Last Update 14 Dec 25

LNN: Future Returns Will Depend On Buybacks Amid Irrigation Headwinds

Analysts have trimmed their price target on Lindsay to $122 from $136, reflecting concerns about ongoing domestic irrigation headwinds and tougher FY26 comparisons in international irrigation and infrastructure following large FY25 projects.

Analyst Commentary

Bullish Takeaways

- Bullish analysts highlight that the recent top line beat suggests underlying demand for Lindsay's products remains resilient despite macro and sector-specific pressures.

- Execution on large FY25 international irrigation and infrastructure projects is viewed as a near term growth driver that can support revenue visibility and cash generation.

- Some see the reset price target as better aligning valuation with current fundamentals, potentially reducing downside risk if management can stabilize margins.

- Strength in select international markets is seen as a structural growth opportunity that could offset softer domestic trends over the medium term.

Bearish Takeaways

- Bearish analysts point to the EPS miss as evidence that profitability is lagging revenue growth, raising concerns about cost control and margin execution.

- Persistent domestic irrigation headwinds are seen as a constraint on near term earnings power and a key reason for a more cautious valuation framework.

- Difficult FY26 comparisons in international irrigation and infrastructure following large FY25 projects could slow reported growth and weigh on the stock's multiple.

- The maintained neutral rating reflects skepticism that management can quickly reaccelerate earnings growth, limiting potential upside in the shares at current levels.

What's in the News

- Lindsay entered a major supply agreement to provide Zimmatic irrigation systems and FieldNET remote management technology across the MENA region, a project expected to generate about $80 million in revenue with roughly $70 million recognized in fiscal 2026 (company announcement).

- The Board of Directors authorized a new share repurchase program allowing the company to buy back up to $150 million of common stock with no expiration date (buyback transaction announcement).

- Between September 1, 2025 and November 3, 2025, Lindsay repurchased 224,420 shares for $29.81 million, bringing total repurchases under the 2014 program to 2,888,941 shares, or 24.7 percent of shares, for $250 million (buyback tranche update).

- From June 1, 2025 to August 31, 2025, the company repurchased 63,097 shares for $8.77 million, increasing cumulative buybacks under the 2014 authorization to 2,664,521 shares, or 22.62 percent of shares, for $220.19 million (buyback tranche update).

- Lindsay appointed Sam Hinrichsen as incoming Chief Financial Officer effective January 1, 2026, succeeding retiring CFO Brian Ketcham, with Hinrichsen joining as Senior Vice President on November 3, 2025 (executive changes).

Valuation Changes

- Fair Value: Unchanged at $127, indicating no revision to the intrinsic value estimate.

- Discount Rate: Fell slightly from 8.59 percent to about 8.55 percent, reflecting a modestly lower required return.

- Revenue Growth: Effectively unchanged at about 4.29 percent, signaling no material shift in top line growth assumptions.

- Net Profit Margin: Essentially flat at about 11.69 percent, with only a negligible model adjustment.

- Future P/E: Edged down slightly from about 18.13x to 18.11x, implying a marginally lower valuation multiple on forward earnings.

Key Takeaways

- Strategic supply chain management and tariff actions help Lindsay maintain margins amid global uncertainties, supporting continued revenue and operating income growth.

- Growth in international markets and new product launches enhance Lindsay's revenue potential, while liquidity supports strategic investments for long-term shareholder value.

- Rising interest rates, tariffs, and infrastructure project timing uncertainties could challenge Lindsay's revenue growth and earnings stability across international and domestic markets.

Catalysts

About Lindsay- Provides water management and road infrastructure products and services in the United States and internationally.

- The completion of large Road Zipper projects and a strong sales pipeline for future projects suggest continued revenue growth in the infrastructure segment. This aligns with expectations for increased operating income and margin improvements due to a favorable revenue mix.

- The growth in international irrigation markets, particularly in MENA and Brazil, driven by large projects and improved commodity prices, positions Lindsay for sustained revenue growth in these regions, even as North American demand remains stable.

- The approval and launch of new safety products, such as the TAU-XR Xpress Repair Crash Cushion, can enhance product offerings and drive higher-margin revenues in the infrastructure sector.

- Strategic supply chain initiatives and potential tariff-related pricing actions indicate an ability to manage cost pressures, helping to maintain or improve net margins despite global economic uncertainties.

- The ample liquidity and strong balance sheet, combined with capital allocation strategies, suggest potential for strategic investments or acquisitions that could enhance earnings and shareholder value over the long term.

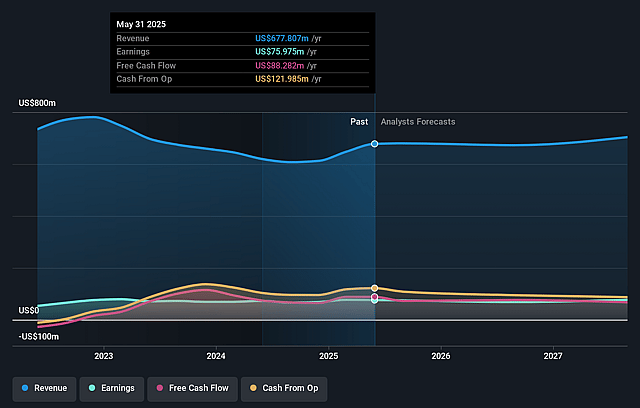

Lindsay Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lindsay's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.2% today to 11.5% in 3 years time.

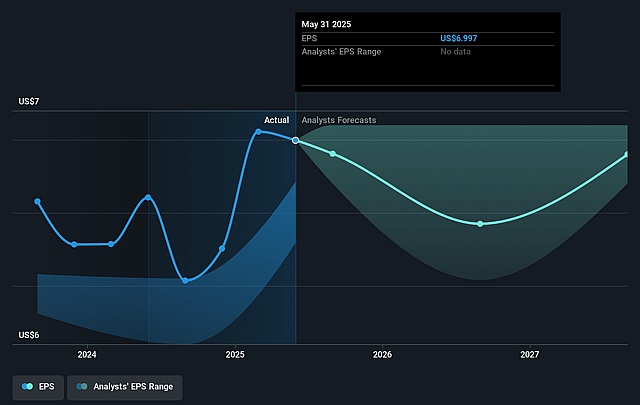

- Analysts expect earnings to reach $86.5 million (and earnings per share of $7.88) by about September 2028, up from $76.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.4x on those 2028 earnings, up from 19.7x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.13%, as per the Simply Wall St company report.

Lindsay Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising interest rates and a more challenging credit environment in Brazil may temper demand for Lindsay's products, potentially impacting international revenue growth.

- The uncertainty around the timing of large infrastructure projects, such as Road Zipper, makes it difficult to predict future revenue streams, thereby impacting earnings stability.

- The North American irrigation market is not expected to see significant improvement in market conditions in the near term, potentially leading to stagnation or decline in domestic revenues.

- Potential tariff impacts, including on goods sourced from Taiwan and Korea, and rising steel prices due to tariff uncertainties, could increase cost of goods sold, affecting net margins if not fully passed through to customers.

- Retaliatory tariffs affecting U.S. agricultural exports could negatively impact the demand from U.S. farmers for irrigation equipment, possibly reducing domestic revenues and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $153.0 for Lindsay based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $170.0, and the most bearish reporting a price target of just $136.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $751.5 million, earnings will come to $86.5 million, and it would be trading on a PE ratio of 22.4x, assuming you use a discount rate of 8.1%.

- Given the current share price of $138.1, the analyst price target of $153.0 is 9.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Lindsay?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.