Narratives are currently in beta

Key Takeaways

- The company stands to gain from strategic acquisitions and strong positioning in nuclear and medical sectors, driving growth in revenue and margins.

- Rising demand for nuclear power and promising project developments enhance commercial and defense opportunities, bolstering long-term growth prospects.

- Operational challenges and mixed revenue streams pose risks to margins and profitability, with potential revenue volatility due to project delays and capital expenditure reliance.

Catalysts

About BWX Technologies- Manufactures and sells nuclear components in the United States, Canada, and internationally.

- The acquisition of A.O.T. is expected to enhance BWXT's special materials portfolio, providing a natural extension of their existing business with the Department of Defense and Department of Energy, which should contribute to top-line revenue growth with solid mid-teens EBITDA margins.

- BWXT's strong position in the nuclear fuel processing cycle, particularly in advanced nuclear reactor fuel fabrication such as HALEU deconversion services, positions the company for future revenue growth from both national security and civilian nuclear projects.

- Increased demand for nuclear power from major companies like Microsoft, Amazon, and Google, along with government contracts for nuclear capabilities, could drive significant growth in BWXT's commercial operations, improving both revenue and net margins.

- BWXT's Medical segment is experiencing robust growth with expectations of similar trends in 2025, driven by increased patient volumes and higher contract drug manufacturing, likely leading to increased revenue and earnings.

- The ongoing development of microreactor projects such as Project Pele, as well as potential future defense contracts, could provide meaningful growth opportunities, thereby contributing to both revenue and margin expansion over the next few years.

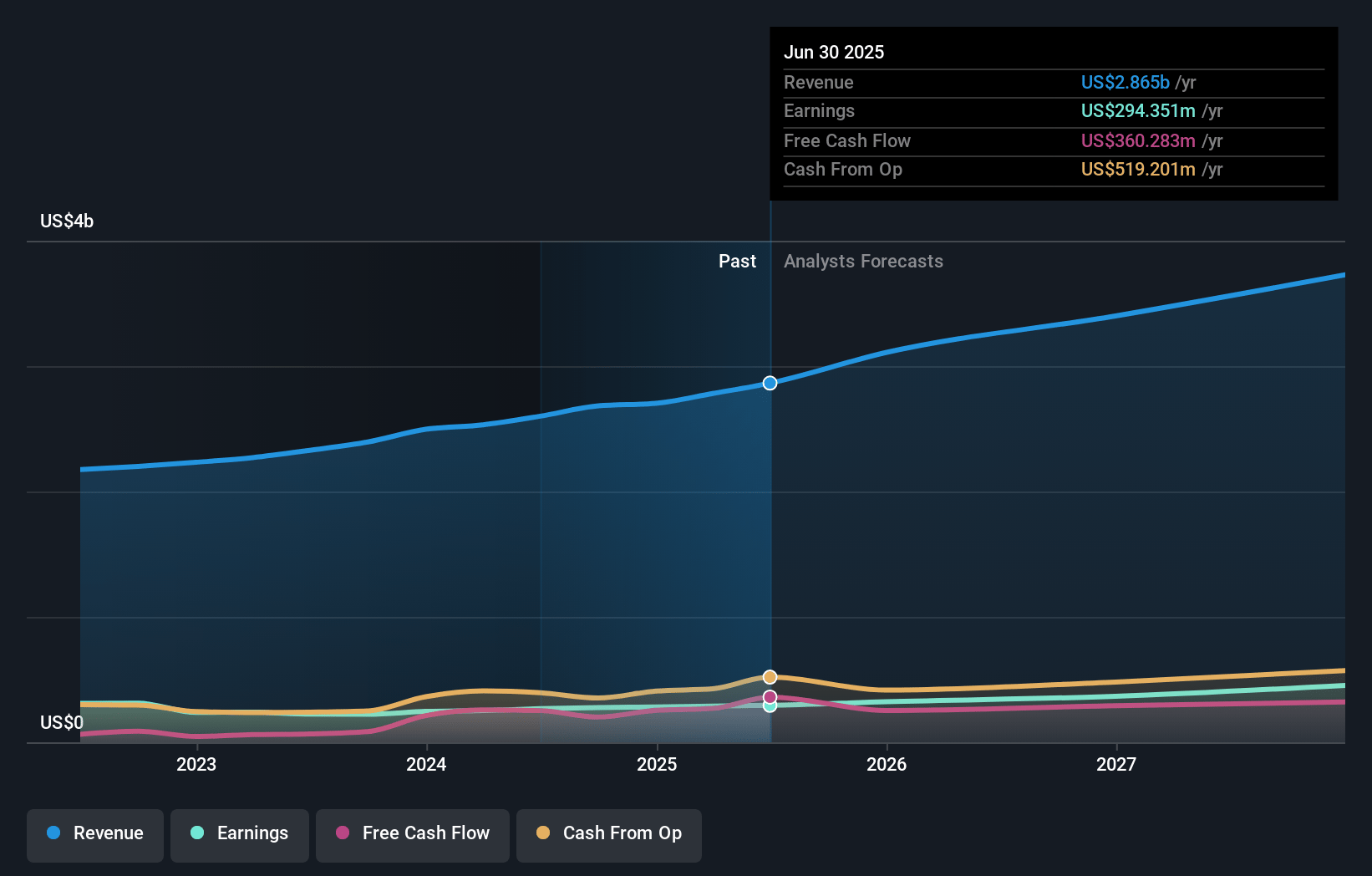

BWX Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BWX Technologies's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.3% today to 11.9% in 3 years time.

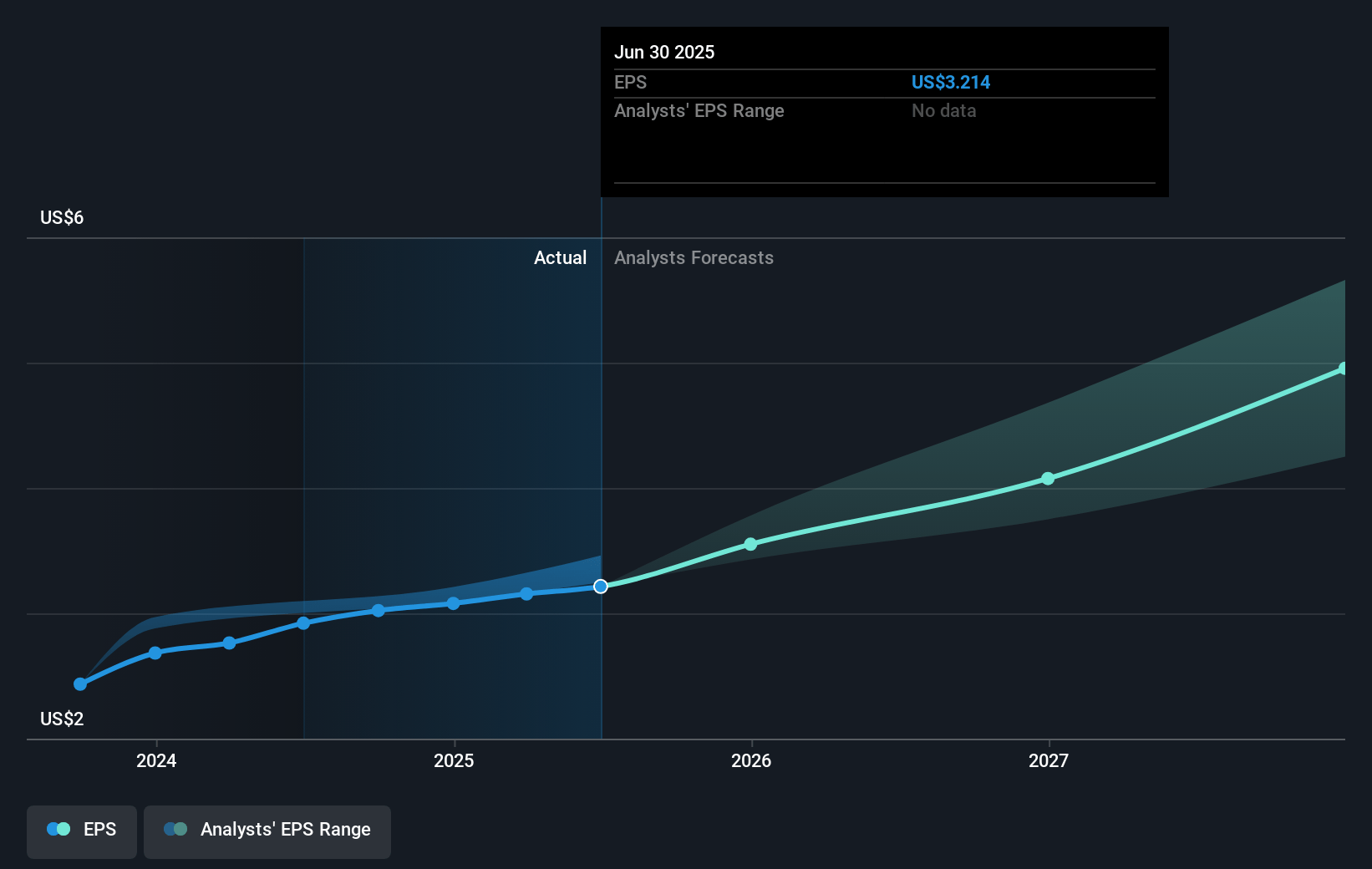

- Analysts expect earnings to reach $398.7 million (and earnings per share of $4.37) by about January 2028, up from $276.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.2x on those 2028 earnings, up from 37.0x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.0x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.36%, as per the Simply Wall St company report.

BWX Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The hurricane-related challenges, such as the three-week shutdown of the navy fuel processing facility, could impact BWXT's 2024 free cash flow, putting the upper half of their guidance range at risk. This may push expected cash inflows into 2025, thereby affecting short-term revenue and profit outlooks.

- The mix of revenues, including lower commercial operations EBITDA due to project timing and revenue mix, could present a risk to net margins and hinder overall earnings growth if these factors persist or worsen.

- The uncertainty and challenges of navigating operational performance and execution in immature programs like microreactors, Project Pele, and DRACO could affect BWXT’s earnings and margins if these projects incur delays or cost overruns.

- The potential for a lull in aircraft carrier production starting as early as 2025 and possibly extending into 2026 could lead to revenue volatility within the Government Operations segment due to changes in naval propulsion volumes.

- A reliance on large capital expenditure projects, such as the Cambridge facility expansion, poses a risk to net cash flows if projected returns do not materialize as anticipated, thus impacting overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $139.0 for BWX Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $166.0, and the most bearish reporting a price target of just $105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $398.7 million, and it would be trading on a PE ratio of 38.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of $112.06, the analyst's price target of $139.0 is 19.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives