Key Takeaways

- Organizational restructuring and strategic decentralization aim to enhance operational efficiency and drive revenue growth by capturing more projects and reallocating resources.

- Focus on high-growth electrical infrastructure markets, supported by a strong project pipeline, positions the company for sustainable revenue and profitability increases.

- Exiting the transmission service line may reduce revenue; challenges in construction costs, productivity, and project uncertainties affect margins and future earnings consistency.

Catalysts

About Matrix Service- Provides engineering, fabrication, construction, and maintenance services to support critical energy infrastructure and industrial markets in the United States, Canada, and internationally.

- Matrix Service is undergoing organizational restructuring to create a more efficient and agile operational structure, which is expected to improve operational efficiency and enhance their competitiveness. This should positively impact net margins and earnings.

- The company is decentralizing its business development organization to create a more integrated sales and operations function. This reorientation is anticipated to improve project capture rates and drive revenue growth.

- Shutdown of the Northeast transmission and distribution service line will eliminate losses from this unprofitable segment, allowing resources to be reallocated to more profitable ventures, positively impacting net margins and overall profitability.

- Matrix Service is leveraging strong demand in the electrical infrastructure market, which aligns with their long-term performance targets. This focus on high-growth segments supports sustainable revenue growth and profitability.

- With a $7 billion pipeline of project opportunities, including an estimated increase in LNG export demand, Matrix Service is well-positioned for future revenue growth and long-term earnings consistency over the next several years.

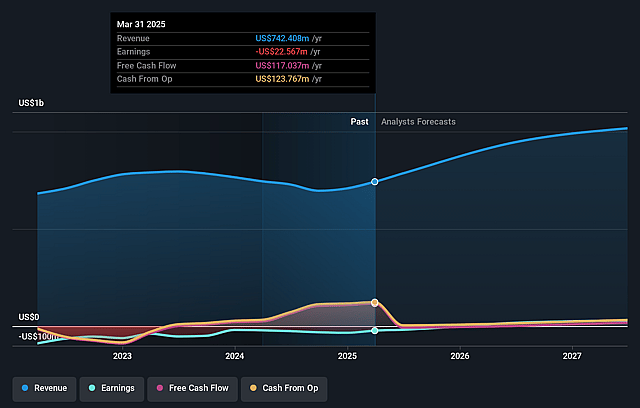

Matrix Service Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Matrix Service's revenue will grow by 15.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -3.0% today to 5.0% in 3 years time.

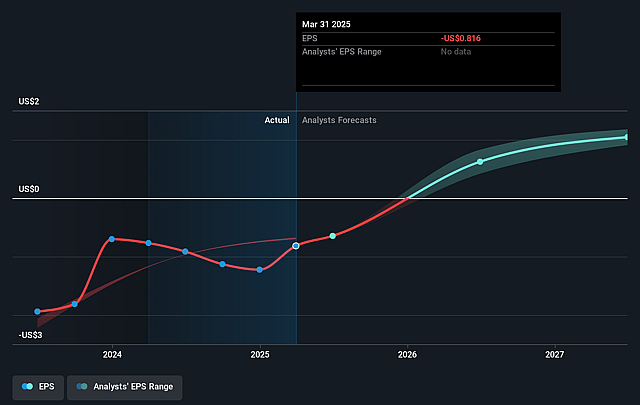

- Analysts expect earnings to reach $56.7 million (and earnings per share of $1.99) by about September 2028, up from $-22.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.3x on those 2028 earnings, up from -17.4x today. This future PE is lower than the current PE for the US Construction industry at 34.5x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

Matrix Service Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decision to exit the transmission and distribution service line due to competitive disadvantage and lack of scale could impact overall revenue by approximately $50 million in fiscal 2025.

- The under-recovery of construction overhead costs, although decreasing, continues to weigh on gross margins and profits, exacerbated by lower-than-anticipated labor productivity on specific projects.

- The macroeconomic and environmental policy uncertainties could cause delays in project starts or final investment decisions from clients, affecting future revenue and earnings consistency.

- Although the company reported strong storage and terminal solutions growth, the gross margins in this segment were negatively impacted by under-recovery of construction overheads and a specific project’s lower-than-expected labor productivity, which could continue to hurt net margins if not addressed.

- The reliance on larger multiyear projects for backlog and revenue could present risks if there are significant project delays or cancellations, impacting revenue visibility and earnings growth in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.0 for Matrix Service based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $56.7 million, and it would be trading on a PE ratio of 10.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $14.24, the analyst price target of $17.0 is 16.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.