Key Takeaways

- Growing demand for smart access technology and international expansion are diversifying revenue streams and increasing resilience across key markets.

- Emphasis on facility upgrades, cost reductions, and favorable self-storage trends are supporting sustained earnings and margin improvement.

- Heavy dependence on self-storage, rising material costs, and shifting market/regulatory dynamics threaten sustainable growth and margins, despite limited mitigation from the repair-oriented segment.

Catalysts

About Janus International Group- Janus International Group, Inc. manufacturers and supplies turn-key self-storage, commercial, and industrial building solutions in North America and internationally.

- Adoption of Janus' Noke Smart Entry and Ion systems continues to ramp up, with installed units growing more than 5% sequentially and customer demand strong for tech-enabled access and automation—a sign future revenue and high-margin software-as-a-service income streams will accelerate as smart building adoption deepens across the self-storage and industrial sectors.

- Urbanization trends and smaller household sizes are sustaining structural demand for self-storage globally, a factor reflected in management’s confidence around long-term fundamentals and an expanding backlog, pointing to robust multi-year project pipelines that will fuel revenue and EBITDA growth as macro conditions stabilize.

- The R3 (repair, restore, replace) segment is entering an acceleration phase, as customers focus capital on improving and upgrading existing self-storage assets rather than new construction; this is already evidenced by 19% year-over-year R3 growth, increasing order flow, and a multiyear runway for facility rebranding and renovations, all of which should support earnings growth and margin stability.

- Janus is successfully executing a $10 million to $12 million structural cost reduction plan set to be fully realized in the second quarter of 2025, underpinning margin expansion and improved net income even before demand fully rebounds.

- International expansion, particularly in Europe, is driving double-digit growth and diversifying revenue streams, supporting long-term earnings growth and reducing reliance on any single geography or customer cohort, ultimately making future cash flows more resilient.

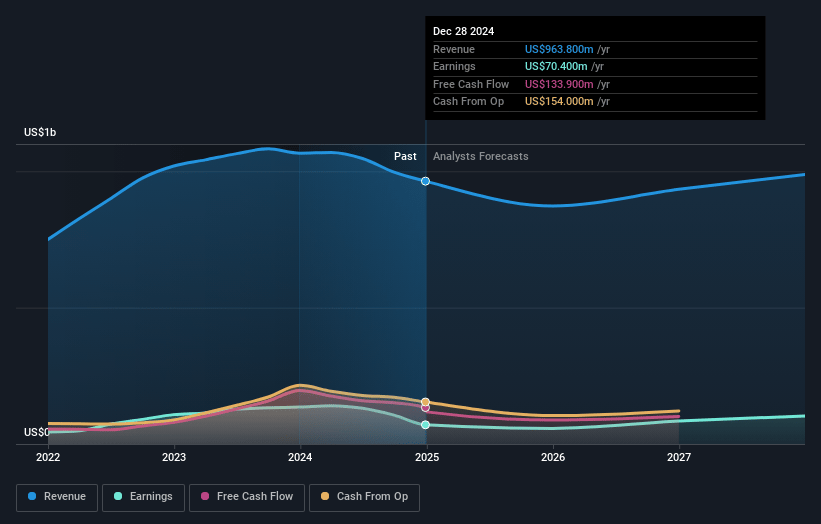

Janus International Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Janus International Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Janus International Group's revenue will grow by 2.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.5% today to 12.1% in 3 years time.

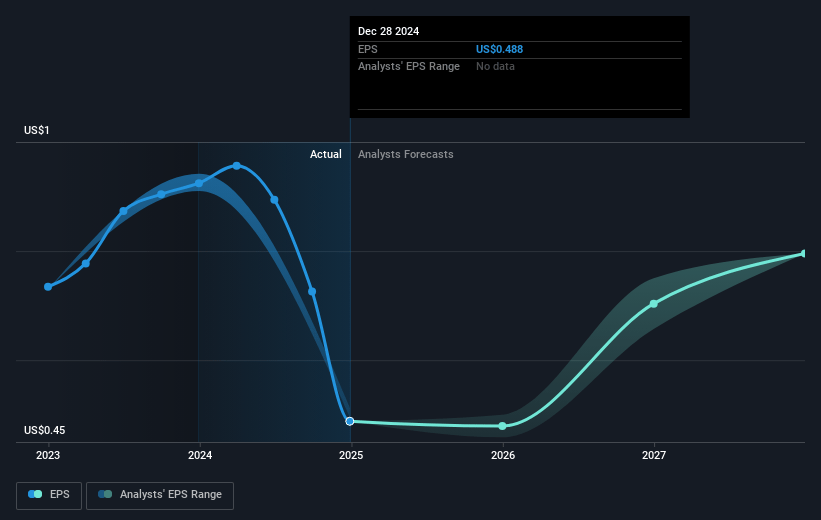

- The bullish analysts expect earnings to reach $121.0 million (and earnings per share of $0.95) by about July 2028, up from $50.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, down from 25.1x today. This future PE is lower than the current PE for the US Building industry at 21.4x.

- Analysts expect the number of shares outstanding to decline by 3.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.84%, as per the Simply Wall St company report.

Janus International Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The combination of sustained high interest rates, tighter credit markets, and macroeconomic uncertainty has resulted in a significant decline in new construction and self-storage revenues, with first-quarter revenue down 17.3 percent and self-storage specifically down 23.1 percent, signaling that future growth in these core markets could be meaningfully constrained and presenting a headwind for total company revenues and earnings.

- Janus’s heavy reliance on the self-storage sector increases its vulnerability to sector-specific downturns or saturation, as illustrated by the pronounced volume-driven revenue decline and project delays, which could materially reduce long-term revenue growth and overall business resilience.

- Ongoing and future increases in tariffs and raw material costs, particularly for steel and related commodities, are expected to result in additional annual expenses in the range of ten to twelve million dollars beyond 2025, and if these costs cannot be sufficiently mitigated or passed through to customers, they could further compress net margins and profitability.

- The R3 (repair, renovation, and replacement) business is partially offsetting declines in new self-storage construction, but the segment’s growth is largely tied to institutional customers, while non-institutional customers have limited capital expenditures, raising concerns about sustainable long-term growth and putting pressure on overall revenue stability.

- The international segment’s lower margin profile, combined with the possibility of increased compliance costs from evolving sustainability demands and stricter environmental regulations, could drag down consolidated adjusted EBITDA margins and reduce overall net income as environmental pressures and global market mix persist.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Janus International Group is $12.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Janus International Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $7.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $997.5 million, earnings will come to $121.0 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of $9.04, the bullish analyst price target of $12.0 is 24.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.