Last Update 16 Aug 25

Fair value Increased 9.09%Shimmick’s consensus price target has risen to $3.00 despite lower revenue growth forecasts and a higher forward P/E, reflecting a notable uplift in perceived fair value.

What's in the News

- Shimmick raised its 2025 projects revenue guidance to $405–$415 million (up from $392–$410 million), with gross margins expected between 9% and 12%.

- Selected as preferred bidder on four contracts totaling $156 million (including $47 million in electrical work), spanning large wastewater and power distribution projects in California.

- Awarded a $51 million contract by Stockton East Water District for Bellota Weir Modifications, supporting water reliability and habitat restoration in the Calaveras River region.

- Launched Axia Electric LLC, a dedicated electrical subsidiary, with $42 million in new awards and over $380 million in electrical projects under contract.

- Added as a constituent to the Russell 3000E Value Index, Russell Microcap Value Index, and their associated benchmarks.

Valuation Changes

Summary of Valuation Changes for Shimmick

- The Consensus Analyst Price Target has risen from $2.75 to $3.00.

- The Consensus Revenue Growth forecasts for Shimmick has significantly fallen from 2.6% per annum to 0.9% per annum.

- The Future P/E for Shimmick has significantly risen from 4.76x to 5.52x.

Key Takeaways

- Expanding focus on core infrastructure markets and strategic new ventures is set to boost revenue diversification, market share, and sustained long-term growth.

- Streamlined operations and stronger discipline in project selection are expected to enhance margins, earnings quality, and financial resilience.

- Persistent losses from noncore projects, weak project execution, and reliance on public infrastructure funding create significant earnings uncertainty and heighten risk of ongoing margin pressure.

Catalysts

About Shimmick- Provides turnkey infrastructure solutions to the water, energy, climate, and transportation markets in the United States.

- Surging bidding activity and a pipeline now exceeding $4.5 billion-double the start of the year-positions Shimmick to capitalize on accelerated infrastructure investment and bipartisan government support, likely driving top-line revenue growth and market share gains.

- Growing focus on climate-resilient and sustainable water, flood control, and electrical infrastructure creates persistent demand for Shimmick's core competencies, increasing visibility and durability of future revenues and supporting backlog expansion.

- Rapid wind-down of loss-generating noncore projects is expected to improve blended gross margins and earnings as new, higher-margin core projects begin to comprise a larger share of revenue.

- Strategic launch and scaling of Axia Electric enables Shimmick to penetrate high-growth markets in electrical, industrial, and data center infrastructure, supporting revenue diversification and higher-margin opportunities, elevating long-term net margins.

- Continued operational improvements and disciplined project bidding are reducing G&A expenses, with a targeted SG&A ratio of 7.5% of revenue, which should expand operating margins and enhance future earnings power.

Shimmick Future Earnings and Revenue Growth

Assumptions

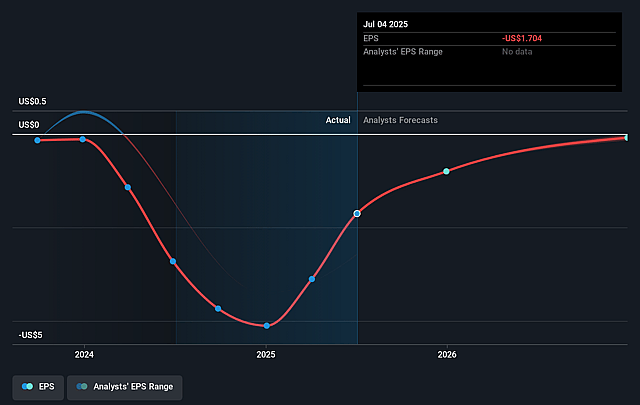

How have these above catalysts been quantified?- Analysts are assuming Shimmick's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts are not forecasting that Shimmick will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Shimmick's profit margin will increase from -11.2% to the average US Construction industry of 5.7% in 3 years.

- If Shimmick's profit margin were to converge on the industry average, you could expect earnings to reach $30.3 million (and earnings per share of $0.76) by about September 2028, up from $-58.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.2x on those 2028 earnings, up from -1.8x today. This future PE is lower than the current PE for the US Construction industry at 34.5x.

- Analysts expect the number of shares outstanding to grow by 4.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.69%, as per the Simply Wall St company report.

Shimmick Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company continues to face persistent losses from its noncore projects, with negative gross margins (as low as -16% in the first half of 2025) and scope growth still impacting results; this ongoing drag could cause unpredictable costs and further margin compression, negatively affecting both earnings and net margins over the next several quarters.

- Shimmick's guidance downgrade for consolidated adjusted EBITDA ($5–15 million vs. previous $15–25 million), primarily due to negative project mix and slower-than-expected ramp-up in new work, suggests ongoing exposure to project execution risks and limited profit visibility, which may constrain net income improvements.

- The firm's heavy focus on public infrastructure projects and dependence on government bidding cycles exposes it to significant budgetary, regulatory, and political risks; any slowdown in government funding, shifting procurement models, or unfavorable regulatory changes could lead to revenue volatility and backlog instability.

- Expansion into new geographies and markets for its Axia Electric subsidiary, while promising, entails execution risks associated with workforce mobility, competitive entry, local supply chains, and cost management; underperformance or overruns in these unfamiliar regions could adversely impact revenue growth and profitability.

- While management aims for significant SG&A reductions (targeting an aggressive 7.5% of revenue), there is uncertainty in their ability to achieve such efficiency gains without underinvesting in talent, project oversight, or technology upgrades; failure to balance these costs could impede operational improvements and margin expansion, affecting long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.0 for Shimmick based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $533.6 million, earnings will come to $30.3 million, and it would be trading on a PE ratio of 5.2x, assuming you use a discount rate of 9.7%.

- Given the current share price of $2.9, the analyst price target of $3.0 is 3.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.