Key Takeaways

- Increased R&D and expansion drive potential future growth, but elevated short-term costs may compress margins and near-term earnings.

- New market focus may boost future revenue, but regulatory challenges and delays pose risks to current backlog and financial performance.

- Powell's diversified market strategy and strong financial position indicate potential for sustained growth and improved profitability through expanded revenue streams and operational efficiencies.

Catalysts

About Powell Industries- Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

- Powell Industries has been significantly increasing its research and development spending, up 52% year-over-year, to develop new technologies and broaden its product portfolio, which could indicate a forward-looking expectation of revenue growth from new products and markets that may not yet be fully realized in financial results. This increased R&D spend could also lead to higher expenses impacting net margins negatively in the short term.

- The company acquired new property and is expanding its manufacturing facilities in Houston, suggesting anticipated capacity to support revenue growth; however, the upfront capital expenditures and ongoing operational costs may impact earnings in the near term as these projects are completed.

- The focus on new markets such as data centers, hydrogen, and carbon capture involves qualifying new products and increasing engagement, potentially raising costs before these efforts generate equivalent revenue, thus impacting net margins in the short term.

- Powell’s expectation for continued strength in Oil & Gas and Petrochemical sectors, including energy transition projects, may be challenged by external regulatory factors like LNG export permitting, which could delay revenue recognition and impact backlog utilization and future earnings.

- The company maintains a solid backlog with a stable composition providing revenue visibility into fiscal 2027, but any changes in customer project schedules or potential future economic downturns could result in lower-than-anticipated revenue realization, affecting overall financial performance.

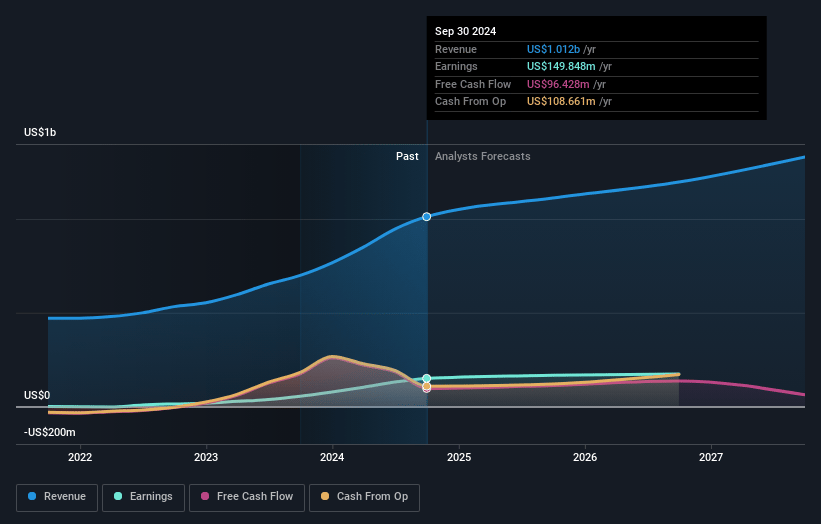

Powell Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Powell Industries's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.8% today to 14.0% in 3 years time.

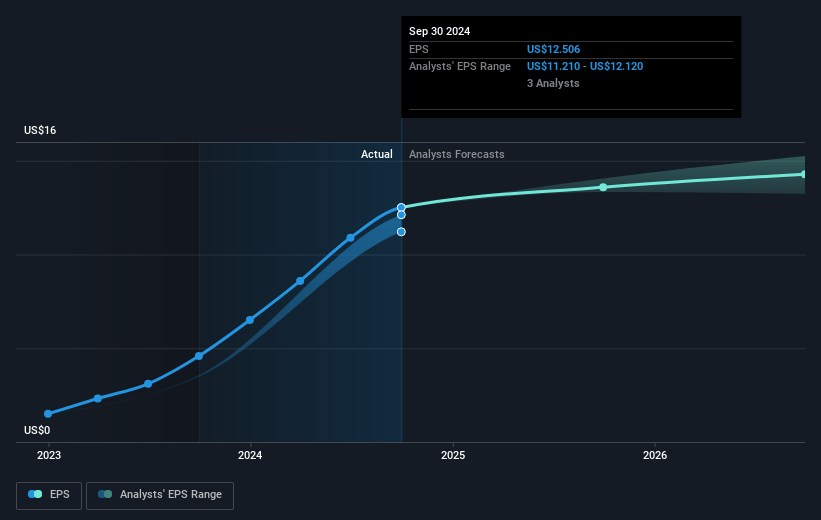

- Analysts expect earnings to reach $186.1 million (and earnings per share of $15.22) by about January 2028, up from $149.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, down from 25.1x today. This future PE is lower than the current PE for the US Electrical industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.22%, as per the Simply Wall St company report.

Powell Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Powell recorded a significant revenue growth of 32% in the fourth quarter, resulting in $1 billion in revenue for the full fiscal year, which indicates strong market demand and effective execution of their strategies. This could lead to continued revenue growth.

- The company's focus on diversifying markets such as utilities, data centers, hydrogen, and carbon capture, coupled with substantial progress in these areas, suggests potential for expanding revenue streams and improving net margins.

- Powell's backlog remains steady at $1.3 billion, indicating sustained demand and future revenue visibility, which supports the potential for stable or increasing earnings.

- With ongoing investments in product development and manufacturing efficiency, including an expansion of their electrical products factory and increased R&D spending, Powell aims to improve operational efficiency and profit margins.

- The company maintains a robust balance sheet with $358 million in cash and no debt, providing financial flexibility to withstand potential market challenges and sustain earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $247.73 for Powell Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $312.0, and the most bearish reporting a price target of just $208.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $186.1 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 7.2%.

- Given the current share price of $311.38, the analyst's price target of $247.73 is 25.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives