Last Update01 May 25Fair value Decreased 3.89%

AnalystConsensusTarget has decreased revenue growth from 2.8% to 2.0%.

Read more...Key Takeaways

- Strategic focus on high-margin medical and industrial markets, leveraging reshoring trends and open capacity, is expected to boost revenue, profit margins, and earnings stability.

- Cost-cutting and operational efficiencies, including workforce optimization, are supporting higher profitability and improved asset utilization across U.S. and European facilities.

- Heavy reliance on uncertain auto markets, new programs, and cost cuts leaves profitability and growth at risk amid margin pressures and limited financial flexibility.

Catalysts

About NN- Designs, manufactures, and sells high-precision components and assemblies for various end markets in the United States, China, Brazil, Mexico, Germany, Poland, and internationally.

- The company has secured $55 million in new business ramping up in 2025, with an additional $100 million expected in 2026, leveraging both new market opportunities like Medical and Industrial, as well as reshoring/nearshoring trends—likely to drive top-line revenue growth as global automation and infrastructure investments expand NN’s addressable markets.

- Substantial open production capacity, combined with targeted additions in high-growth sectors (Medical/Industrial), allows for revenue expansion with minimal incremental capital investment, which should support improved profitability and net margins as volumes grow.

- Strategic pivot toward higher-margin medical and industrial components, supported by recent wins and pipeline momentum, positions NN to benefit from premium pricing and recurring revenues, which should enhance both net margin and earnings stability moving forward.

- Aggressive cost reduction initiatives—including workforce rightsizing and footprint optimization—are expected to deliver $15 million in annual savings, directly reducing operating costs and supporting higher EBITDA and net margins.

- Benefiting from manufacturing reshoring and tariff-driven realignment, NN’s U.S. and European facilities are capturing new RFQs and immediate ramp-up business from automotive and industrial customers seeking local, compliant suppliers—poised to boost revenue and improve asset utilization.

NN Future Earnings and Revenue Growth

Assumptions

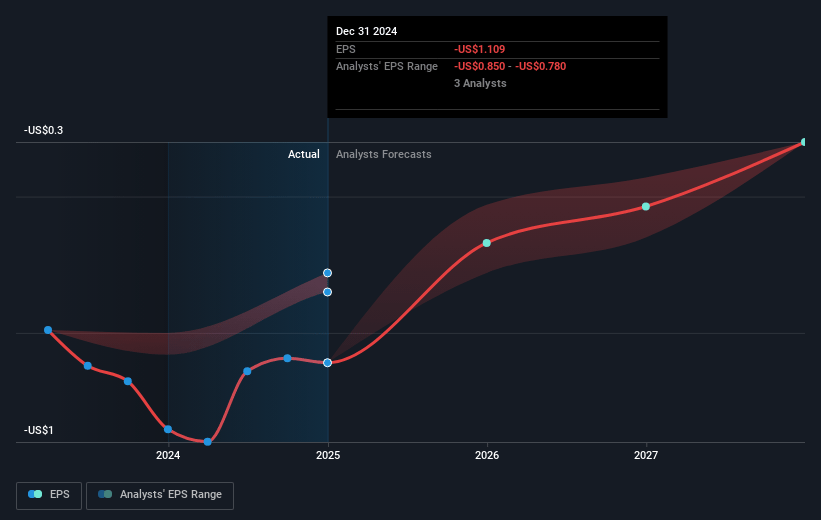

How have these above catalysts been quantified?- Analysts are assuming NN's revenue will grow by 2.0% annually over the next 3 years.

- Analysts are not forecasting that NN will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate NN's profit margin will increase from -10.9% to the average US Machinery industry of 9.5% in 3 years.

- If NN's profit margin were to converge on the industry average, you could expect earnings to reach $45.2 million (and earnings per share of $0.89) by about May 2028, up from $-48.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, up from -2.3x today. This future PE is lower than the current PE for the US Machinery industry at 24.2x.

- Analysts expect the number of shares outstanding to grow by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.36%, as per the Simply Wall St company report.

NN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued softness and unpredictable demand in core automotive markets—currently representing about 40% of NN’s sales—could lead to persistent revenue stagnation or declines, especially if EV and hybrid transitions accelerate and legacy fuel system components see secular declines.

- The company is relying heavily on new business wins and pipeline ramp-ups to offset a flat or shrinking base business, creating significant execution risk if those programs are delayed, underperform, or are subject to increased competitive pricing pressure, potentially impacting revenue and net margins.

- Ongoing plant consolidation and program rationalization, while aimed at cost efficiency, may not fully resolve margin compression or underperformance in certain geographies, leaving risk of persistent unprofitable operations that could erode overall profitability.

- Past acquisitions and inherited high leverage, alongside periods of negative or low EBITDA, constrain financial flexibility and increase sensitivity to interest expenses, threatening net margins and limiting investment in organic growth or restructuring.

- Dependence on cost-out actions and short-term operational improvements to maintain EBITDA and free cash flow targets may not be sustainable if macroeconomic or industry conditions deteriorate, or if rising labor, input costs, or tightening regulations increase structural expenses over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.333 for NN based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $475.9 million, earnings will come to $45.2 million, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 11.4%.

- Given the current share price of $2.2, the analyst price target of $6.33 is 65.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.