Narratives are currently in beta

Key Takeaways

- GE Aerospace's LEAP engine durability upgrades and expanded MRO capabilities aim to boost service revenue, profitability, and operating margins amidst fleet growth.

- New technologies and strong order growth position GE for future revenue acceleration and market leadership in next-generation aircraft propulsion.

- Supply chain issues, inflation, and risky investments are pressuring General Electric's operating margins, net earnings, and revenue growth objectives.

Catalysts

About General Electric- General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

- GE Aerospace's LEAP engine is set for a 2.5x improvement in time on wing with durability upgrades, which should enhance customer satisfaction and reduce maintenance costs. This improvement is likely to boost service revenue and profitability as fleet size is projected to double by 2030.

- The company is investing $1 billion over the next five years to expand MRO capabilities, partnering with third-party networks, and opening new facilities. These efforts are aimed at meeting increased demand, thereby driving aftermarket growth and improving operating margins.

- GE Aerospace is leveraging its proprietary lean operating model, FLIGHT DECK, to enhance supplier relationships and manufacturing efficiencies, which should facilitate increased engine outputs and improve delivery schedules. This operational focus is expected to positively affect revenues and net margins by reducing bottlenecks and improving cost structures.

- Strong order growth in both Commercial Engines & Services and Defense & Propulsion Technologies positions GE for robust revenue streams. The substantial backlog of $149 billion, with significant commitments for new engine programs like the GE9X, is indicative of anticipated revenue acceleration as these orders convert to sales.

- The rollout of new technologies such as the open fan design and the Catalyst turboprop engine aim to provide advancements in sustainability and efficiency. These innovations are potential catalysts for future revenue and market share growth, particularly as GE positions itself at the forefront of next-generation aircraft propulsion technologies.

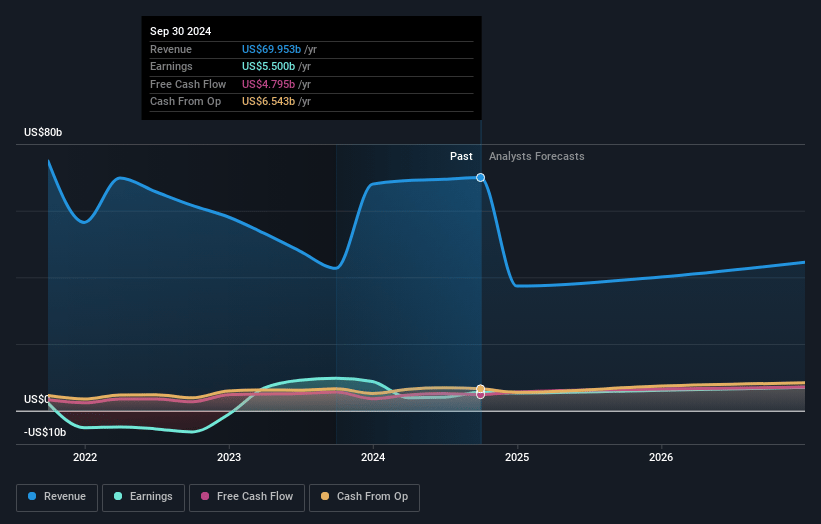

General Electric Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming General Electric's revenue will decrease by -12.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.9% today to 17.0% in 3 years time.

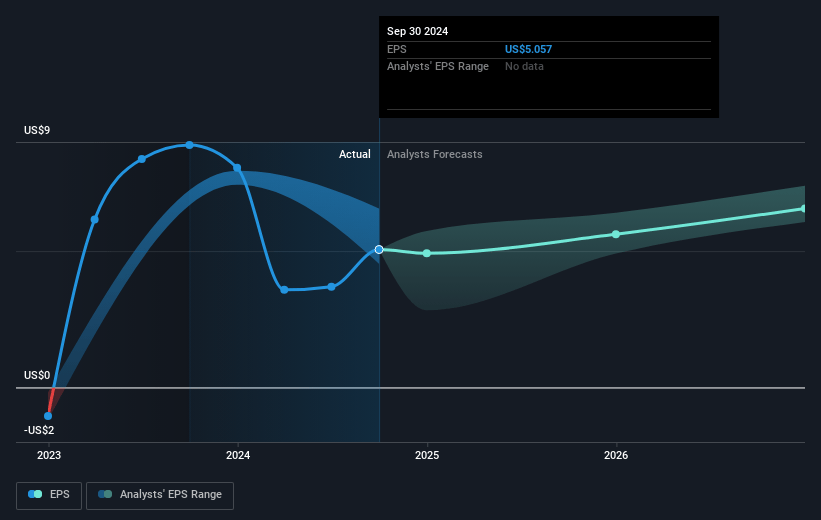

- Analysts expect earnings to reach $8.0 billion (and earnings per share of $7.47) by about January 2028, up from $5.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.8x on those 2028 earnings, down from 33.9x today. This future PE is greater than the current PE for the GB Aerospace & Defense industry at 33.2x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.34%, as per the Simply Wall St company report.

General Electric Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Supply chain constraints have impacted shipments across narrowbody and widebody engine deliveries, which could affect revenue and net margins due to increased costs and delayed sales.

- Increase in inflation and investments are partially offsetting gains from service volume and favorable mix, posing a risk to operating margins and net earnings.

- Decline in Defense & Propulsion Technologies profit despite strong order increases, driven by unfavorable engine mix and inflation, may challenge revenue growth and margin expansion goals.

- Continued investment in R&D for next-gen products, despite a tough margin environment, can pressure net margins and earnings if the investments don't yield substantial returns.

- Delays in major projects like the 777X program could lead to timing issues in revenue recognition and increase operating losses on specific program lines, negatively affecting overall net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $210.12 for General Electric based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $47.0 billion, earnings will come to $8.0 billion, and it would be trading on a PE ratio of 33.8x, assuming you use a discount rate of 6.3%.

- Given the current share price of $172.31, the analyst's price target of $210.12 is 18.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives