Narratives are currently in beta

Key Takeaways

- Acquiring AspenTech enhances Emerson's software strategy, optimizing costs through synergies and potentially increasing revenue and recurring revenue streams.

- Divesting non-core segments while focusing on automation solutions aims to improve margins and shareholder returns, supported by substantial stock buybacks.

- Reliance on acquisitions and strategic moves faces risks that could affect revenue growth, margins, and shareholder value if expected synergies and market recoveries falter.

Catalysts

About Emerson Electric- A technology and software company, provides various solutions for customers in industrial, commercial, and consumer markets in the Americas, Asia, the Middle East, Africa, and Europe.

- Emerson is pursuing the acquisition of the remaining shares of AspenTech, which could unlock significant value creation and accelerate Emerson's industrial software strategy. This move is expected to enhance revenue by integrating AspenTech's capabilities with Emerson's portfolio and optimizing costs through synergies.

- By exploring strategic alternatives, including a potential sale for its Safety & Productivity business, Emerson aims to align its focus on automation solutions and maximize shareholder value, likely impacting net margins positively as non-core segments are divested.

- The company plans to increase capital returns to shareholders through substantial stock buybacks, suggesting potential earnings per share (EPS) growth by reducing share count and highlighting confidence in its free cash flow generation capabilities.

- The alignment of technology roadmaps between Emerson and AspenTech is expected to foster innovation and shift towards a software-defined enterprise automation architecture, which could expand recurring revenue streams and improve long-term earnings stability.

- Emerson's focus on leveraging its existing strengths in automation markets, coupled with investments in energy transition, digital transformation, and life sciences, is expected to drive mid-single-digit growth in process and hybrid markets, potentially boosting revenue growth and market share.

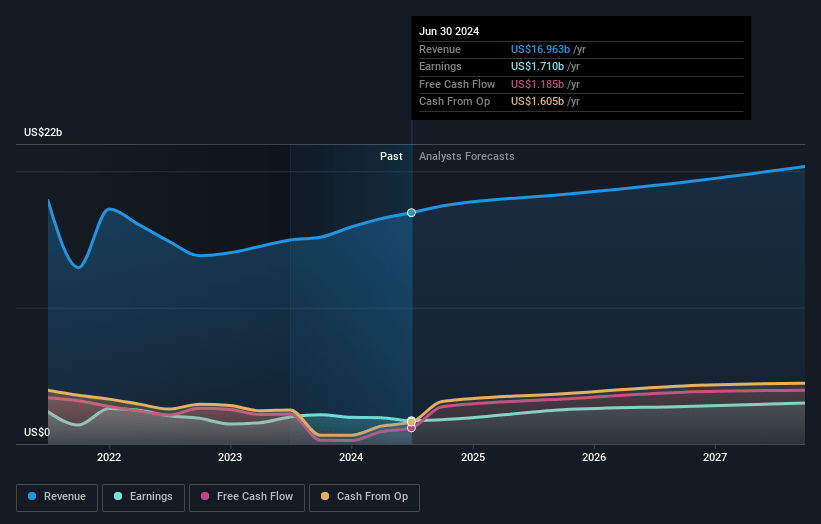

Emerson Electric Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Emerson Electric's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.2% today to 14.8% in 3 years time.

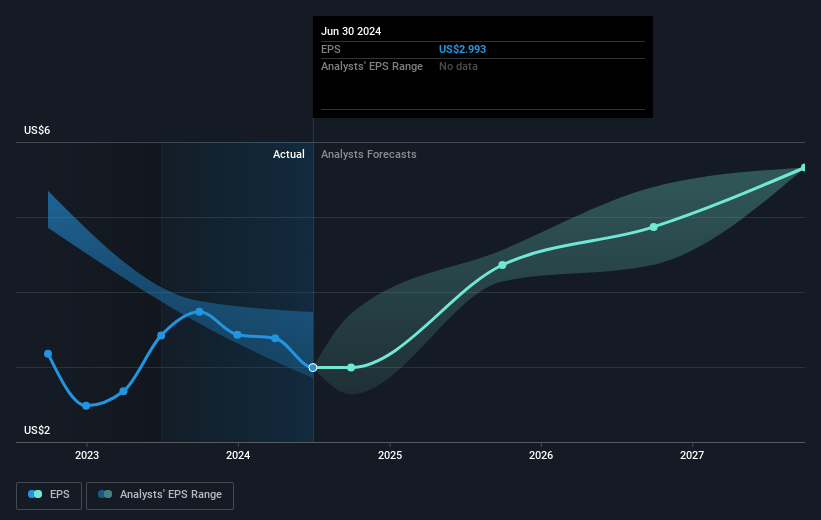

- Analysts expect earnings to reach $3.0 billion (and earnings per share of $5.66) by about November 2027, up from $1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.1x on those 2027 earnings, down from 46.0x today. This future PE is greater than the current PE for the US Electrical industry at 25.0x.

- Analysts expect the number of shares outstanding to decline by 2.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

Emerson Electric Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bid to acquire remaining shares of AspenTech might not succeed, which introduces uncertainty in strategic goals and could negatively impact future revenue synergies anticipated from the transaction.

- The exploration of strategic alternatives for the Safety & Productivity business could lead to a sale that might not maximize shareholder value, impacting net margins and overall earnings.

- The assumed recovery in discrete markets and ongoing semiconductor and industrial automation markets may not materialize as expected, potentially affecting revenue growth and earnings forecasts.

- Exposure to fluctuating global demand, particularly in key regions like China which is expected to return to growth, presents a risk that could impact revenue projections if the recovery is slower than anticipated.

- Relying on the successful execution of integration synergies with acquired businesses like AspenTech is risky and any delays or failures could impact anticipated cost savings and operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $133.4 for Emerson Electric based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $154.0, and the most bearish reporting a price target of just $105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $20.3 billion, earnings will come to $3.0 billion, and it would be trading on a PE ratio of 29.1x, assuming you use a discount rate of 7.3%.

- Given the current share price of $130.16, the analyst's price target of $133.4 is 2.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives