Last Update07 May 25Fair value Increased 1.90%

AnalystLowTarget has increased revenue growth from 1.1% to 1.9%.

Read more...Key Takeaways

- Macroeconomic uncertainty and tariffs may limit Flowserve's revenue expansion, impacting global market demand and project spending.

- Complex supply chain adjustments might strain margins, while uneven tariff exposure pressures segment-specific earnings.

- Geopolitical, tariff, and currency issues pose risks, potentially impacting Flowserve's margins, revenue growth, and project execution in volatile energy sectors.

Catalysts

About Flowserve- Designs, manufactures, distributes, and services industrial flow management equipment in the United States, Canada, Mexico, Europe, the Middle East, Africa, and the Asia Pacific.

- The ongoing macroeconomic uncertainty, combined with the new dynamic introduced by the changing tariff environment, could limit Flowserve's ability to expand revenue despite a healthy start to the year, as tariffs may impact global market demand which might first affect project spending.

- Supply chain disruptions and trade policies have pushed Flowserve to develop more resilient and diversified supply networks; however, the complexity and cost involved in adjusting these logistics could impact net margins over time. While the company claims readiness, tariff pressures, especially from essential materials sourced from China, India, and Mexico, could affect earnings depending on how well mitigation tactics offset these pressures.

- The 80/20 operational efficiency program could drive gross margin expansion with anticipated 50 basis points or more contribution at the Flowserve level, but if market conditions worsen or if the expected complexity reductions face hurdles, margin improvements might not reach targets, affecting earnings.

- While Flowserve has identified a core growth area in nuclear and aftermarket bookings which offer steady revenue streams, potential project deferrals in industries like mining and renewables could limit the company's top-line growth if macroeconomic conditions shift abruptly.

- The disparity in Flowserve's tariff exposure, with FCD (valves) affected more than FPD (pumps), could pressure segment-specific margins unevenly, potentially offsetting broader corporate earnings improvements, particularly if tariff conditions intensify in the latter half of the year.

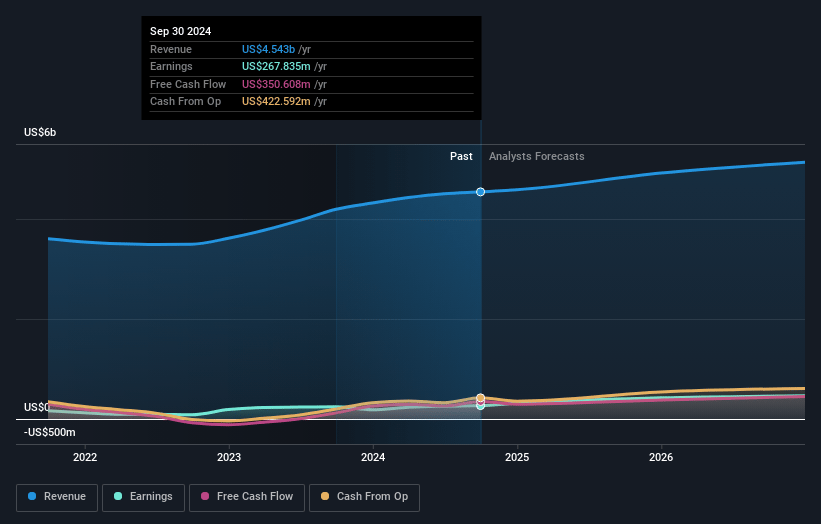

Flowserve Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Flowserve compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Flowserve's revenue will grow by 1.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.1% today to 10.8% in 3 years time.

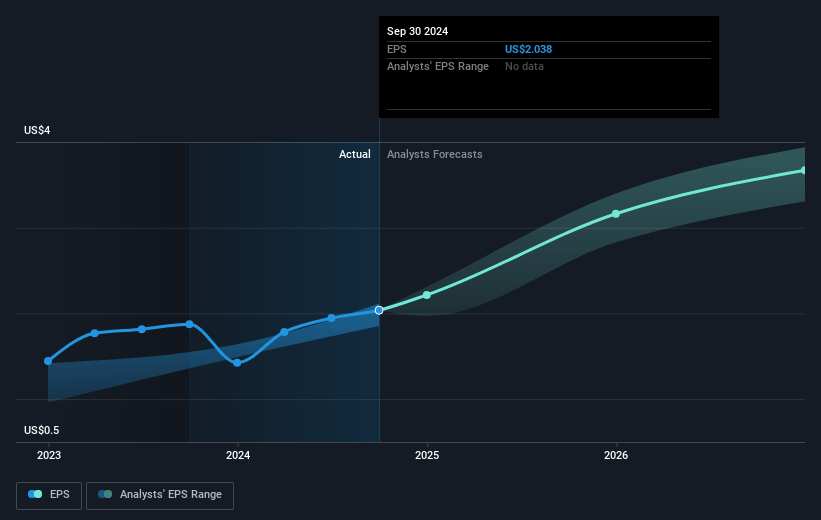

- The bearish analysts expect earnings to reach $527.8 million (and earnings per share of $3.94) by about May 2028, up from $282.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, down from 24.1x today. This future PE is lower than the current PE for the US Machinery industry at 23.1x.

- Analysts expect the number of shares outstanding to decline by 0.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.78%, as per the Simply Wall St company report.

Flowserve Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The evolving tariff environment, especially with exposures tied to China, India, and Mexico, poses a risk to the supply chain, potentially affecting gross margins by $90 million to $100 million annually if not mitigated.

- There is macroeconomic uncertainty ahead, which could lead to possible slowdowns in bookings and project delays, impacting revenue projections and backlog execution.

- The foreign currency translation negatively impacted reported sales growth, posing a risk that could continue to affect revenues if the U.S. dollar strengthens throughout the year.

- Flowserve's reliance on project funding in nuclear and energy sectors could lead to volatility in booking as geopolitical and regulatory challenges affect project execution, influencing future revenue growth.

- While execution under the Flowserve Business System is cited as a strength, supply chain disruptions or inefficiencies could erode the expected 200-plus basis points of margin expansion, reducing operating margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Flowserve is $53.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Flowserve's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $53.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.9 billion, earnings will come to $527.8 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 7.8%.

- Given the current share price of $52.13, the bearish analyst price target of $53.0 is 1.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.