Narratives are currently in beta

Key Takeaways

- Strong global product demand and new product lines are expected to drive sustained revenue growth and increased profitability.

- Expanded U.S. manufacturing and recent acquisitions aim to boost sales, profit margins, and operational efficiency.

- Political uncertainties, pricing competition, and execution risks could affect revenue and margins, with dependency on U.S. infrastructure amplifying regulatory and demand variability concerns.

Catalysts

About Nextracker- An energy solutions company, provides solar tracker and software solutions for utility-scale and distributed generation solar projects in the United States and internationally.

- Strong demand for Nextracker products globally, driven by a focus on providing the highest quality and most reliable products with the lowest operating costs, is expected to sustain revenue growth.

- Significant backlog increase to over $4.5 billion, indicating future revenue recognition and profitability from secured sales orders.

- Introduction of new product lines like NX Horizon and NX Foundation Solutions, born from focused R&D investments, to drive future revenue growth.

- Increased manufacturing capabilities for a 100% U.S. manufactured tracker may boost U.S. sales and profit margins, as it enables customers to achieve higher scores for investment tax credits.

- Integrations of recent acquisitions in the Foundation business are expected to enhance operational efficiency and open new revenue streams, potentially improving net margins.

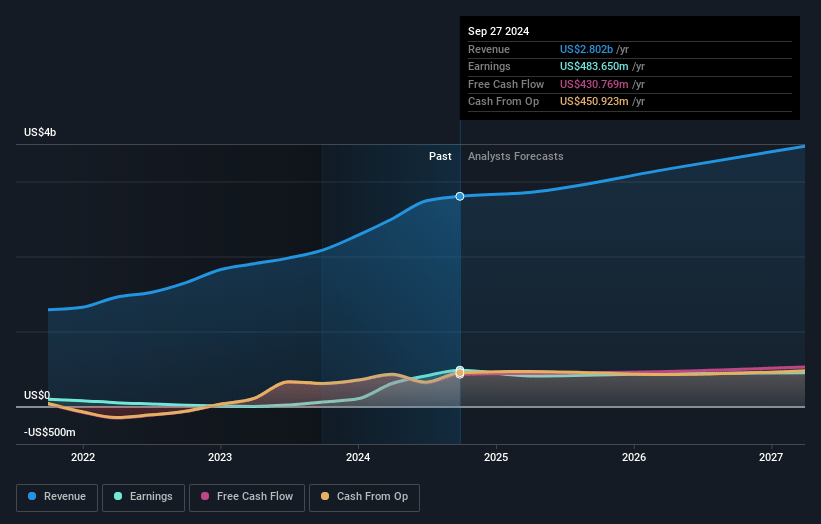

Nextracker Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nextracker's revenue will grow by 9.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.3% today to 12.1% in 3 years time.

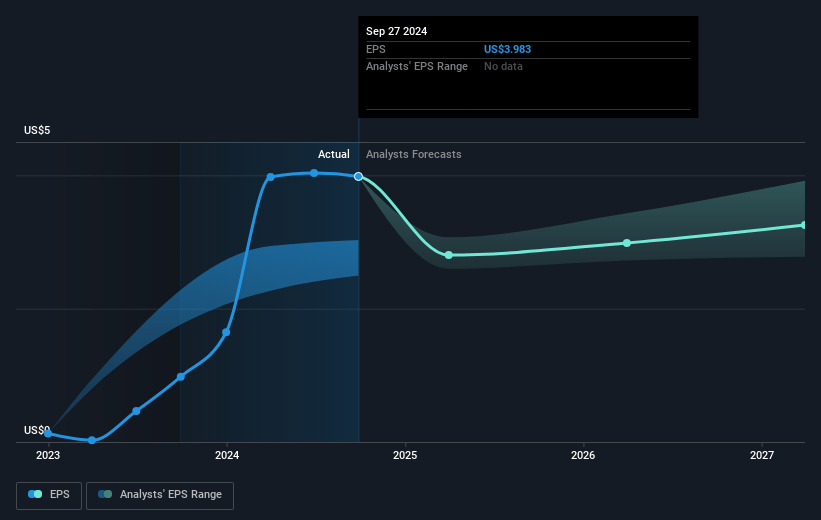

- Analysts expect earnings to reach $440.8 million (and earnings per share of $2.99) by about January 2028, down from $483.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.0x on those 2028 earnings, up from 13.0x today. This future PE is lower than the current PE for the US Electrical industry at 22.7x.

- Analysts expect the number of shares outstanding to grow by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.28%, as per the Simply Wall St company report.

Nextracker Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Political uncertainties in the United States could potentially impact the solar industry, despite current bipartisan support, which may create volatility in revenue forecasts.

- Intense pricing competition in international markets, especially the Middle East, could pressure net margins as these regions have the lowest-cost solar electricity markets.

- Execution risks related to the integration of recent acquisitions and new product developments could impact the expected profitability and earnings.

- The reliance on U.S. infrastructure for a significant part of revenue may pose risks if there are regulatory or policy shifts that affect investment tax credits or incentives.

- Variability in demand cycles and shipping schedules, influenced by global or regional macroeconomic factors, could lead to uneven revenue realization and earnings across quarters.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $53.37 for Nextracker based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $440.8 million, and it would be trading on a PE ratio of 22.0x, assuming you use a discount rate of 7.3%.

- Given the current share price of $43.92, the analyst's price target of $53.37 is 17.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives