Catalysts

About CSW Industrials

CSW Industrials is a diversified industrial growth company providing essential products and solutions across HVACR, plumbing, electrical, and infrastructure applications.

What are the underlying business or industry changes driving this perspective?

- Expansion in HVACR repair focused offerings through Aspen Manufacturing and the pending MARS Parts acquisition positions CSW to benefit from the growing preference for repairing rather than replacing systems, supporting durable revenue growth and higher through cycle earnings.

- Sustained investment in product breadth and availability for professional contractors, combined with customer feedback that suggests share gains as distributors restock, may enable CSW to outgrow underlying end markets and lift total revenue and EBITDA over time.

- Systematic pricing discipline across all segments to offset tariffs, commodity inflation and freight costs is expected to preserve margin dollars and gradually rebuild gross and EBITDA margins as cost pressures normalize.

- Mix shift within Engineered Building Solutions toward higher margin smoke and life safety products, supported by tightening building standards and code enforcement, may enhance segment profitability and contribute to consolidated margin expansion and EPS growth.

- Prudent balance sheet management with net leverage projected at around 2 times at MARS closing, combined with strong and rising free cash flow, may create capacity for continued bolt on M&A and opportunistic share repurchases, supporting long term earnings per share and free cash flow per share growth.

Assumptions

This narrative explores a more optimistic perspective on CSW Industrials compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

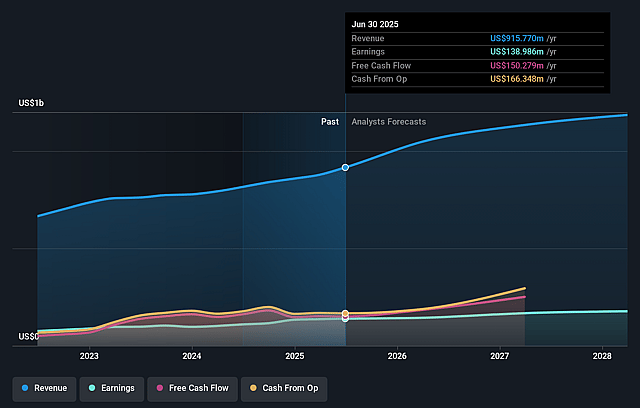

- The bullish analysts are assuming CSW Industrials's revenue will grow by 13.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 14.9% today to 16.2% in 3 years time.

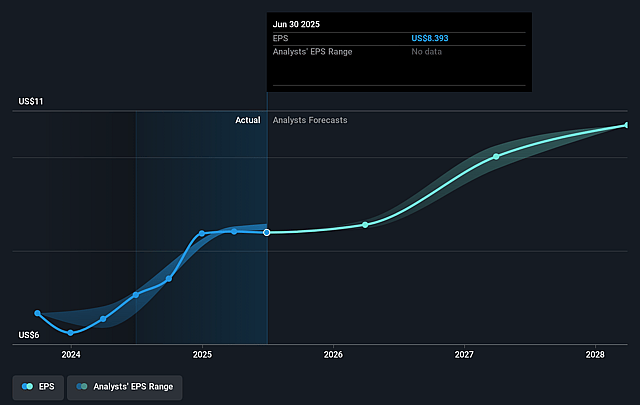

- The bullish analysts expect earnings to reach $229.2 million (and earnings per share of $11.18) by about December 2028, up from $143.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.9x on those 2028 earnings, down from 35.1x today. This future PE is greater than the current PE for the US Building industry at 19.4x.

- The bullish analysts expect the number of shares outstanding to decline by 0.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.37%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- CSW Industrials is increasingly exposed to the residential HVACR repair and replacement cycle through Aspen Manufacturing and the pending MARS Parts acquisition. A prolonged period of weak housing activity, depressed existing home sales and structurally lower replacement rates as consumers favor repair over new systems could cap volume growth and lead to slower revenue and earnings expansion than assumed.

- The growth profile is becoming more acquisition driven, with recent record results largely powered by Aspen, PSP Products and PF Waterworks while consolidated organic revenue declined and management withdrew short term organic guidance. This raises the risk that a less favorable M&A environment, slower growth in acquired businesses as refrigerant transition tailwinds normalize or integration missteps could drag on revenue growth and compress net margins.

- Tariff policy and broader commodity inflation, including higher costs for copper, aluminum and freight, have already caused gross margin and EBITDA margin contraction across all three segments. If input costs remain elevated or rise further while competitive and project bidding pressures limit additional pricing power, sustained margin compression could weigh on consolidated EBITDA and net income.

- The MARS Parts deal will push leverage to around 2 times and concentrates the portfolio even further in HVACR components. If the acquisition underperforms synergy targets, faces stronger than expected competitive pricing pressure or experiences a cyclical downturn before integration benefits are realized, the combination of higher interest expense and weaker profitability could limit earnings growth and free cash flow generation available for buybacks and future bolt on deals.

- End market exposure in areas like energy, rail transportation and specific geographies such as the previously robust Toronto project market has already contributed to flat or declining revenues and lower EBITDA margins in the Specialized Reliability Solutions and Engineered Building Solutions segments. A longer term slowdown in these industrial and infrastructure spend cycles, even as the mix shifts toward higher margin smoke and life safety products, could constrain diversified growth and pressure consolidated earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for CSW Industrials is $350.0, which represents up to two standard deviations above the consensus price target of $291.67. This valuation is based on what can be assumed as the expectations of CSW Industrials's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $350.0, and the most bearish reporting a price target of just $259.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $229.2 million, and it would be trading on a PE ratio of 31.9x, assuming you use a discount rate of 8.4%.

- Given the current share price of $302.18, the analyst price target of $350.0 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on CSW Industrials?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.