Last Update 04 Dec 25

Fair value Decreased 0.49%MDU: Pipeline Projects And Equity Raise Will Shape Future Utility Profile

Analysts nudged their price target on MDU Resources slightly higher to $22 from $20, reflecting modestly lower perceived cost of capital and steady expectations for mid single digit earnings growth, supported by visible pipeline upside and a favorable utilities capex backdrop.

Analyst Commentary

Recent Street research presents a generally constructive but balanced view on MDU Resources, with bullish analysts highlighting re-rated upside tied to capital deployment and pipeline projects, while more cautious voices point to relative value constraints versus higher growth peers in the utilities space.

Bullish Takeaways

- Bullish analysts see the higher price target as supported by a lower perceived cost of capital, which enhances the present value of MDU's regulated and midstream cash flows.

- Visible upside from the Bakken East Pipeline is seen as a key driver of incremental earnings, with some models attributing roughly one dollar per share of potential value at partial probability.

- Core utility and infrastructure businesses are viewed as offering compelling value at current share levels, with expectations for mid to high single digit annual earnings growth that compares favorably to many traditional utility names.

- The broader sector backdrop of elevated power demand and rising capex is seen as supportive for rate base expansion and earnings compounding, which underpins the recent move to a more constructive rating and higher valuation multiples.

Bearish Takeaways

- Bearish analysts maintain a Hold stance, arguing that the current share price already discounts much of the pipeline optionality and regulated growth, limiting near term upside.

- Compared with faster growing integrated utilities positioned for large scale generation additions, MDU is seen as offering more moderate growth, which can cap relative valuation expansion.

- Some coverage highlights execution risk around delivering the full earnings contribution from pipeline projects and planned capex, which could pressure multiples if timelines or returns slip.

- In a sector with a number of perceived higher growth and pure play beneficiaries of the power demand cycle, MDU is sometimes grouped among names that warrant more neutral ratings until catalysts are further de risked.

What's in the News

- Completed a follow on equity offering of approximately $200 million, issuing 10,152,284 common shares at around $19.70, bolstering the balance sheet and funding growth initiatives (Key Developments)

- Filed for a $200 million follow on equity offering of common stock ahead of the final transaction, signaling planned capital raising to support utility and infrastructure investments (Key Developments)

- Added TD Securities, Inc. as co lead underwriter on the $199.999995 million follow on equity offering, expanding the underwriting syndicate for the capital raise (Key Developments)

- Entered a non binding MOU with North Plains Connector LLC for 150 megawatts of capacity on the 3,000 megawatt North Plains Connector HVDC transmission project, potentially covering over 15% of MDU's 2024 peak load once operational (Key Developments)

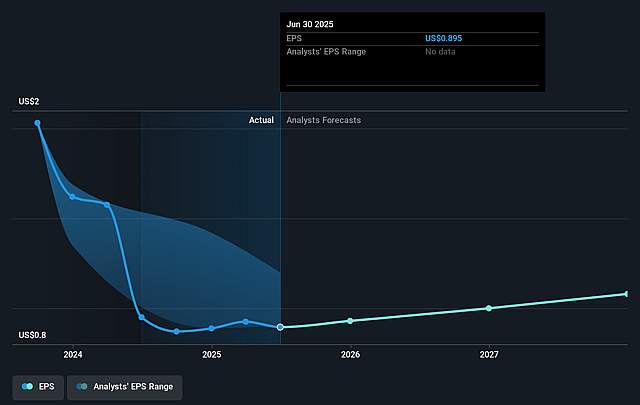

- Narrowed 2025 earnings guidance to $0.90 to $0.95 per share, from $0.88 to $0.95, while reaffirming long term EPS growth expectations of 6% to 8% (Key Developments)

Valuation Changes

- Fair Value Estimate has edged down slightly, from $20.60 to $20.50 per share, reflecting a marginally less optimistic intrinsic valuation.

- Discount Rate has decreased fractionally, from 6.956% to 6.956%, indicating an essentially unchanged view of MDU Resources Group's cost of capital.

- Revenue Growth Assumption is effectively flat, ticking down from 4.65% to 4.65%, implying no meaningful change in top line growth expectations.

- Net Profit Margin has increased very slightly, from 11.57% to 11.57%, suggesting a negligible improvement in projected profitability.

- Future P/E Multiple has fallen modestly, from 20.66x to 20.56x, which points to a small reduction in the valuation multiple applied to forward earnings.

Key Takeaways

- Focused investment in regulated utility and infrastructure projects positions the company for steady growth amid rising energy and construction demand.

- Divestment of non-core operations streamlines capital allocation, enhancing predictability and supporting stable, long-term earnings and cash flow potential.

- Mounting operational costs, infrastructure investment needs, and energy transition risks threaten stable growth, margin performance, and long-term returns amid regulatory, weather, and technological uncertainties.

Catalysts

About MDU Resources Group- Engages in the regulated energy delivery businesses in the United States.

- Strong ongoing and future investment in U.S. infrastructure, including large pipeline expansion projects and potential new transmission or generation to serve data centers, positions MDU to benefit from robust construction demand and growing energy needs, providing significant future revenue and earnings uplift.

- Accelerating demand for natural gas as a bridge fuel-supported by increasing data center loads, regional industrial growth, and population expansion in the Midwest and West-propels stable volumetric growth, underpinning consistent rate base and utility revenue expansion.

- Regulatory support for grid modernization, rate case success (Wyoming, South Dakota, Idaho, Montana), and capital-light approaches for initial data center loads enable higher allowed returns and margin optimization in the utility segment, supporting improved long-term net margins.

- The spinoff of non-core operations (like Knife River) has sharpened capital allocation, focusing investment on regulated businesses where high predictability and backlog visibility can drive steady EBITDA and earnings growth.

- A growing, diversified project pipeline and storage opportunities in the Bakken, supported by state interest and customer commitments, offer optionality for incremental growth beyond what is currently forecast, increasing upside potential for future earnings and cash flows.

MDU Resources Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MDU Resources Group's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.9% today to 11.5% in 3 years time.

- Analysts expect earnings to reach $233.0 million (and earnings per share of $1.08) by about September 2028, up from $182.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, up from 18.0x today. This future PE is greater than the current PE for the US Gas Utilities industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

MDU Resources Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating transition to renewable energy and potential carbon regulations may threaten long-term demand for natural gas infrastructure, risking stranded assets and slower growth in MDU's core pipeline and utility segments, thereby impacting long-term revenue and asset returns.

- Persistently rising operation and maintenance expenses, driven by payroll inflation, insurance, and regulatory compliance (including wildfire mitigation), could outpace rate recovery and offset revenue growth from rate cases, putting pressure on net margins and long-term earnings.

- Required multi-billion-dollar capital investments in rate base and new infrastructure may necessitate accessing equity markets, potentially leading to shareholder dilution and increasing financial leverage, which can limit EPS growth and negatively impact return on equity.

- Exposure to region-specific weather risks (as seen with warmer winters impacting natural gas volumes in Idaho and Montana) and reliance on localized customer and industrial demand, including uncertain data center expansion, may lead to unpredictable revenue streams and earnings volatility over the long term.

- Slow but steady electrification trends and technological competition in the utility sector could reduce future gas throughput and render legacy assets less competitive, limiting organic growth opportunities and pressuring long-term operating margins and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.5 for MDU Resources Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $233.0 million, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $16.06, the analyst price target of $19.5 is 17.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.