Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and infrastructure funding drive significant revenue growth and market expansion, enhancing earnings and advancing Roadmap 2027 goals.

- Operational efficiencies and integration improve margins, leveraging economies of scale and maintaining a robust project backlog for continued growth.

- Reliance on acquisitions and integration risks, increased debt, and dependency on infrastructure funding could pressure margins amid potential delays and rising expenses.

Catalysts

About Construction Partners- A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, and Tennessee.

- The acquisition of Lone Star Paving, which has robust 20% plus EBITDA margins, is expected to enhance Construction Partners' margin expansion strategy, potentially improving overall earnings and facilitating quicker progress towards their Roadmap 2027 goals.

- The significant and increasing infrastructure funding in Texas, supported by local supplemental funding programs in addition to federal allocations, is poised to drive revenue growth for Construction Partners through increased construction opportunities in growth-heavy regions.

- With a record project backlog of $1.96 billion as of September 30, 2024, Construction Partners is positioned to experience continued revenue growth, benefiting future earnings as they execute on current and expanding projects across the Sunbelt states.

- The strategic acquisitions and their subsequent organic growth potential are expected to drive higher revenue and market share, with recent acquisitions contributing 10% to the total revenue growth for the fiscal year 2024, supplementing organic growth.

- Operational efficiencies and vertical integration efforts are anticipated to further improve net margins, with ongoing strategies in place to leverage economies of scale and the integrated execution of construction services in expanding markets.

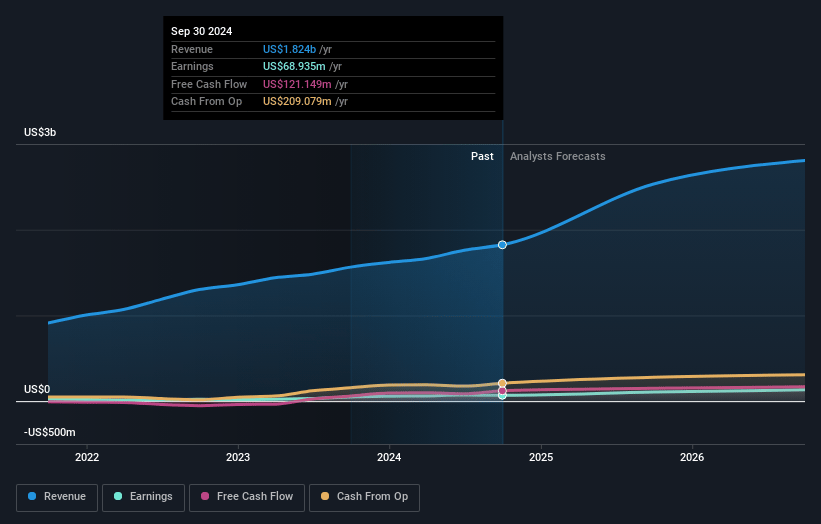

Construction Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Construction Partners's revenue will grow by 23.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.8% today to 5.1% in 3 years time.

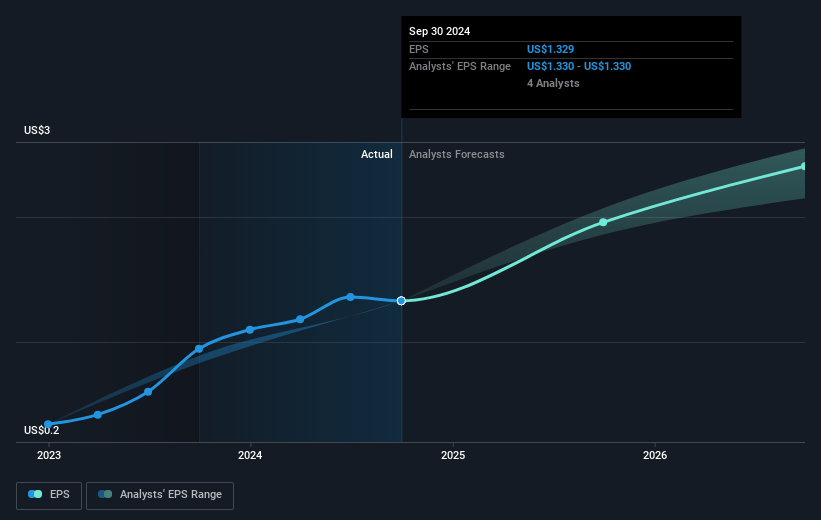

- Analysts expect earnings to reach $173.1 million (and earnings per share of $3.1) by about January 2028, up from $68.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.7x on those 2028 earnings, down from 72.8x today. This future PE is greater than the current PE for the US Construction industry at 30.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.16%, as per the Simply Wall St company report.

Construction Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on acquisitions for growth presents integration and execution risks, which could impact future revenue and profit margins if newly acquired businesses do not meet expectations.

- Increased debt from the Lone Star acquisition, with a pro forma leverage ratio expected to reach 3.3x EBITDA, may pressure net margins and earnings if cash flows do not materialize as anticipated.

- The construction industry in Texas and other Sunbelt states is heavily dependent on state and federal infrastructure funding, which could be subject to delays or budget cuts, impacting revenue.

- Seasonal fluctuations in construction projects can lead to variability in cash flow and earnings, particularly if adverse weather conditions or project delays occur.

- Rising general and administrative expenses, partly due to acquisition-related costs, may erode net income margins if not managed effectively as the company scales.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $104.0 for Construction Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $173.1 million, and it would be trading on a PE ratio of 40.7x, assuming you use a discount rate of 7.2%.

- Given the current share price of $89.8, the analyst's price target of $104.0 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives