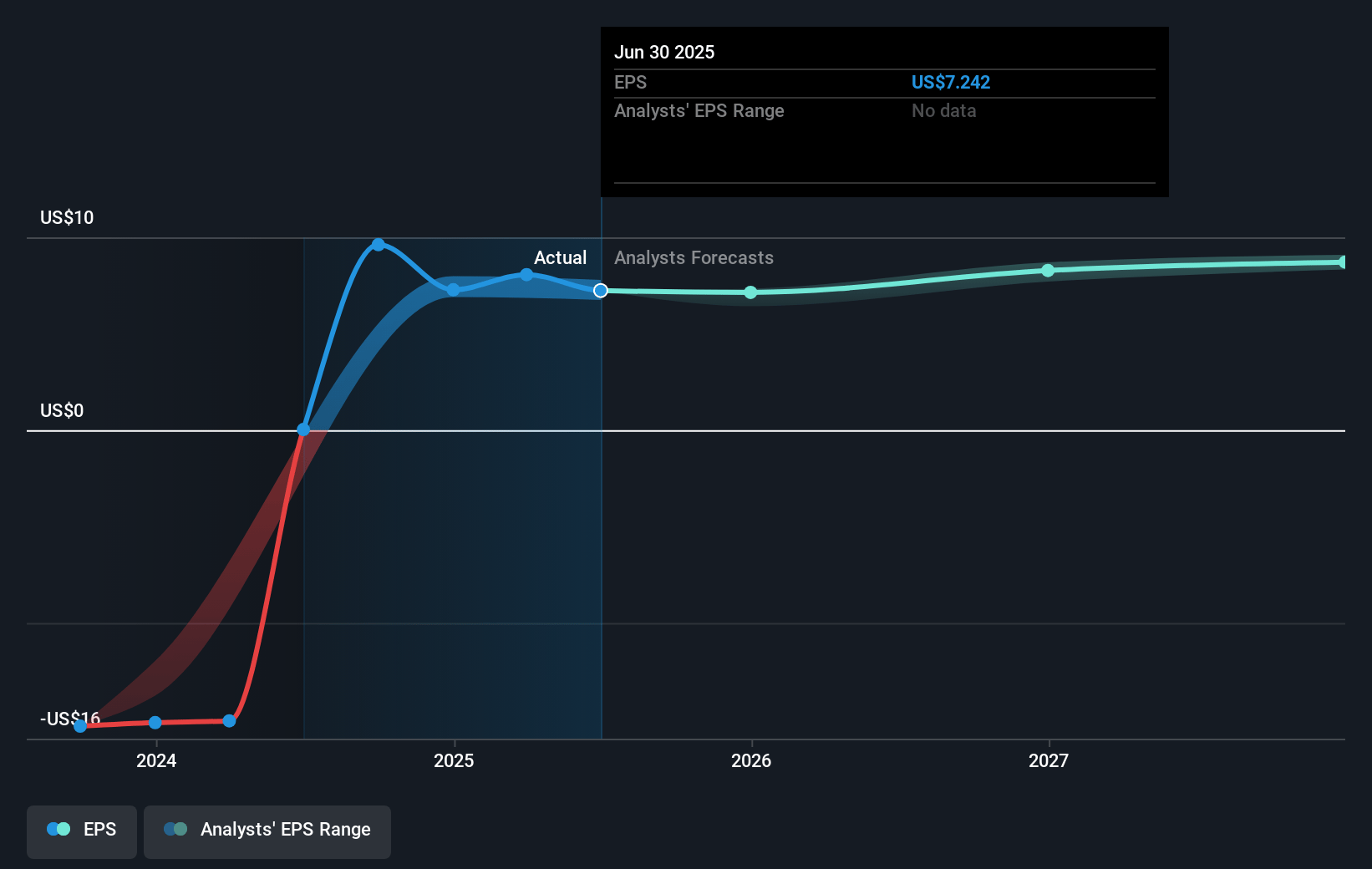

- Analysts expect earnings to reach $4.7 billion (and earnings per share of $8.9) by about December 2027, down from $5.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2027 earnings, up from 13.3x today. This future PE is greater than the current PE for the US Industrials industry at 13.3x.

- Analysts expect the number of shares outstanding to decline by 1.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.7%, as per the Simply Wall St company report.

3M Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- 3M has shown consistent growth in electronics, driven by strong consumer electronics demand and spec-in wins, which could positively impact revenue and earnings.

- The company is effectively enhancing operational efficiency with a 140 basis point increase in margins, indicating improved net margins and profitability.

- Continued strong free cash flow generation, with a 141% conversion rate, supports financial stability and potential shareholder returns, positively affecting cash flow and earnings.

- Increasing new product launches by 10% and improving R&D focus could lead to heightened innovation-driven revenue growth and market share expansion.

- With a disciplined capital deployment strategy and strong balance sheet, 3M is well-positioned to invest in growth opportunities and maintain or improve profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $146.35 for 3M based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $184.0, and the most bearish reporting a price target of just $89.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $26.4 billion, earnings will come to $4.7 billion, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 6.7%.

- Given the current share price of $129.77, the analyst's price target of $146.35 is 11.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives