Narratives are currently in beta

Key Takeaways

- AerCap's revenue and profitability are boosted by limited aircraft supply, leading to higher lease rates and asset valuations.

- Strategic share repurchases and significant gains from asset sales indicate efficient capital management, enhancing earnings per share and shareholder value.

- Boeing strikes and Airbus delays, high lease rates, increased competition, maintenance costs, and geopolitical tensions could negatively impact AerCap's revenue and operational margins.

Catalysts

About AerCap Holdings- Engages in the lease, financing, sale, and management of commercial flight equipment in China, Hong Kong, Macau, the United States, Ireland, and internationally.

- AerCap is benefiting from ongoing constraints on new aircraft and engine deliveries from OEMs, which are expected to persist through the end of the decade. This supply limitation supports higher lease rates and asset valuations, likely contributing to increased revenue and profitability.

- The company has successfully executed a large number of transactions and maintains a high utilization rate of 99%, indicating sustained demand for both new and older generation aircraft. This demand underpins consistent cash flows and earnings growth.

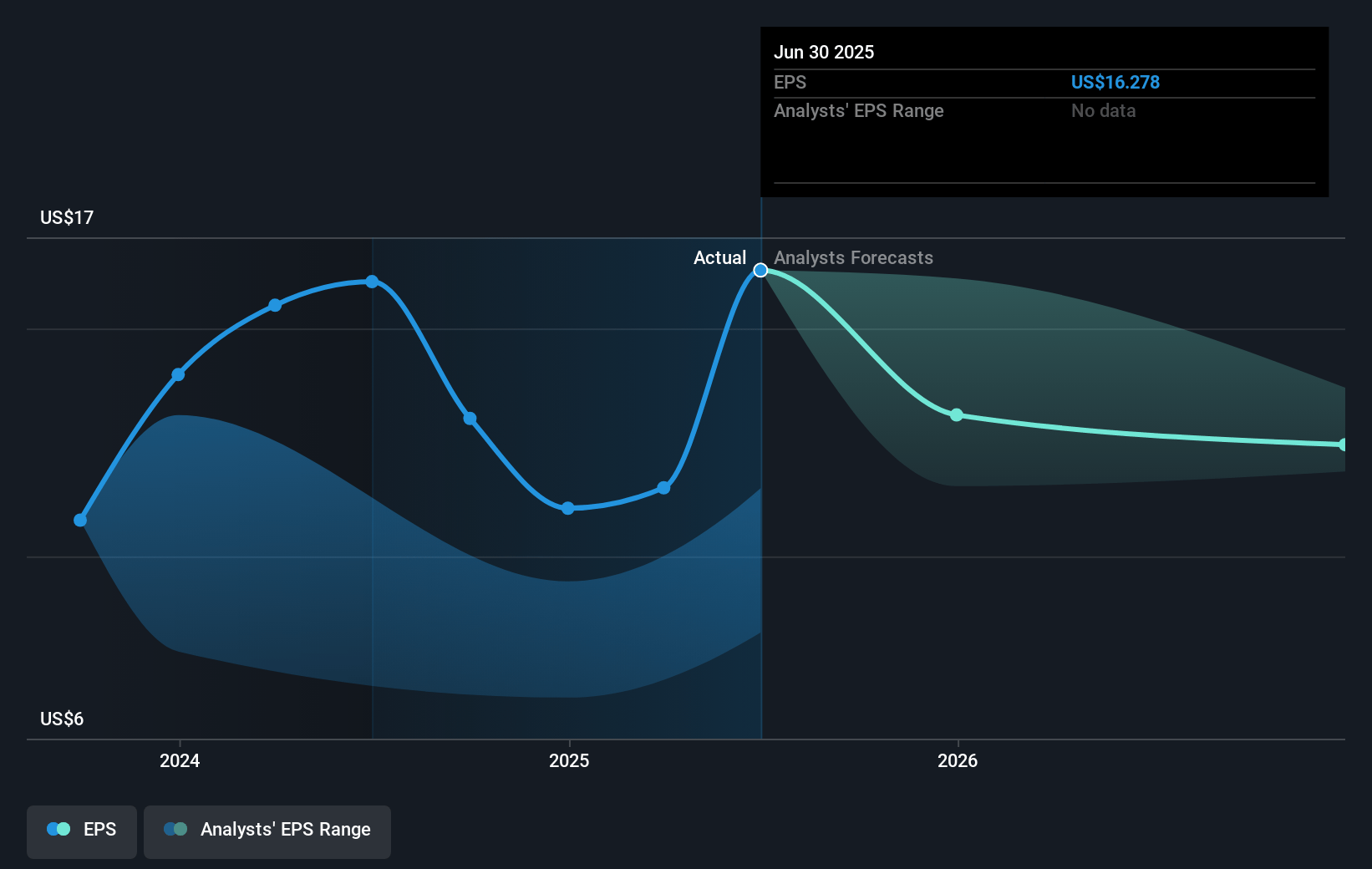

- Share repurchase authorizations totaling $1.5 billion year-to-date demonstrate AerCap's confidence in its undervalued stock, which is expected to enhance earnings per share (EPS) over time through reduced share count.

- AerCap reports significant unlevered margins on asset sales, with 27% gain on sales of older aircraft, suggesting conservative asset management and potentially undervalued book equity. This can lead to improved net margins and higher profitability.

- The company's strong liquidity position and strategic capital allocation, whether through share buybacks or new aircraft investments, offer financial flexibility to exploit market opportunities, likely leading to enhanced future earnings and shareholder value.

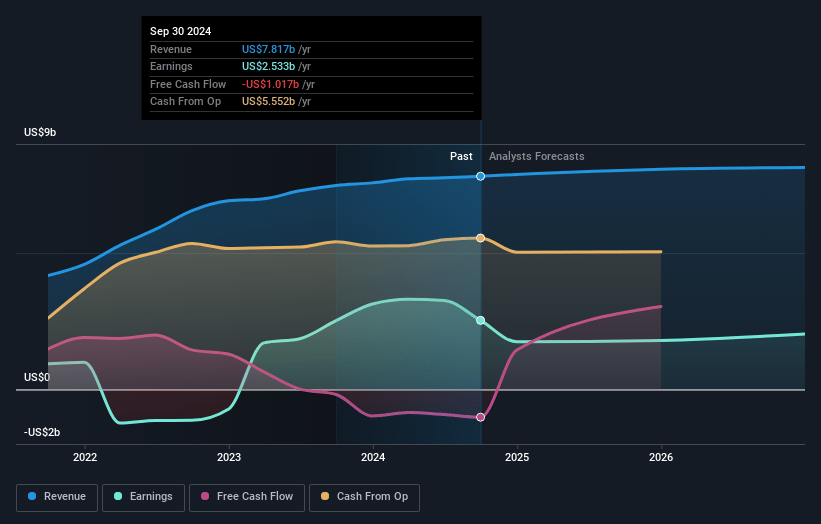

AerCap Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AerCap Holdings's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 32.4% today to 21.2% in 3 years time.

- Analysts expect earnings to reach $1.8 billion (and earnings per share of $10.99) by about November 2027, down from $2.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.4x on those 2027 earnings, up from 7.0x today. This future PE is lower than the current PE for the US Trade Distributors industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 4.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

AerCap Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing strike at Boeing and delays at Airbus are leading to delivery postponements, which could impact AerCap's ability to grow its fleet and consequently affect its future revenue streams.

- High lease rates may become problematic for airlines, potentially leading to resistance that could affect lease renewals and new agreements, impacting AerCap's revenue stability.

- Increased competition in the aircraft leasing industry due to attractive sector conditions could lead to pricing pressures, affecting AerCap's revenue and margins.

- The risk of unplanned maintenance and inefficiencies due to older aircraft fleet utilization might result in increased operational expenses, potentially reducing net margins.

- Economic uncertainties and geopolitical tensions, specifically with China and other key regions, could result in decreased demand for AerCap's assets, impacting both revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $112.38 for AerCap Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $103.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $8.4 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 12.3%.

- Given the current share price of $95.73, the analyst's price target of $112.38 is 14.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives