Narratives are currently in beta

Key Takeaways

- Strategic investments and operational enhancements at GE Aerospace are poised to boost productivity, improve margins, and support long-term revenue and earnings growth.

- Share repurchases and dividend increases are expected to enhance earnings per share and attract investor interest, strengthening stock valuation.

- Supply chain issues, defense budget uncertainties, and execution risks in new technologies could collectively hinder revenue growth and impact profitability.

Catalysts

About General Electric- General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

- The introduction of GE Aerospace's proprietary lean operating model, FLIGHT DECK, is expected to enhance productivity, safety, and reliability, which could drive improvement in net margins and operational efficiencies.

- GE Aerospace's backlog of orders and the anticipated growth in services and engine deliveries, including for LEAP engines, suggests significant future revenue potential, likely impacting overall revenue growth positively.

- The expansion of LEAP aftermarket capacity and the collaboration with third-party MROs for shop visits are expected to drive service revenue growth, which should improve profit margins and support earnings growth.

- Investments exceeding $1 billion in internal MRO facilities over the next five years are aimed at reducing maintenance costs and turnaround time, potentially enhancing net margins and supporting sustainable free cash flow.

- GE's strategic share repurchases and anticipated dividend increases due to a solid balance sheet are expected to drive earnings per share growth, attracting investor interest and potentially lifting stock valuation.

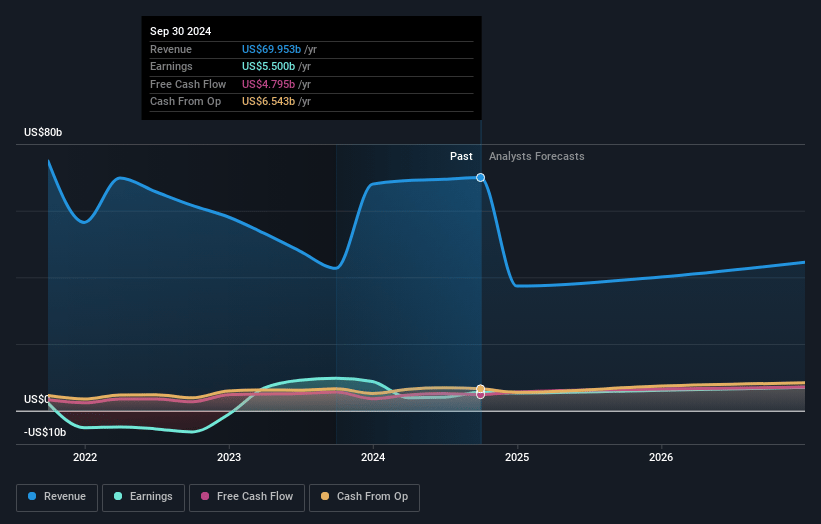

General Electric Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming General Electric's revenue will grow by 6.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.2% today to 16.5% in 3 years time.

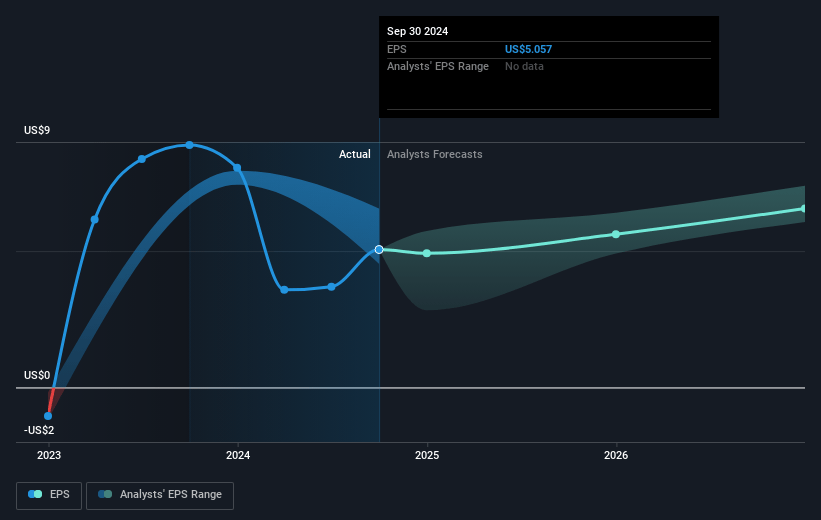

- Analysts expect earnings to reach $7.8 billion (and earnings per share of $7.67) by about January 2028, up from $6.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $6.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.0x on those 2028 earnings, up from 31.4x today. This future PE is greater than the current PE for the GB Aerospace & Defense industry at 34.0x.

- Analysts expect the number of shares outstanding to decline by 1.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.31%, as per the Simply Wall St company report.

General Electric Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent supply chain constraints and material availability challenges could impact revenue growth and profit margins due to delays in production and delivery schedules.

- The anticipated increase in military spending and defense orders may not materialize or could face defense budget cuts, impacting revenue from Defense and Propulsion Technologies (DPT).

- Expected improvements in LEAP engine technology and production efficiency may not be realized, potentially affecting the profitability and cash flow projections.

- Potential inflationary pressures and increased R&D investments might exceed savings from productivity measures, impacting overall net margins.

- Execution risks associated with new technology developments, such as the hybrid electric propulsion systems and open fan engine designs, could lead to higher costs and lower earnings if projects do not proceed as planned.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $223.71 for General Electric based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $261.0, and the most bearish reporting a price target of just $190.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $47.2 billion, earnings will come to $7.8 billion, and it would be trading on a PE ratio of 35.0x, assuming you use a discount rate of 6.3%.

- Given the current share price of $194.43, the analyst's price target of $223.71 is 13.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives