Key Takeaways

- Expansion into high-growth markets and advanced planning tools position EMCOR for enhanced revenue, earnings, and improved operational efficiency.

- Strong cash flow and prudent capital management support strategic growth initiatives, including acquisitions and shareholder returns, boosting future earnings.

- Macro-economic challenges and declining revenues in key segments may threaten EMCOR's revenue growth and profit margins, requiring strategic contract and market adjustments.

Catalysts

About EMCOR Group- Provides construction and facilities, building, and industrial services in the United States and the United Kingdom.

- Strong growth in RPOs, particularly in data centers and connectivity, high-tech manufacturing, and traditional manufacturing and industrial sectors, suggests a bright revenue outlook as these sectors continue to drive demand.

- Expansion into high-growth markets and increasing capabilities through training, greenfield expansions, and acquisitions positions EMCOR to enhance its revenues and earnings by capturing diverse sector opportunities.

- The introduction of advanced planning tools like Virtual Design Construction (VDC) and prefabrication capabilities contributes to improved field execution and productivity, leading to potential operating margin improvements.

- Significant cash generation, with operating cash flow surpassing operating income, enables strategic allocation toward organic growth, M&A, and shareholder returns, potentially boosting future earnings.

- With a strong balance sheet and prudent capital management, the company is well-positioned to continue growth via acquisitions and capital expenditures, likely enhancing long-term revenue and earnings growth.

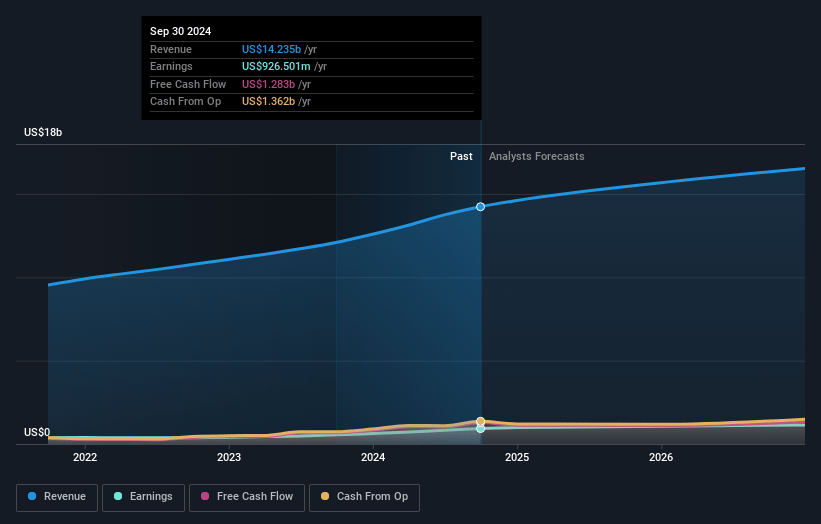

EMCOR Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EMCOR Group's revenue will grow by 7.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.5% today to 7.0% in 3 years time.

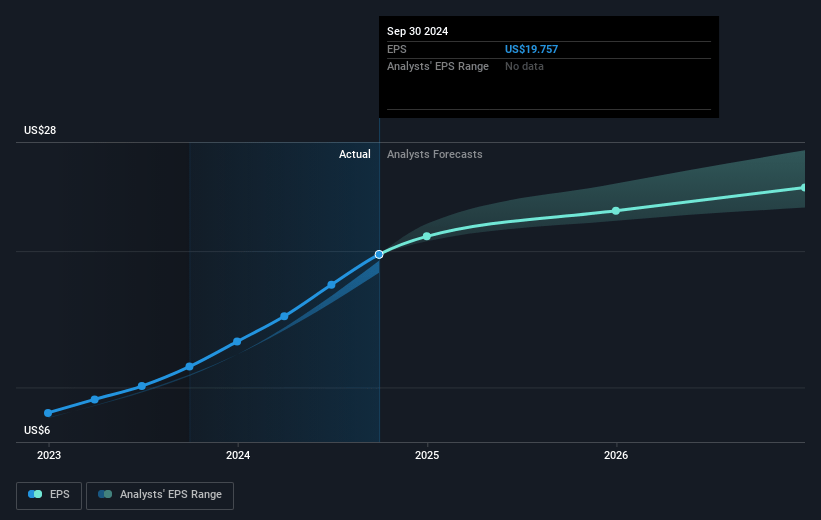

- Analysts expect earnings to reach $1.2 billion (and earnings per share of $26.71) by about January 2028, up from $926.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.2x on those 2028 earnings, up from 21.8x today. This future PE is lower than the current PE for the US Construction industry at 31.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.92%, as per the Simply Wall St company report.

EMCOR Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- EMCOR's exposure to the commercial sector, which has seen a decrease in revenues due to reduced demand in commercial real estate and warehouse distribution projects, could continue to negatively affect revenue growth.

- The decline in revenues for U.K. Building Services by 4% and less favorable work mix in the U.K. market suggests potential challenges that could impact overall revenue and international margins.

- The nonrenewal of certain facilities maintenance contracts within the U.S. Building Services segment, which resulted in a revenue decrease of 2.5%, poses a risk to future revenue streams if not replaced with equivalent or better contracts.

- The gradual resumption of normal demand in the Industrial Services segment, alongside previously discussed loss contracts, may not provide the growth needed to maintain revenue and profit margins in line with other segments.

- Macro-economic factors such as supply chain disruptions, economic uncertainty, interest rates, and geopolitical tensions could pose risks to EMCOR's earnings and operational efficiencies across all sectors.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $540.0 for EMCOR Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $600.0, and the most bearish reporting a price target of just $445.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $17.5 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 24.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of $438.27, the analyst's price target of $540.0 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

JO

Joey8301

Community Contributor

EMCOR's stock price is set to rise with 9% revenue growth and electrification trends

Company Overview EMCOR Group (NYSE: EME) is a leader in mechanical and electrical construction services, infrastructure solutions, and industrial facility management. With strong exposure to data center expansion, electrification, infrastructure spending, and industrial reshoring, the company has demonstrated consistent revenue growth and improving profitability.

View narrativeUS$468.79

FV

13.7% undervalued intrinsic discount9.00%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

New narrative