Key Takeaways

- Accelerated cost synergies and broad-based order growth suggest earlier, larger profitability gains and sustained revenue expansion across multiple sectors and regions.

- Advancements in automation, digital solutions, and emerging market expansion strengthen recurring high-margin revenue streams and position the company for long-term outperformance.

- Rising trade barriers, demand cyclicality, and integration challenges threaten profitability and revenue stability, while shifts toward sustainability and alternative proteins put long-term growth at risk.

Catalysts

About JBT Marel- Provides technology solutions to food and beverage industry in North America, Europe, the Middle East, Africa, the Asia Pacific, and Central and South America.

- While analyst consensus highlights the $150 million cost synergies achievable by year three through integration, the pace and scope of realized synergies in early 2025 already outpace expectations, suggesting the combined organization could surpass targeted annual run-rate savings ahead of schedule, providing an earlier and larger uplift to EBITDA and margins.

- Analyst consensus views revenue synergies, especially from cross-selling in poultry, as significant, but record first-quarter order growth across diverse end markets-including pet food, pharma, and global regions-signals revenue growth potential is not only broader, but could compound multi-year as JBT Marel leverages its expanded platform and customer relationships for persistent double-digit top-line increases.

- The shift toward automation and robotics-driven by global labor shortages and surging protein demand-is accelerating at a faster rate than anticipated, positioning JBT Marel as a prime beneficiary for outsized equipment and software sales growth that could structurally expand revenue and widen net margins.

- JBT Marel's unmatched end-to-end solutions, bolstered by its robust digital and traceability capabilities, are set to capture higher demand as food processors and regulators worldwide intensify focus on food safety and sustainability, likely driving orders for high-value, recurring software and aftermarket services and resulting in a sustained and resilient increase in recurring, high-margin revenue streams.

- Ongoing geographic expansion, particularly leveraging substantial manufacturing and innovation capacity in Brazil and emerging markets, is already yielding outsized order growth in less-penetrated protein sectors like seafood and alternative proteins; this positions JBT Marel for long-term, above-market revenue growth independent of cyclicality in developed regions.

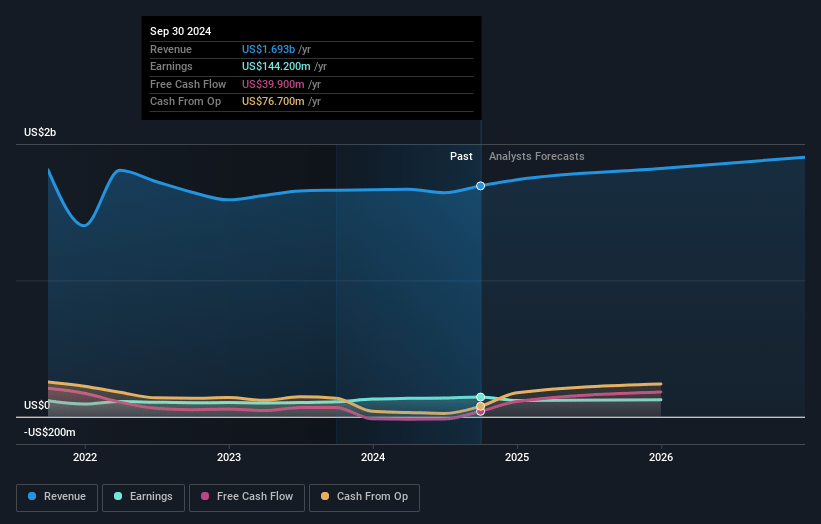

JBT Marel Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on JBT Marel compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming JBT Marel's revenue will grow by 27.0% annually over the next 3 years.

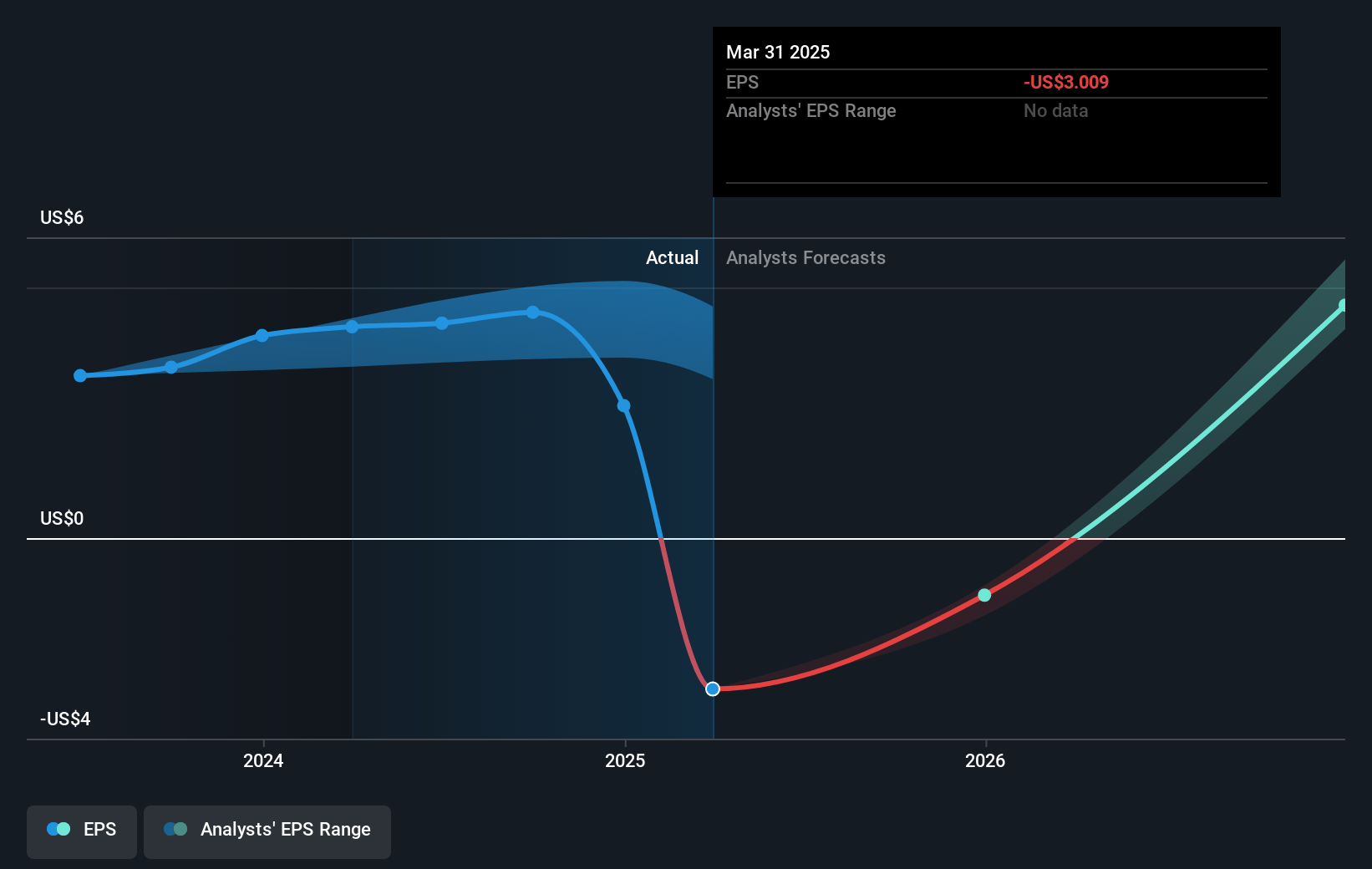

- The bullish analysts assume that profit margins will increase from -5.1% today to 19.9% in 3 years time.

- The bullish analysts expect earnings to reach $888.6 million (and earnings per share of $22.44) by about July 2028, up from $-111.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, up from -62.3x today. This future PE is lower than the current PE for the US Machinery industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.14%, as per the Simply Wall St company report.

JBT Marel Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened global protectionism and U.S. tariffs are already impacting JBT Marel's cost structure, with management estimating a negative cost impact of $12 million to $15 million per quarter before mitigation, which could compress gross margins and reduce overall profitability if cost pass-throughs to customers prove difficult.

- JBT Marel's temporary suspension of full-year guidance, citing uncertainty around trade policy, macroeconomic headwinds, and customer investment decisions, signals limited visibility and heightened earnings risk for the second half of 2025 and beyond, increasing the likelihood of revenue and earnings volatility.

- The company remains heavily reliant on cyclical capital expenditures from food processors, with management noting order delays and lost orders as customers defer investment amid uncertainty, which amplifies the company's exposure to industry downturns and presents risk to predictable revenue streams.

- The integration of JBT and Marel, while progressing, still faces risks from potential operational inefficiencies, possible failure to realize projected synergy savings, and challenges in optimizing combined R&D and innovation spend, all of which could limit net margin expansion and erode the bottom line if not carefully managed.

- Long-term secular trends toward sustainability, ESG mandates, and the rapid rise of alternative proteins and food processing technologies threaten the traditional animal processing market that underpins much of JBT Marel's business, potentially shrinking its addressable market and impinging future revenue growth if the company does not successfully pivot its portfolio.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for JBT Marel is $148.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of JBT Marel's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $148.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.5 billion, earnings will come to $888.6 million, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 8.1%.

- Given the current share price of $133.25, the bullish analyst price target of $148.0 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.