Key Takeaways

- Strategic acquisitions and innovation in energy-efficient HVAC and building solutions strengthen market position and drive long-term growth and pricing power.

- Supply chain optimization, margin protection measures, and robust M&A pipeline support stable earnings and diversified revenue streams.

- Exposure to trade policy risks, heavy reliance on specific segments, acquisition integration challenges, and equity dilution threaten profit margins and sustainable per-share earnings growth.

Catalysts

About CSW Industrials- Provides various industrial products in the United States and internationally.

- CSWI's expansion of its HVAC product offering through the acquisition of Aspen Manufacturing strengthens its positioning in the energy efficiency and indoor air quality markets, directly benefiting from increasing regulatory focus on building sustainability and healthier indoor environments-supporting future revenue growth and EBITDA accretion.

- Ongoing pricing actions and supply chain optimizations, including reshoring and diversification away from high-tariff regions such as China, are mitigating input cost pressure and tariff impacts, positioning CSWI to protect and potentially expand gross and net margins over time.

- The company's robust M&A pipeline and continued discipline in pursuing accretive, synergistic acquisitions in adjacent markets are expected to increase addressable market size, diversify revenue streams, and improve overall earnings stability and growth.

- Record backlog and high booking trends in the Engineered Building Solutions segment, combined with a strong U.S. urbanization and infrastructure renewal cycle, suggests near

- and long-term tailwinds for organic growth, margin expansion, and improved cash flow generation.

- Sustained innovation and product development efforts, especially in environmentally conscious and high-value engineered solutions, position CSWI to capitalize on secular demand shifts towards advanced, integrated building and HVAC technologies, enhancing long-term revenue growth and pricing power.

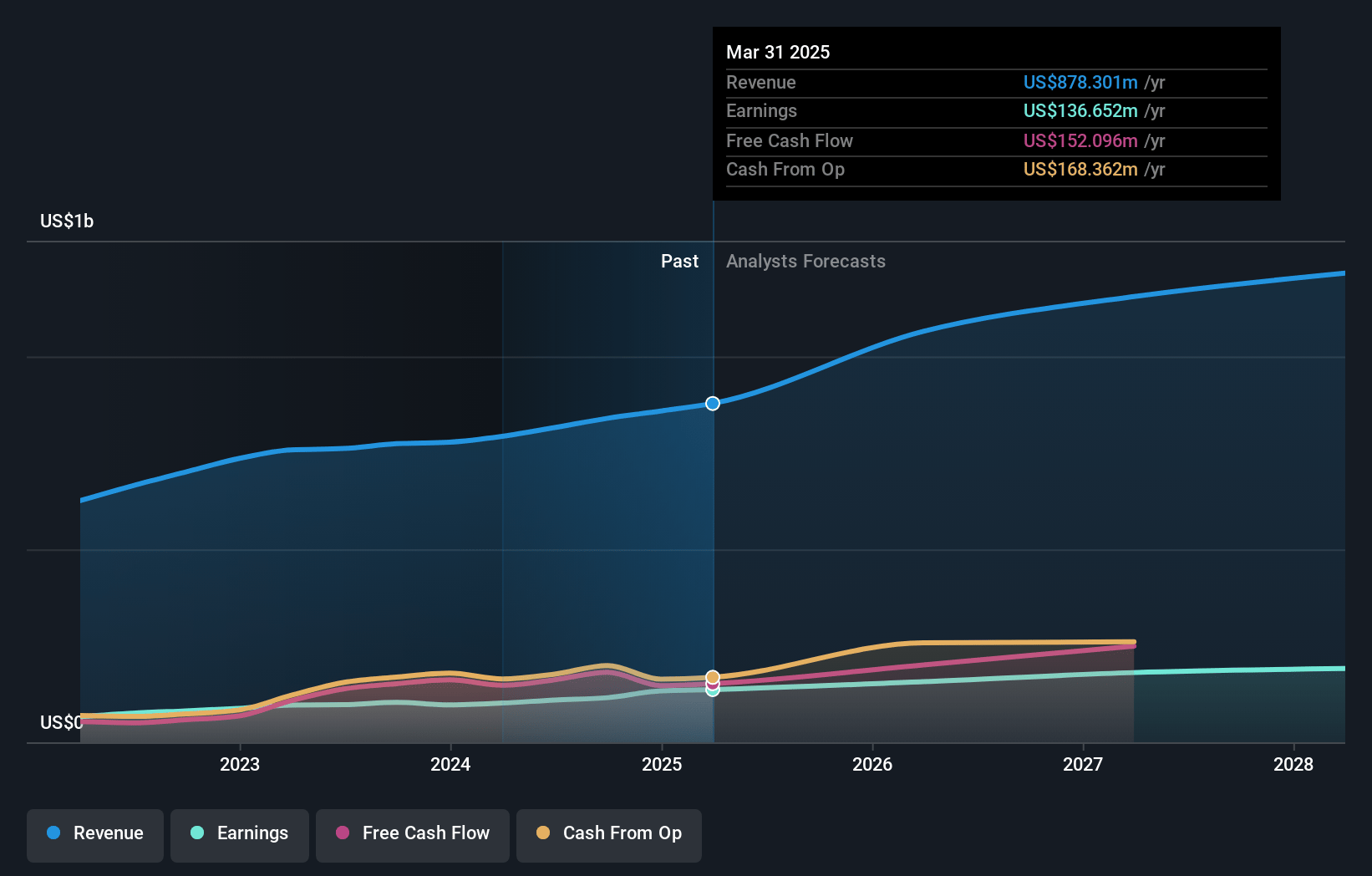

CSW Industrials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CSW Industrials's revenue will grow by 11.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.6% today to 15.7% in 3 years time.

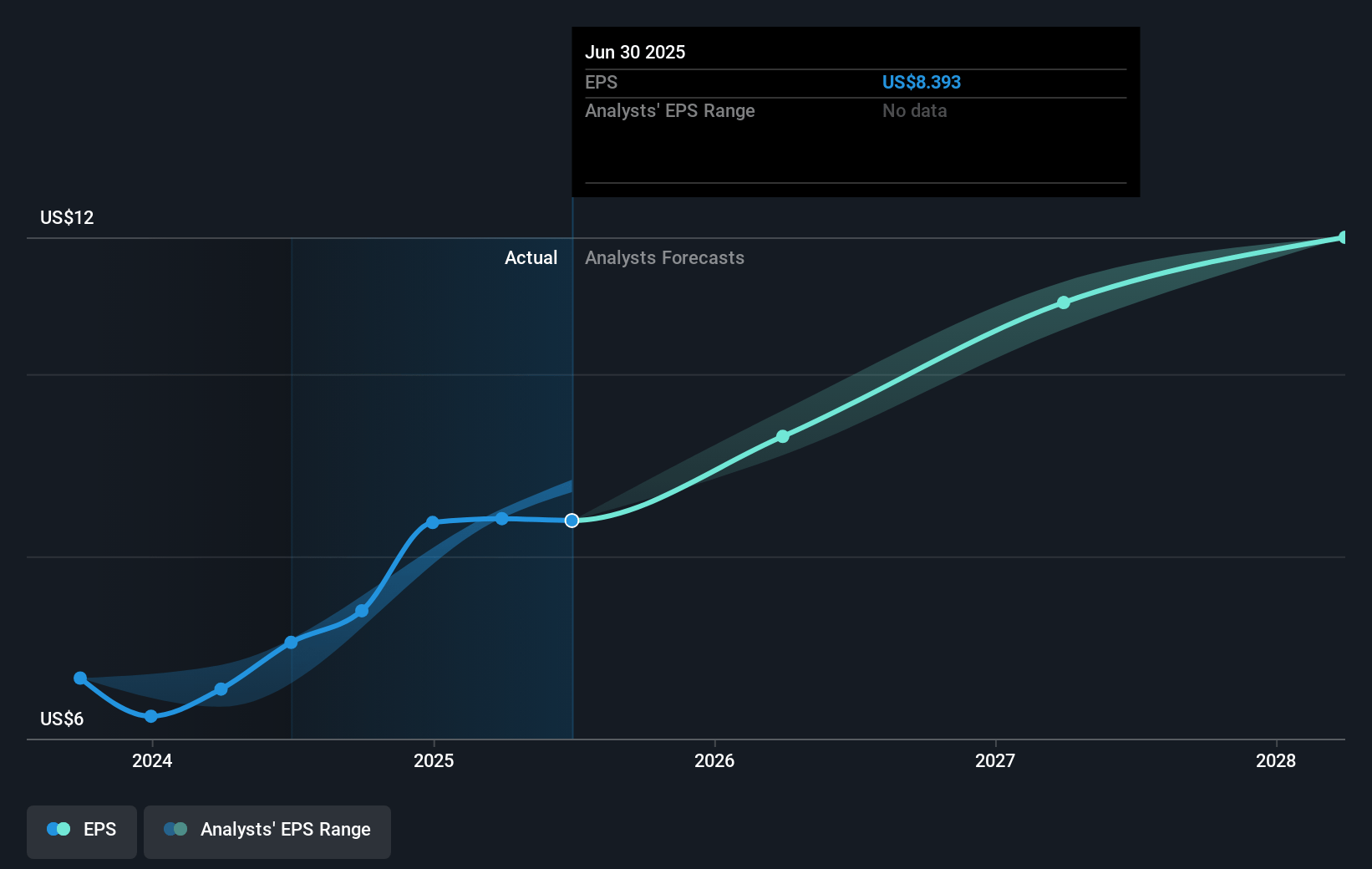

- Analysts expect earnings to reach $191.0 million (and earnings per share of $11.5) by about July 2028, up from $136.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.7x on those 2028 earnings, up from 35.8x today. This future PE is greater than the current PE for the US Building industry at 20.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.64%, as per the Simply Wall St company report.

CSW Industrials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's increasing exposure to tariffs and global trade policy uncertainty-especially regarding Vietnam and China-could result in higher costs of goods sold, with potential for only partial offset via pricing, leading to long-term margin compression and risk to EBITDA and net margins.

- Ongoing acquisition activity (such as the recent large Aspen Manufacturing deal) creates integration risks and significant increases in both amortization and interest expenses; if anticipated synergy and margin improvements do not materialize, there could be negative impacts on EPS growth and return on invested capital.

- Margin declines in segments such as Specialized Reliability Solutions and Engineered Building Solutions, driven by volume softness, adverse sales mix, heightened freight costs, and challenges in passing through price increases on project-based/bid work, indicate long-term susceptibility to cyclical end-market downturns, which could depress segment revenues and overall profit margins.

- Heavy dependence on the Contractor Solutions segment (71% of consolidated revenue) exposes the company to concentration risk; any downturn or commoditization in HVAC and construction end markets, or inability to maintain pricing power in response to increased competition and customer consolidation, could materially hurt revenue growth and profitability.

- Expansion of share count from equity offerings dilutes earnings per share, and with more large acquisitions possible (enabled by an upsized revolver), per-share earnings and free cash flow growth may lag behind operating profit growth, especially if future acquisitions are not immediately accretive or are funded through further dilution.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $334.667 for CSW Industrials based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $405.0, and the most bearish reporting a price target of just $305.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $191.0 million, and it would be trading on a PE ratio of 43.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $291.31, the analyst price target of $334.67 is 13.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.