Key Takeaways

- Growing demand in energy transition and infrastructure modernization is driving sustained revenue growth, increased aftermarket bookings, and more predictable, recurring earnings.

- Digitalization, operational efficiency initiatives, and strategic acquisitions are improving margin expansion, portfolio diversification, and quality of earnings.

- Heavy reliance on legacy energy sectors, slow digital adoption, and rising global competition threaten Flowserve’s margins, adaptability, and long-term growth potential.

Catalysts

About Flowserve- Designs, manufactures, distributes, and services industrial flow management equipment in the United States, Canada, Mexico, Europe, the Middle East, Africa, and the Asia Pacific.

- Flowserve is seeing rapidly expanding demand from utilities and industry for specialized flow control solutions in nuclear, LNG, and other energy transition projects, as evidenced by consecutive quarters of $100 million-plus in nuclear awards and significant carbon capture bookings, positioning revenues for long-term growth as decarbonization investments accelerate globally.

- Modernization of critical infrastructure and persistent global megatrends like water scarcity are fueling a multi-year cycle of investment, which is underpinning Flowserve’s strong aftermarket bookings and supporting high recurring revenue and margin expansion through both service contracts and new projects, improving predictability and overall earnings growth.

- The company’s aggressive push into digitalization and IoT-enabled products, such as the RedRaven predictive monitoring platform, is beginning to generate measurable recurring revenue streams and higher aftermarket capture rates, which are likely to further lift margins and strengthen quality of earnings over time.

- Ongoing operational excellence programs, supply chain optimization, and the 80/20 complexity reduction initiatives—including SKUs reductions of 10 to 15 percent and a focus on best customers/products—are driving sustained gross and operating margin expansion, which is expected to add over 200 basis points to margins by 2027 and unlock significant EBIT growth.

- Strategic M&A, including the Mogas acquisition, is accelerating portfolio diversification into structurally growing areas like mining and minerals while delivering immediate cost synergies and improved scale, boosting both reported net sales growth and adjusted earnings per share, with integration benefits expected to accelerate through 2025 and beyond.

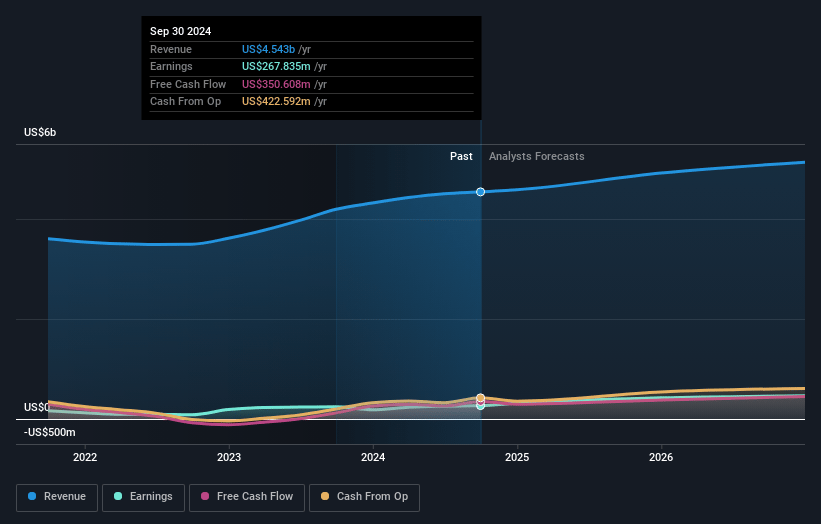

Flowserve Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Flowserve compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Flowserve's revenue will grow by 5.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.2% today to 9.9% in 3 years time.

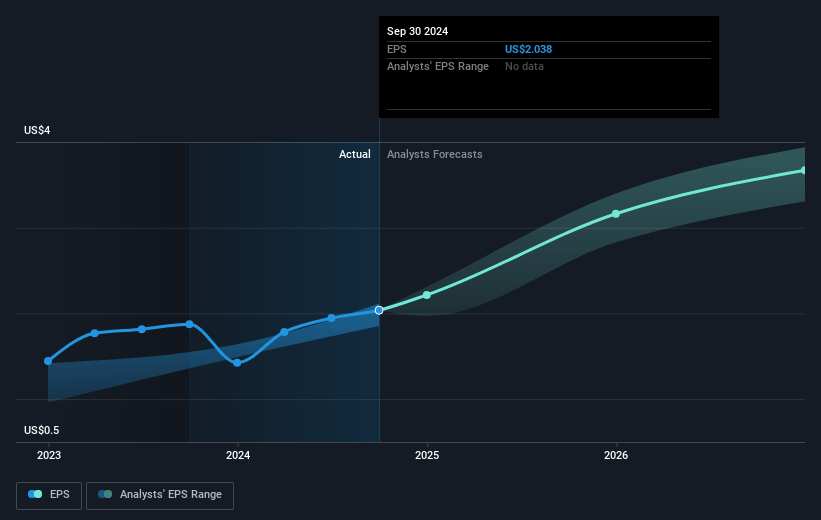

- The bullish analysts expect earnings to reach $527.3 million (and earnings per share of $3.98) by about April 2028, up from $282.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.8x on those 2028 earnings, up from 19.7x today. This future PE is greater than the current PE for the US Machinery industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

Flowserve Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Flowserve’s core business remains heavily exposed to the oil, gas, and petrochemical sectors, making it vulnerable to a long-term global transition toward renewable energy and electrification that could suppress infrastructure investment and lower overall revenues.

- The company acknowledges rising regulatory pressures and the potential for increased compliance costs, especially in traditional process industries, which could result in delayed or canceled projects and ultimately compress net margins as expenses rise faster than sales.

- While Flowserve highlights innovation and digital offerings, there is limited detailed evidence in the text of significant, sustained investment in advanced IIoT or industry-leading data analytics; lagging digitalization relative to peers may gradually erode market share and put downward pressure on gross margins and earnings.

- The business’s large installed base and significant fixed cost structure, rooted in an aged manufacturing footprint, may inhibit its ability to swiftly adapt to cyclical downturns or shifts in demand, increasing the risk of underutilization and negatively impacting net earnings during less favorable macro conditions.

- Increasing global competition, particularly from lower-cost Asian manufacturers and the trend toward decentralized, customized fluid management solutions, could drive intensified price-based competition, reducing Flowserve’s pricing power and profitability even as it seeks margin gains through its internal programs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Flowserve is $80.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Flowserve's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $49.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.3 billion, earnings will come to $527.3 million, and it would be trading on a PE ratio of 24.8x, assuming you use a discount rate of 7.7%.

- Given the current share price of $42.32, the bullish analyst price target of $80.0 is 47.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:FLS. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.