Key Takeaways

- Leadership transition under Sean O'Connell is set to enhance operational efficiencies and drive revenue growth through strategic transformations.

- Bren-Tronics integration and lithium Gigafactory initiatives are poised to expand production capacity and margins, bolstering revenue in high-growth sectors.

- Leadership transition risks and execution delays in the fast charging business may impact EnerSys' revenue growth and ability to meet sales targets.

Catalysts

About EnerSys- Engages in the provision of stored energy solutions for industrial applications worldwide.

- EnerSys' transition to new leadership under Sean O'Connell, who has successfully implemented cost-saving measures and strategic transformations, positions the company for future operational efficiencies and revenue growth.

- The integration of Bren-Tronics is expected to exceed expectations, driving revenue growth and margin expansion in the aerospace and defense sector.

- EnerSys is planning a $200 million Department of Energy award-backed lithium Gigafactory, which will enhance production capacity, reduce costs, and create new revenue streams in the high-margin lithium battery segment.

- Ongoing investments in automation and flexible production capabilities aim to double production capacity at lower operational costs, significantly boosting net margins and earnings.

- The first installation of EnerSys’ fast charge and storage system introduces a new chapter in energy management solutions, offering promising demand indicators for future revenue growth.

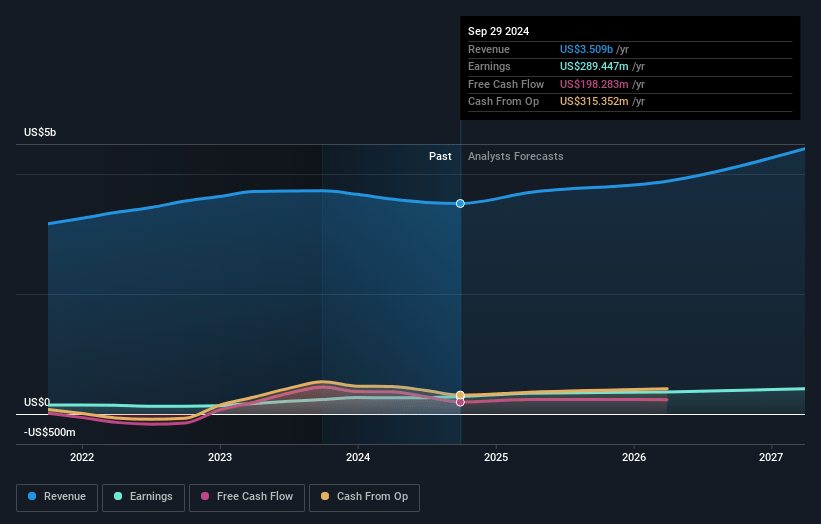

EnerSys Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EnerSys's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.2% today to 10.1% in 3 years time.

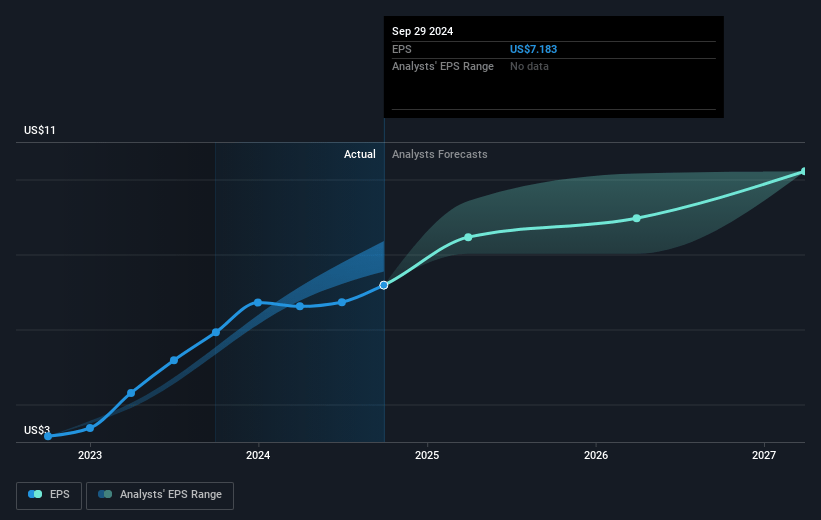

- Analysts expect earnings to reach $416.0 million (and earnings per share of $8.81) by about January 2028, up from $289.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.4x on those 2028 earnings, up from 13.2x today. This future PE is lower than the current PE for the US Electrical industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 5.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

EnerSys Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Leadership transition risks could impact continuity and strategic execution, affecting future earnings and revenue growth.

- Delays in the fast charging and storage business may impact projected revenue growth, hindering EnerSys' ability to meet ambitious sales targets in this sector.

- Potential downturns in the Class 8 truck market could continue to suppress OEM demand, affecting revenue and margins, particularly in the Specialty segment.

- High inventory levels and stagnant demand in certain markets, like Motive Power, could lead to decreased revenue and profit margins if not managed effectively.

- Increased capital expenditures, such as those related to the lithium Gigafactory, may strain cash flow or financial resources, impacting net margins and long-term earnings if expected returns do not materialize as planned.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $115.15 for EnerSys based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $416.0 million, and it would be trading on a PE ratio of 16.4x, assuming you use a discount rate of 8.0%.

- Given the current share price of $96.12, the analyst's price target of $115.15 is 16.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives