Narratives are currently in beta

Key Takeaways

- New product releases and recent acquisitions strengthen Lincoln Electric's market presence and competitive edge, driving revenue growth and system integration capabilities.

- Cost-saving measures, sustainability focus, and strategic capital allocation improve efficiency, appeal to eco-conscious customers, and enhance shareholder value and EPS.

- Macroeconomic uncertainty and slowing demand in key regions and segments pose risks to Lincoln Electric Holdings' revenue growth and net earnings.

Catalysts

About Lincoln Electric Holdings- Through its subsidiaries, designs, develops, manufactures, and sells welding, cutting, and brazing products worldwide.

- The release of over 35 new products, including advancements in TIG, laser, plasma, and thermal heating, is expected to drive future revenue growth by expanding Lincoln Electric's presence in underpenetrated areas and enhancing their competitive edge in the market.

- Cost-saving initiatives, including structural changes and the consolidation of manufacturing and warehouse facilities, are projected to yield $40 million to $50 million in annualized savings. These efforts are likely to improve net margins by enhancing operational efficiency.

- The integration and expansion of capabilities from recent acquisitions, such as Zeman, Fori, RedViking, Vanair, and Inrotech, could support revenue growth by providing unique customer solutions and strengthening Lincoln Electric’s position as an automation system integrator.

- Strong focus on sustainability, improved safety, ergonomics, recyclability, and energy efficiency could attract more environmentally conscious industrial customers, potentially bolstering future revenue streams and margin profiles.

- Strategic capital allocation, including dividends and share repurchases, coupled with robust R&D investments, is expected to enhance earnings per share (EPS) by returning value to shareholders and supporting long-term profitable growth.

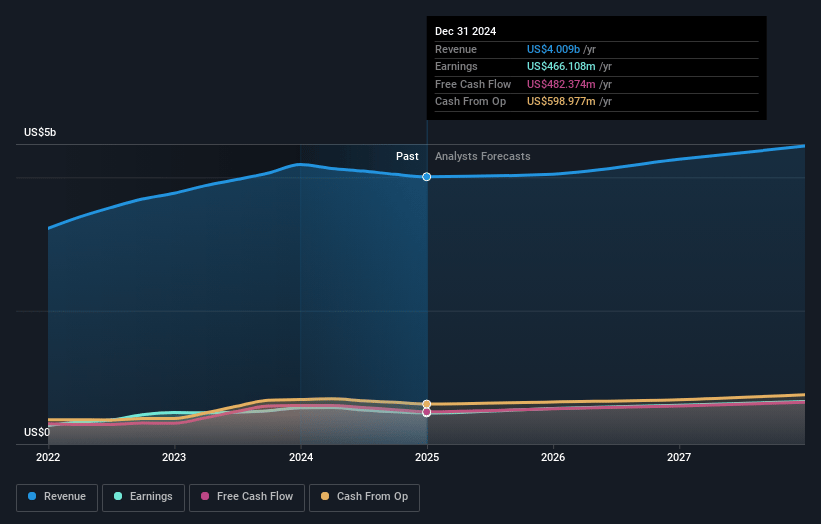

Lincoln Electric Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lincoln Electric Holdings's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.9% today to 14.8% in 3 years time.

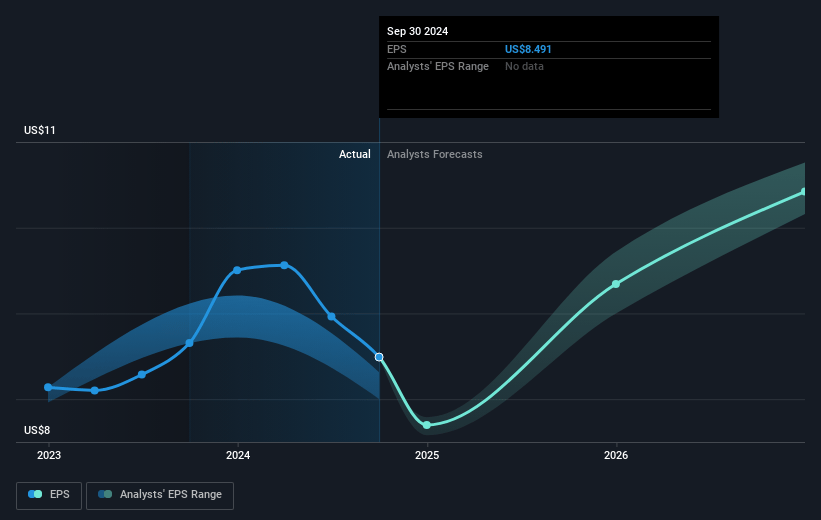

- Analysts expect earnings to reach $662.8 million (and earnings per share of $12.12) by about January 2028, up from $482.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, down from 22.9x today. This future PE is lower than the current PE for the US Machinery industry at 23.3x.

- Analysts expect the number of shares outstanding to decline by 1.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.03%, as per the Simply Wall St company report.

Lincoln Electric Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The broad deceleration in demand due to challenging end market dynamics and mix profile suggests potential risks to revenue growth, especially given the 8% decline in organic sales in the third quarter.

- Weakness among a large mix of the customer base and cautious posture from general industry customers due to macroeconomic uncertainty could impact future revenue growth and overall earnings.

- Continued curtailment of production levels by heavy industry customers to rightsize inventories, as well as delayed capital projects in the automotive sector, could lead to reduced consumables demand and affect revenue projections.

- Slowing OEM customer orders and industrial weakness in key regions like Europe pose a risk to future revenues, as these trends are expected to persist into the first quarter of 2025 and could impact both top-line growth and net margins.

- The pressure from lower volumes, reflected by a consistent decline in sales across major segments such as Americas Welding and International Welding, can affect the company’s ability to maintain current margin levels, thereby impacting net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $221.33 for Lincoln Electric Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $255.0, and the most bearish reporting a price target of just $174.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.5 billion, earnings will come to $662.8 million, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 7.0%.

- Given the current share price of $196.15, the analyst's price target of $221.33 is 11.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives